Technical analysis: Cairn Energy, AG Barr and Ethereum

Our chartist reviews last week's analysis and gives us an update on potential movements.

22nd July 2019 09:00

by Alistair Strang from Trends and Targets

Our chartist reviews last week's analysis and gives us an update on potential movements.

Ethereum, Cairn, and A G Barr

Starting a new week by reviewing our previous reports certainly provides an easy way to clear the mental fog of a lazy weekend. While we tend not to review our FTSE for Friday (in case an apology is needed!), Friday's song and dance managed to step on all the wrong notes. Confusing would be an understatement.

The funny thing though, it was not just the FTSE 100 which self immolated. Japan retained some dignity but of course, when the Nikkei opens in the early hours of Monday, it will probably follow the rest of the world in adopting a chaotic stance to market moves.

The problem we experienced, broadly speaking, related to our initial upward targets. Most markets hit and slightly exceeded these targets. But as the day progressed, rather than attempt higher travel, markets instead opted to race downward faster than the media attempting to take the worst possible meaning from anything said by Trump, Corbyn, or Johnson.

Our suspicion remains of some coming reversals, hopefully nothing severe. And doubtless surprise recovery toward the middle of August.

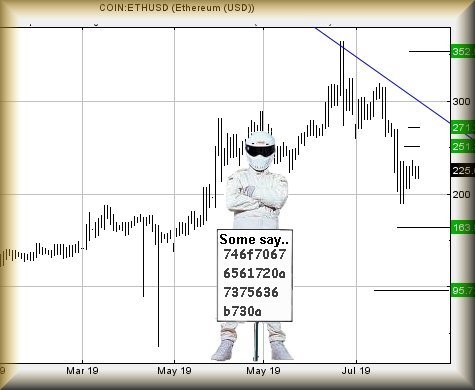

As for Ethereum, the fake coin indeed reached our initial bounce target of $227, even exceeding it slightly and hitting $237. The recovery situation can be refined slightly as movements above $237 should now bring an initial 251 dollars.

If exceeded, our secondary is at 271 dollars. If triggered, the market needs below $209 to cancel the rise potentials. Please remember, from a bigger picture stance, we suspect it intends to hit 95 dollars eventually!

Source: Trends and Targets Past performance is not a guide to future performance

Cairn Energy (LSE:CNE) hasn't really done anything interesting yet but near-term, any drift below 152p should find a bottom by 143.75p, a point at which we'd hope for a rebound. This potential is enhanced, due to its previous drip to this level back in June.

Source: Trends and Targets Past performance is not a guide to future performance

A G Barr (LSE:BAG), once pride of Scotland, allowed us to issue a warning for the future, if the share closed a session below 616p.

The share price has now closed below this trigger twice and now just awaits a drip below 600p and it shall doubtless fulfill the next part of our outlook, a trip down to 498p.

While we're fond of our warning, "if it ain't going down, it's going up", only four sessions have elapsed since the severe drop.

The share requires above 712p just to give a slight hint a further drop is not on the immediate cards.

It remains worth keeping an eye on as we do anticipate a rebound, should 498p make an appearance.

Source: Trends and Targets Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang, or interactive investor will be responsible for any losses that may be incurred as a result of following a trading idea.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.