These top China funds rebound after sell-off

1st October 2018 11:33

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Chinese stockmarkets have plunged this year, but there's lots of buying at these low levels. Saltydog analyst Douglas Chadwick asks whether this sector is on the turn, and which funds are on the move.

China appears on our radar

So far, 2018 has been a miserable year for people investing in China. The Shanghai Composite, a stockmarket index of all stocks that are traded at the Shanghai Stock Exchange, is down over 15%, and the Shenzhen Composite Index, which includes all companies listed on the Shenzhen Stock Exchange, is down nearly 25%. The Chinext (China's equivalent of the NASDAQ) is down around 20%.

In the last couple of months, the Shanghai Composite has closed below 2,700 on several occasions. It hasn't been that low since 2014.

Past performance is not a guide to future performance

It's now lost 46% of its value since its peak in June 2015 and is 54% lower than the all-time high that we saw in October 2007. Or, to put it another way, it would need to go up by nearly 120% to set a new record high.

The poor performance this year has mainly been attributed to the trade war between China and the USA. President Trump is attempting to level up the playing field and reduce the imbalance of trade between America, China, the EU, and many nations around the world.

At the beginning of the year, the US started by imposing tariffs on solar panels, most of which are manufactured in China, then during the summer another $50 billion worth of goods were targeted. In September US duty was applied to a further $200 billion of Chinese imports. Chinese stocks initially dipped, but the Shanghai Composite index ended the week higher partly because the US tariffs had been set at a lower level than initially feared.

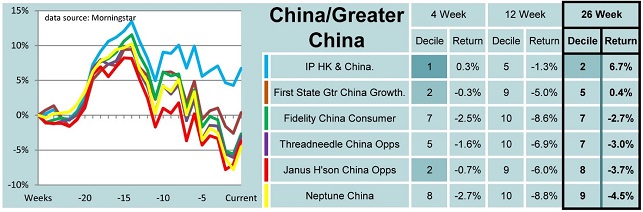

Each week, Saltydog Investor looks at the sector performance of the leading 50% of funds in each of the Investment Association sectors. In last week's reports one of the standout performers was the China & Greater China sector, gaining 3.4% in a single week. Could it be that this sector is on the turn?

We also look at the leading funds in each sector based on their performance over the last four and 26 weeks.

Here's one of those tables.

Past performance is not a guide to future performance.

All of the funds have gone up in the last couple of weeks. It's too early to tell if they're going to drop back again, as we've seen several times over the last six months, but we'll certainly be keeping an eye on them over the next few weeks.

• Why FAANG stocks may be the wrong place to be

• A resurgence for UK smaller companies

• A shot across the bow for funds with overseas earnings

Regardless of the actions of the United States, the long-term growth of the world economy is probably still going to come from China. It's predicted that China's growth will drop from 6.9% in 2017 to 6.6% in 2018 and then 6.4% in 2019, but that's still significantly higher than anything that we're expecting to see in the developed economies. Forecasts for the US, the euro area, and Japan are all below 3%.

China also has a well-developed infrastructure, access to natural resources with established supply chains, and an enormous workforce that is becoming increasingly more skilful. I recently read that it now has four times as many science and technology graduates as the US. All these things make expansion possible.

It has its own domestic population to sell to - all 1.4 billion of them - and they're only just starting down the road of consumerism. It also has India, Australia, Russia and the ASEAN countries on its doorstep.

The last year may have been difficult, but at some point the tide will turn and when it does it could be dramatic.

For more information about Saltydog Investor, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.