Three-day fee-free trading offer on US shares

interactive investor launches offer as US earnings season buzz continues.

31st July 2024 11:08

by Camilla Esmund from interactive investor

- interactive investor customers (new and existing) will not pay trading fees (usually £3.99) on buy and sell orders of US shares from Wed 31 July to Fri 2 August 2024 (inclusive), as US earnings season launches into its busiest period

interactive investor (ii) the UK’s second-largest investment platform for private investors, is launching a three-day trading offer on US shares, to coincide with the busiest period of US earnings.

During this three-day offer, interactive investor customers (new and existing) will enjoy £0 commission on buy and sell orders of US shares placed via the ii website and the ii mobile app, executed from Wed 31 July to Fri 2 August 2024 (inclusive).

The offer is open to both new and existing ii customers. Not only will investors on interactive investor be benefiting from the platform’s unique flat-fee pricing, allowing them to keep more of what they accumulate over time, they’ll also be getting a unique chance to explore opportunities in the US market without paying any additional fee.

With US earnings season in full swing, there’s a lot for investors to keep their eyes on. Investors can see if US big tech companies retain their popularity, and ii’s investors will have access to the likes of Apple Inc (NASDAQ:AAPL), Amazon.com Inc (NASDAQ:AMZN), and Meta Platforms Inc Class A (NASDAQ:META), which are all due to announce their results over the course of ii’s three-day US trading offer.

Lee Wild, Head of Equity Strategy, interactive investor, says: “It’s easy to simply focus on UK stocks and funds when it comes to investing, as we tend to stick with what’s familiar to us. However, it’s important to remember that looking to other markets, such as the US, can play a big role in helping to diversify your portfolio and find additional pockets of growth.

“A market like the US gives you access to exciting household names who may be enjoying a significant growth period, and this three-day trading offer is the perfect opportunity to dip your toes into the US market.

“Our recent ii index found that many ii investors are currently interested in UK financial services and pharmaceutical companies. It may be that some of the large American equivalents also catch the eye.”

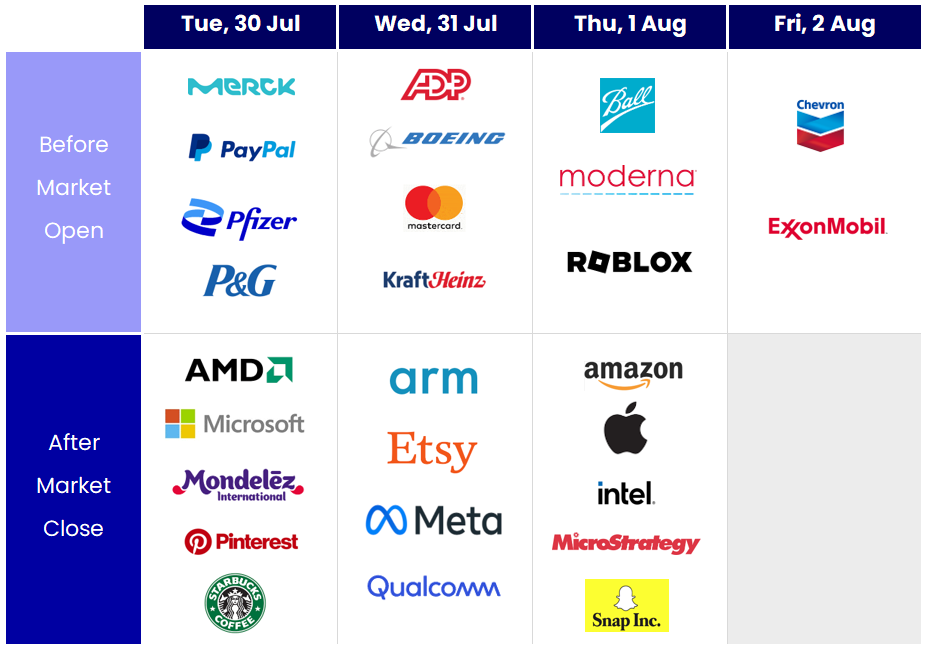

Key US earnings announcements this week

Will the ‘Magnificent Seven’ hold up in this earnings season?

Victoria Scholar, Head of Investment, interactive investor, explains what investors should look out for, she says: “We are in the midst of a highly opportunistic moment for investors. US earnings season is in full swing, providing potentially pivotal clues into the strength of corporate America.

“So far this year, US indices have performed well, fuelled by the excitement around artificial intelligence that has powered tech giants like NVIDIA Corp (NASDAQ:NVDA), Microsoft Corp (NASDAQ:MSFT), and Apple. But more recently, price action has become shakier amid concerns about a lack of market breadth in the rally and an over-dependence on a handful of tech names that arguably leaves markets vulnerable to a correction.

“Last week Tesla Inc (NASDAQ:TSLA)’s earnings sent its shares down over 12% in a single session, leading to a wider market sell-off with the tech-heavy Nasdaq shedding 3.6%, its worst session since 2022. On Tuesday, Microsoft’s shares fell on lower-than-expected quarterly cloud revenue despite a headline top and bottom line beat.

“Further earnings reports out this week will provide critical insight into the recent performance at US companies including Meta later today, followed by Amazon and Apple tomorrow…to name just a few.

“This week is also very important in terms of monetary policy – the Bank of Japan raised its benchmark interest rate overnight, while the Federal Reserve and the Bank of England will announce their rate decisions today and tomorrow respectively. When combined with the fact that Friday brings the latest US jobs report, this week is shaping up to be a highly eventful one for investors.”

Notes to Editors

US share trading offer - terms and conditions

- A trading fee of £0 is applicable to all buy and sell orders of US shares placed via the ii website and using the interactive investor mobile apps executed between 2.30pm (BST) on 31 July 2024 and 9pm (BST) on 2 August 2024 (the "Offer Period")(the "Offer"). For the avoidance of any doubt, any orders placed within the Offer Period but not executed until after the Offer Period has ended will not be eligible for this Offer.

- The Offer is open to new and existing customers.

- Before you can buy US-listed shares, you need to complete the relevant IRS W-8 form. If you are a UK resident and your account is in your individual name you can complete the form online. We cannot guarantee that the process of either opening a new account and/or enabling the account for international share dealing will be completed before the Offer closes.

- These terms and conditions should be read in conjunction with the Interactive Investor Services Limited ("IISL", "ii", "we" or "our") Terms of Service and the ii SIPP Terms (together, the "Terms of Service"). In the event of a conflict between these terms and conditions and the Terms of Service, these terms shall prevail.

- After the Offer Period, the trading fee you will be required to pay will be as set out in our Rates and Charges.

- Orders placed via telephone dealing are not included in this Offer and will be subject to the charge set out in our Rates and Charges.

- All other fees set out in our Rates and Charges, (eg foreign exchange rates for currency conversion and government charges), are not subject to this Offer and shall continue to apply during the Offer Period.

- Anyone who is (in our reasonable opinion) seen to be abusing the offer may be excluded at our sole discretion.

- By participating in the Offer, you agree that ii will not be liable for any costs, expenses, loss, or damage sustained or incurred with regards to the Offer.

- We reserve the right to alter, withdraw or amend this Offer and/or these terms and conditions at any time without prior notice.

- All participants to this Offer agree to be bound by these terms and conditions.

- These terms are governed by English law.

- IISL is the promoter of this Offer. IISL’s registered office is at 201 Deansgate, Manchester M3 3NW.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.