Top 10 most-popular investment trusts: October 2021

Investors have been on the lookout for new opportunities, with four new entries to the top 10 table.

1st November 2021 14:35

by Tom Bailey from interactive investor

Investors have been on the lookout for new opportunities, with four new entries to the top 10 table.

There have been several new additions to our list of the most-bought investment trusts among interactive investor customers in October.

The latest figures show that Edinburgh Worldwide (LSE:EWI) re-entered the rankings, flying up to third place. The trust has been a regular member in the top 10, until it lost its place in August.

- Invest with ii: Top Investment Trusts | ii Super 60 Investments | Open a Trading Account

The trust was recently highlighted by interactive investor’s Kyle Caldwell, in his investment trust Bargain Hunter column. Due to recent short-term poor performance, the trust fell to an uncharacteristic discount. Earlier in October, the trust was trading on a discount of 8.3%. In contrast, the trust has typically traded at a premium, with its average over the past year being 1.1%. The surge of the trust towards the top of the most-bought list may reflect investors trying to snap up a bargain.

- Bargain Hunter: six trusts that are not usually this cheap

- Funds Fan: tax attack on Scottish Mortgage, and tech share tips

- Andrew Pitts’ trust tips: Nick Train available on a rare discount

The trust invests in small companies, usually with a growth or tech tilt, as it common for trusts managed by Baillie Gifford. Over the past three years, the trust has returned just shy of 100%.

Another new edition to the table was HarbourVest Global Private Equity (LSE:HVPE). The trust is a private equity-focused fund-of-funds. Its strategy is designed to give investors “part-ownership of a diversified portfolio of underlying private companies, spanning investment stages from early venture to large-cap buyouts”. Over the past year, it has demonstrated strong performance, returning investors more than 40%. Over the past three years, the trust has returned more than 80%.

Another addition to the list was Personal Assets (LSE:PNL) in 10th place. Personal Assets is seen as a defensive strategy. The trust’s portfolio generally lags markets when they are rising, but tends to fall less when markets are experiencing some turbulence. Over the past year ,it has returned 12% and over the past three years 28.6%.

Another defensive trust, Capital Gearing (LSE:CGT), moved up two places to fifth. The increase in popularity of both Personal Assets and Capital Gearing can be viewed as some investors becoming increasingly bearish.

Pacific Horizon (LSE:PHI) was another new entry. The Asia-Pacific focused trust, managed by Baillie Gifford, has seen strong performance over the past year, returning 41.6%. Even better, over three years it has provided investors with a return of 217%. Recent data from the Association of Investment Companies (AIC) showed that £1,000 put into the trust on 9/11 in 2001 would have been worth £27,080 after two decades.

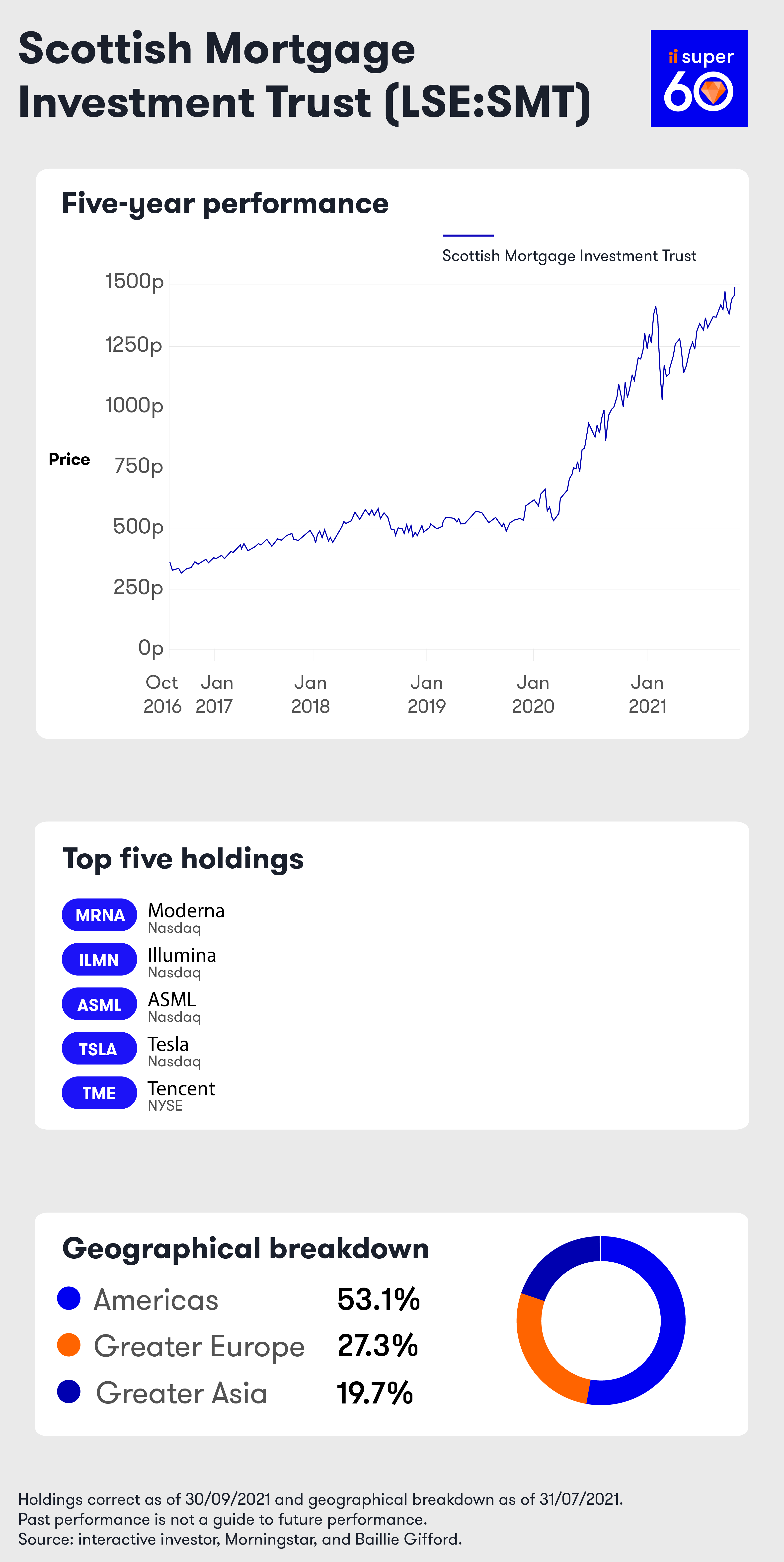

The only trust on the list with performance to rival this is Scottish Mortgage (LSE:SMT), which is also managed by Baillie Gifford. The trust has long been a favourite of investors, rarely losing its spot as the number one most-bought trust on the interactive investor platform. With a three-year performance of 224.7%, the appeal of this trust to investors is easy to understand. On a one-year basis, performance has also been strong, with returns standing at 48.4%.

Another regular member of the most-bought list is Smithson Investment Trust (LSE:SSON). The trust has once again made an appearance, albeit four places below where it was in the previous month. Since its launch in 2018, it has generally been an investor favourite. In part, this is due to its association with Terry Smith, who via Fundsmith Equity has consistently outperformed the market. However, Smithson’s performance alone would also put the trust in the spotlight, even without the association with the star fund manager. Over the past three years, it has returned investors 85.6%.

- Ian Cowie: this theme is a long-term winner

- Autumn Budget 2021 in 100 seconds

- Inflation forecast a real-life scare story for spooked pensioners and savers

City of London (LSE:CTY) climbed one place, coming in as the second most-bought trust. The trust has a long pedigree and is consistent dividend payer, having increased income payments for 55 consecutive years. However, over the past few years it has struggled with performance during the dividend drought that played out following Covid-19, returning investors just 15% over the past three years. Despite this, investors have by and large stuck by the trust, with it consistently being among the five most-bought trusts.

BlackRock World Mining Trust (LSE:BRWM) fell by two places. Managed by Evy Hambro, the trust has returned 47.8% over the past year, buoyed by the global rally in commodities.

Those exiting the top 10 were: BlackRock Throgmorton Trust (LSE:THRG), Finsbury Growth & Income (LSE:FGT) and Fidelity China Special Situations (LSE:FCSS).

Top 10 most-popular investment trusts: October 2021

| Rank | Trust | Sector | Rank change from September | One year-performance to 1 November | Three-year performance to 1 November 2021 (%) |

| 1 | Scottish Mortgage | Global | No change | 48.4 | 224.7 |

| 2 | City of London | UK Equity Income | Up 1 | 31.7 | 15 |

| 3 | Edinburgh Worldwide | Global Smaller Companies | New entry | 9.4 | 96.3 |

| 4 | HarbourVest Global Private Equity | Private Equity | New entry | 43.4 | 82.4 |

| 5 | Capital Gearing | Flexible Investment | Up 2 | 14.3 | 27.8 |

| 6 | Smithson Investment Trust | Global Smaller Companies | Down 4 | 27.1 | 85.6 |

| 7 | BlackRock World Mining | Commodities and Natural Resources | Down 2 | 47.8 | 96.7 |

| 8 | Monks Investment trust | Global | Up 2 | 20.1 | 85.8 |

| 9 | Pacific Horizon | Asia Pacific | New entry | 41.6 | 217.4 |

| 10 | Personal Assets | IT Flexible Investment | New entry | 12.4 | 28.6 |

Note: the top 10 is based on the number of “buys” during the month of October.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.