A UK small-cap and some future price potentials

Independent analyst Alistair Strang considers the future direction of James Fisher shares.

3rd April 2024 08:33

by Alistair Strang from Trends and Targets

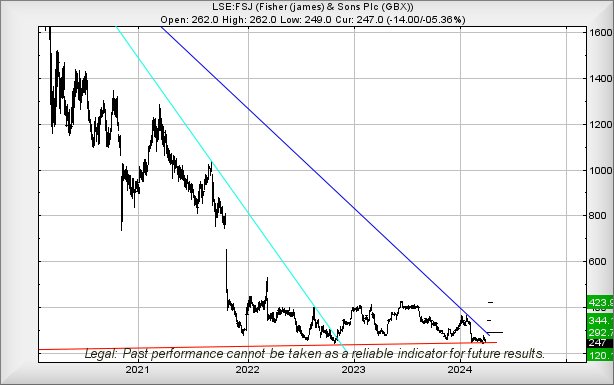

Fisher (James) & Sons (LSE:FSJ) are at around 247p currently.

For the past couple of years, it’s almost felt like a rule was being applied, one designed to make traders believe the share price could not sink below 245p. We often believe this can be an example of brokers exercising a sense of humour, awaiting sufficient number of shares purchased at “bottom” prior to executing a final “gotcha” drop.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

In the case of Fisher, we're not entirely confident this is the case as, from a big-picture stance, it is difficult to calculate below 245p without coming up with answers that are prefaced by impossible minus signs. Perhaps it is the case that the share price is indeed at a “bottom”, although when we review movements since 2022, there is a vague chance that weakness below 245p could maybe bottom at 120p.

Should we chose to embrace optimism, above 277p could hopefully trigger recovery to an initial important 292p. Recovery such as this would be important, exceeding the blue downtrend and transporting the share price into a zone where a longer-term cycle to 344p looks very possible.

In this instance, we can even supply a third-level target potential at 423p, an ambition which makes a lot of visual sense and implies that any break upwards is liable to find the share price stuck in its channel between 245p and 423p. Only with closure above 423p will we dare to believe a significant change has taken place in its longer-term potentials.

Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.