Three travel shares to buy and sell

Our head of markets suggests stocks to watch given that global tourism is booming.

9th December 2019 09:54

by Richard Hunter from interactive investor

Our head of markets suggests stocks to watch given that global tourism is booming.

Travel and leisure is an intriguing sector at the moment. On the one hand it has obvious attractions (we tend to go on holiday whatever the economic weather), yet it’s one that’s being buffeted by global economic concerns.

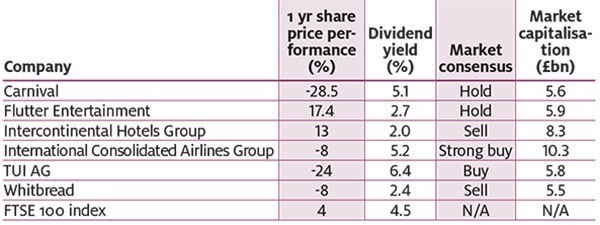

As defined by the London Stock Exchange (we are limiting the scope of this article to the FTSE 100 index), the sector comprises six firms, the details of which are highlighted below and in the Tape table.

Travel and leisure sector

Carnival (LSE:CCL) is a UK-based cruise firm that provides leisure travel to major cruise destinations around the world. Its portfolio of cruise brands includes Carnival Cruise Line, Princess Cruises, Cunard and P&O Cruises.

Flutter Entertainment (LSE:FLTR) was formerly known as Paddy Power Betfair. It is a UK-based gaming and sports betting operator, although its markets are also international.

InterContinental Hotels Group (LSE:IHG) owns, manages, franchises, and leases hotels and resorts. It operates hotels under its brands, which include InterContinental Crowne Plaza and Holiday Inn.

International Consolidated Airlines Group (LSE:IAG) is in the operation of international and domestic scheduled air services for the carriage of passengers and cargo. It operates through airlines including British Airways, Iberia and Vueling.

TUI AG (LSE:TUI) is an integrated leisure tourism company that offers holiday planning, booking, flights, accommodation, transfers and other activities.

Whitbread (LSE:WTB) operates hotels and restaurants, and is largely represented by the Premier Inn brand, which provides services in relation to accommodation in the UK and internationally. The company’s restaurant brands include Beefeater and Brewers Fayre.

Tale of the tape

Sources: Digital Look/ProQuote/FT, as at 23 October 2019

Travel

As is clear from some of the one-year share price movements in the table, the potential of the travel sector has not been realised in the recent past.

Such potential is evidenced by the World Tourism Organisation (UNTWO) reporting a record 1.4 billion of international tourist arrivals in 2018, 6% up from the year before, equating to $1.7 trillion (£1.3 trillion) of spending, itself equivalent to around 2% of total global GDP. By way of context, the number of tourist arrivals was 25 million in 1950, 166 million in 1970 and 435 million in 1990.

The drivers for this growth remain intact, the most recent being the revolution of online bookings and online reviews, which has both increased satisfaction and reduced prices, meaning more people are travelling more often. Meanwhile, the rise in the middle-class population across the globe, the increased propensity of millennials to travel when compared to previous generations, and increased youth awareness about travel destinations are all playing their part.

Unfortunately, the overhangs from the China/US trade war spat, leading to fears of a global economic slowdown, and the implications of Brexit have largely had a detrimental effect on travel companies’ share prices, if not (as yet) on the travellers themselves.

There is an old investment adage that “It is often better to travel than to arrive”, referring to the market’s need to anticipate future earnings and profits. For the moment at least, the shares of the travel companies have not received the memo.

Leisure

Firmly in the ‘leisure’ part of the equation is Flutter Entertainment, formerly known as Paddy Power Betfair. The firm is well placed to benefit from a couple of developments which have driven online gaming, and sports betting in particular, to new levels.

Increased mobile penetration has been a major factor, with data company H2 Gambling Capital estimating that mobile usage for online gaming will rise from 41% in 2018 to over 50% in 2022.

Elsewhere, the relaxation of local regulations in the United States has opened another door, following the repeal last May of the Professional and Amateur Sports Protection Act (PASPA) of 1992, which had banned sports betting in all but four states.

Three stocks to watch

Tui: a recent trading update delivered proof, if it were needed, that these are tough times in the travel industry.

The Holiday Experiences, Cruises and Destination Experiences divisions have continued their strong run in line with expectations, with the summer season closing out as forecast. Even the embattled markets and airlines division has seen something of an improvement since the previous trading update; for the latter, the continued grounding of its Boeing 737 fleet is both costly and currently out of TUI’s hands. The demise of rival Thomas Cook Group (LSE:TCG) may well present TUI with unexpected opportunities, although it may be some time until such benefits wash through. The current market consensus of the shares is a buy.

Whitbread: the majority of the group is now represented by Premier Inn following the sale of Costa Coffee, and is therefore largely in the hands of the hotels market. As business confidence wanes given the uncertain economic outlook in the UK, corporate business travel expenditure is at risk.

In an effort to spread its wings, Whitbread is looking to expand into a German market which lends itself to this business model. Although the longer-term strategy is understandable, the current timing is unfavourable, with Germany currently facing its own economic turmoil.

The shares have underperformed of late and the market consensus of the shares has now swung to a sell.

International Consolidated Airlines: as can be seen from the demise of several smaller airlines over recent times, fortunes can turn on a sixpence in this highly cyclical industry. A profits warning at the end of September, following the cancellation of more than 2,000 British Airways flights due to industrial action, was not welcomed.

Even so, the company remains cash-generative, as partly evidenced by the current dividend yield of 5.2%. In addition, it also has access to the lower end of the market via its budget airline presence, while ongoing industry consolidation could present further opportunities.

There has been little progress in talks with the BALPA union over pilot pay, leaving the risk that this year’s performance could be blighted by further strikes. The market consensus of the shares as a strong buy, however, defies this gloom in favour of strong longer-term prospects.

Richard Hunter is head of markets at interactive investor, Money Observer’s parent company.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.