The three UK funds we just sold

The Tory leadership contest and Brexit uncertainty have spooked markets, so time to exit these funds.

15th July 2019 12:44

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

The Tory leadership contest and Brexit uncertainty have spooked markets, so time to exit these funds.

Saltydog Portfolios continue to reduce exposure to the UK

At the beginning of this year our demonstration portfolios were basically out of the equity markets, with significant cash holdings. We only really started reinvesting at the end of January and into February.

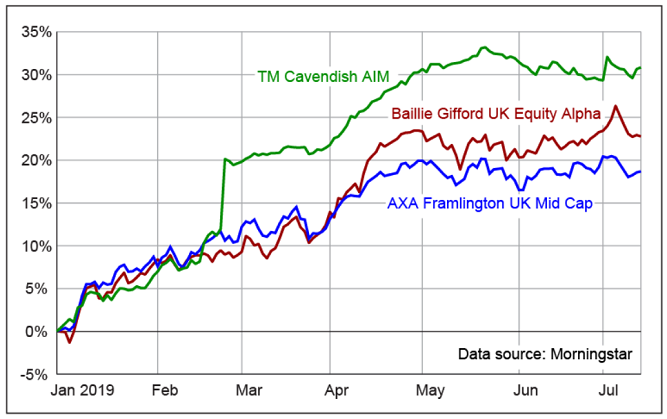

Some of our earliest purchases were into funds investing predominantly in the UK. On the 24 January we invested in the AXA Framlington UK Mid Cap fund, on 7 February we invested in the Baillie Gifford UK Equity Alpha fund, and on 7 March we invested in the Cavendish AIM.

We weren't particularly optimistic when we first bought the AXA Framlington UK Mid Cap fund. I said…

"Over the last fortnight we've seen the UK equity sectors start to perform well. In the 'Steady as She Goes' Group the UK All Companies sector is now at the top of the table followed by the UK Smaller Companies sector. With all the uncertainty over Brexit there are plenty of things that could affect these sectors, but on the other hand if they've survived the recent turmoil then perhaps they've hit rock-bottom and are on the way up."

In the following weeks, the recovery around the world strengthened and the UK equity sectors continued to perform well. We added to our holdings in March.

Here's a graph showing how those funds have performed since the beginning of the year.

On 14 March, the UK Parliament voted to reject a no-deal Brexit under any circumstances, and, although there were many challenges ahead, it looked like Theresa May might finally get her withdrawal agreement through the House of Commons. The UK markets tended to rally when it looked like we would leave with a deal (or not leave at all), and at the same time the pound strengthened.

Well, now that all feels like ancient history. We didn't leave the EU on the 29 March, or the revised deadline of the 12 April. Theresa May has resigned as leader of the Tory party and Boris Johnson and Jeremy Hunt are competing to take her place. The winner will then become Prime Minister. Both candidates have said that we must leave the EU, and both are willing to leave without a deal as a last resort.

Last week, we saw the pound fall below $1.25 – it hasn't regularly been this low since 2016/2017.

The UK funds that we invested in started well but have gone off the boil in the last few weeks. The imminent leadership contest and uncertainty over Brexit seems to have spooked the markets.

We started reducing our exposure to these funds last month and have now completely exited the AXA Framlington and Cavendish AIM funds.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.