These cheap trusts could smash forecasts

2nd October 2018 13:28

by Graeme Evans from interactive investor

There are wide discounts on many UK income and small-mid-cap investment trusts right now, but a lot of the bad news may already be priced in, writes Graeme Evans.

Unless we get a dramatic fourth quarter, it's looking like 2018 won't be going down in stockmarket history as a year to remember for UK investors.

The FTSE 100 Index has just eked out a modest 2.7% rise in the year to September 30, held back by political uncertainty and fears of a no-deal Brexit, as well a spike in the number of profit warnings.

Any growth is better than no growth, of course, but this FTSE 100 percentage takes on a different complexion when you see that the S&P 500 on Wall Street is up by 16.5% and the Nikkei ahead by 18.8%.

Clearly the consensus view towards UK equities is far from enthusiastic, with only one net monthly inflow into UK equities funds in the previous 19 months.

But this has prompted analysts at Stifel to ask whether most of the potential bad news in the UK is already in company share prices and investment trusts.

If there are positive developments on Brexit before the end of the year, Stifel notes the potential for opportunities as the FTSE All Share Index is on a price earnings ratio of only 12.9x and the FTSE 100 offers a 4% dividend yield.

In its contrarian view, Stifel said: "Perhaps the market has already priced-in a negative view on the Brexit outcome and instead there is a positive surprise.

"In such a scenario, we could see some strong performance from UK Equity Income Trusts and also UK Mid and Small Cap Trusts."

While any Brexit-driven recovery in sterling would knock companies with significant overseas earnings, Stifel said increased capital flows from investors may still result in an upward move in equity markets.

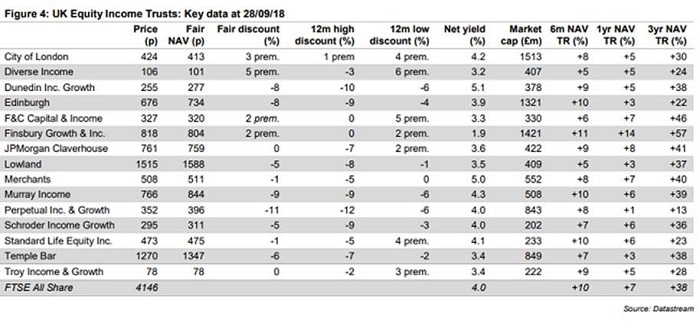

The average UK Equity Income sector discount to net asset value currently stands at 4%, compared with zero three years ago. Perpetual Income & Growth stands out at a discount of 11%, Murray Income at 9% and Temple Bar 6%.

Today's report from Stifel compiled some recent comments from managers of investment trusts specialising in UK assets.

Past performance is not a guide to future performance

Among them, Simon Gergel at Merchants Trust said the fact that the majority of UK-listed companies generated sales and profits overseas provided investors with considerable protection from the worst case Brexit scenarios.

He added: "Due to the modest valuation of the UK stockmarket, we have been able to identify many attractively priced companies that meet our investment criteria.

"Specifically we are looking for fundamentally sound businesses, trading on reasonable valuations, that benefit from supportive structural and cyclical thematic trends."

Alastair Mundy at Temple Bar recommends not getting drawn into the emotions of Brexit, and is instead substituting 'a recession' for 'Brexit'.

He explained: "We are trying to find those stocks which look cheap on a through-the cycle basis i.e. not for next year but for an average year.

"And a cycle typically includes a recession. And the good news is on through-the-cycle numbers several stocks are getting cheaper."

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.