Trouble ahead for M&S in 2026?

After successfully calling a rally in the retailer's shares in September, independent analyst Alistair Strang runs through his new share price forecast.

18th December 2025 07:52

by Alistair Strang from Trends and Targets

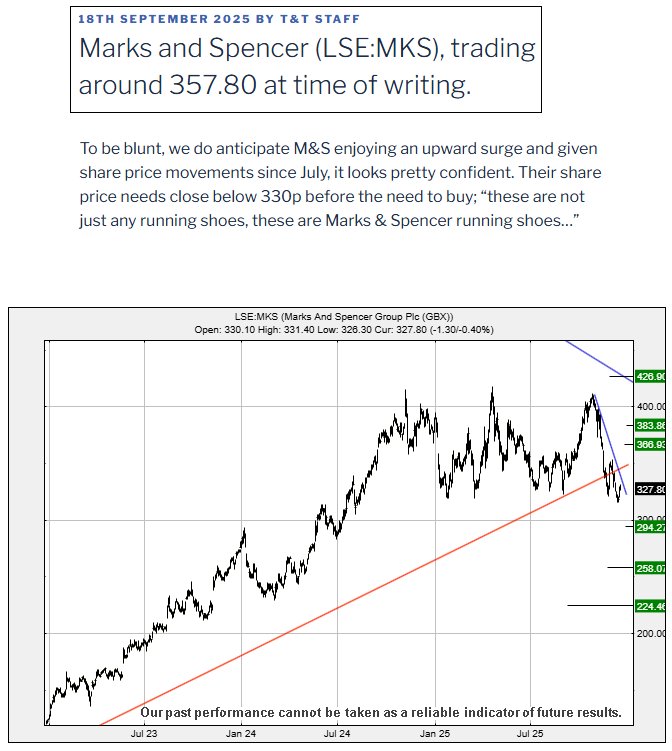

We reviewed Marks & Spencer Group (LSE:MKS) in mid-September, giving one of our very rare “no-brainer” price movement predictions. Within days, it fulfilled the requirements detailed in our scenario, achieving our 393p target and even, somewhat hesitantly, taking the first step on a path to 428p. But alas, the share price has now managed to cancel our serious Big Picture optimism by closing below 330p.

- Invest with ii:Open a Stocks & Shares ISA | Top ISA Funds | Transfer your ISA to ii

From our perspective, numerically this is a hanging offence. Now, the situation with M&S demands the price close above 342p to escape its visual doom as it .

At present, it looks like weakness below 315p shall trigger reversals down to an initial 294p with our secondary, if broken, calculating at ideally a bounce before 256p. We should mention that closure below 256p implies a future bottom awaits at 224p, but our suspicion is the market shall declare an “oops” moment before our secondary target of 294p is broken.

Of course, there’s always the risk M&S shall somehow find something positive to say about life in the UK, meaning above 342p should trigger an attempt at 366p with our secondary, if beaten, at a future 383p. With regret, about the best we can suggest is those who profited with our September gain scenario remain wearing their M&S running shoes as it looks like further dips are ahead.

Then again, perhaps the speculated BoE interest rate reduction today shall give immediate hope for an improvement in M&S's retail sales in the months ahead. We suspect the converse.

Source: Trends and Targets. Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.