Top sectors in August and the metals doing better than gold

Saltydog analyst runs through the best-performing sectors and where he is fishing for ideas.

9th September 2019 13:50

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Saltydog analyst runs through the best-performing sectors and where he is fishing for ideas.

IA sectors struggle in August

At Saltydog Investor we review the performance of all of the Investment Association sectors each week and then go on to highlight the leading funds in each sector.

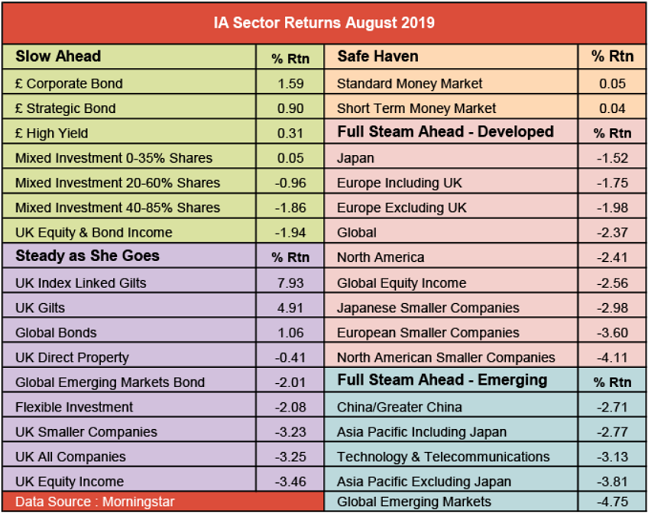

To help our analysis we group together sectors which have had a similar level of volatility in the past. These groups are:

Safe Haven: Very low risk, but also very low returns.

Slow Ahead: Normally a low risk level and often with adequate returns.

Steady as She Goes: Generally low to medium risk, with potentially higher returns.

Full Steam Ahead: Higher risk, but with the possibility of the highest returns.

We focus on the sectors because they reflect what is happening at a macroeconomic level. Once we've established which sectors we want to invest in, picking the best-performing funds is relatively straightforward.

In August, most sectors went down:

The two money market sectors in the 'Safe Haven' Group made gains, but nothing to write home about. At 0.05%, the Standard Money Market rate would give you less than 1% per year and is similar to the current Bank of England interest rate of 0.75%.

In the 'Slow Ahead' group, the sectors focusing on bonds did better than the ones also investing in equities, which was expected as most stock markets around the world had a difficult August.

The same was true in the 'Steady as She Goes' group where the best performing sector of all, 'UK Index Linked Gilts,' went up by nearly 8% during the month. All of the sectors in the ‘Full Steam Ahead’ groups went down.

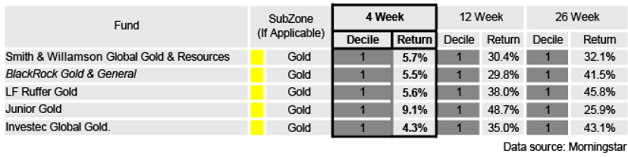

The Investment Association doesn't provide data for the specialist sector because it contains all sorts of different funds that can't really be compared on a like-for-like basis. At Saltydog Investor, we don't include them in any of our groups, but we do report on the sector as a whole, and break it down into various SubZones.

Over the last few months the gold funds, which tend to invest in companies mining gold or other precious metals, have been at the top of the table, and they were again last week:

We've been holding the Investec Global Gold fund for a few months, and recently invested in the Smith & Williamson Global Gold and Resources fund.

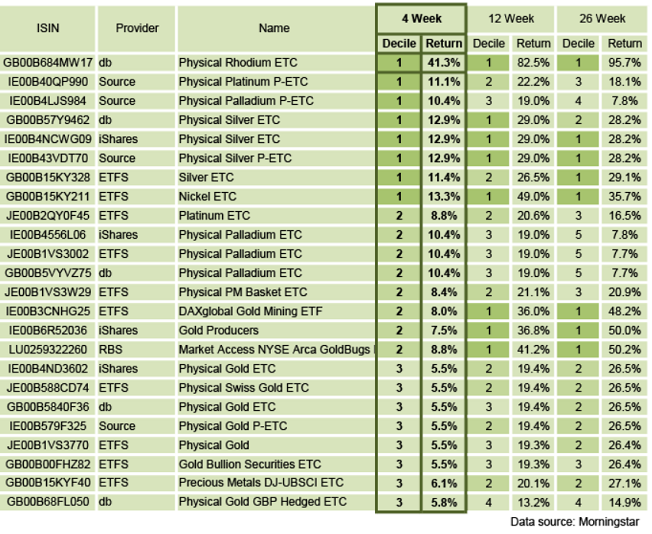

As well as looking at Unit Trusts and Open-Ended Investment Companies, we also analyse ETFs/ETCs and Investment Trusts. In our ETF/ETC reports, gold is performing well, but it's interesting to see that other metals are doing better.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.