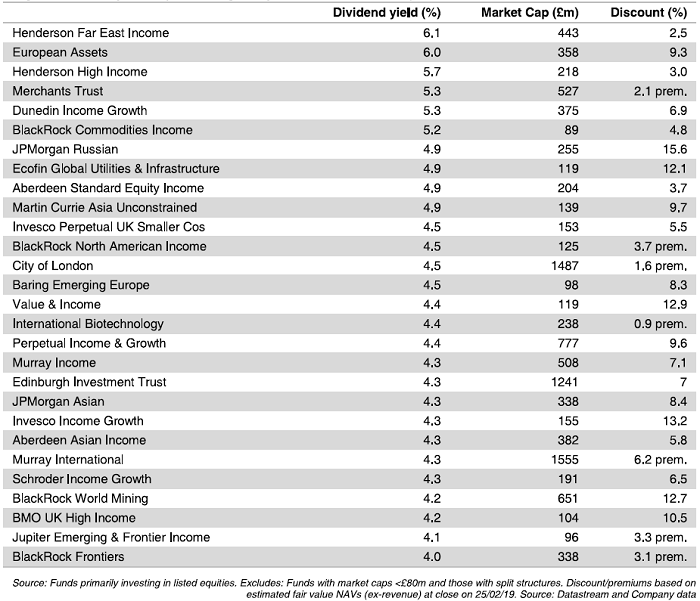

The top investment trusts yielding over 4%

There are now 28 trusts currently paying generous dividends. Investment bank Stifel names them here.

4th March 2019 10:11

by Tom Bailey from interactive investor

There are now 28 trusts currently paying generous dividends. Investment bank Stifel names them here.

The number is an increase from the 21 trusts on the list six months ago. That increase, however, is the result of both increases in dividend payouts and share price falls among trusts.

Murray International (LSE:MYI), for instance, has a yield of 4.3%. That however, was the function of both an increased dividend and a 4% share price fall over the past year.

UK equity trusts continued to be well represented among those with the highest yield. Merchants, which invests in FTSE 100 listed companies, had the highest yield in the UK sector, at 5.3%. Also on the list was City of London (LSE:CTY). Its 4.5% yield in part reflects the fact that it is once again able to grow its dividend, as it has done for the past 52 years.

When it came to Asia-focused trusts, Henderson Far East Income (LSE:HFEL) with a dividend yield of 6.1% topped the list for both this sector and trusts overall.

Following closely behind was European Assets (LSE:EAT), with a yield of 6%. The trust invests in European mid and small caps. According to Stifel:

"The trust has adopted a high distribution policy whereby dividends are paid out of current year net profits and other reserves, and its yield currently stands near the top of the list at 6.0%."

Also among high-yielding European trusts was Baring Emerging Europe (LSE:BEE), with a yield of 4.5%. In order to pay its dividend the trust is able to use up to 1% of its net asset value for payouts.

Another on the list was BlackRock World Mining Trust (LSE:BRWM), which, owing to commodity price falls in 2015 and 2016, was forced to cut payouts for both years. However, since 2017 the trust has been able to start growing its dividend again, and it currently yields 4.3%.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.