What next for BHP Group shares?

18th August 2021 08:02

by Alistair Strang from Trends and Targets

The shares hit a 10-year high yesterday, just as this technical analyst predicted. Here's his updated analysis.

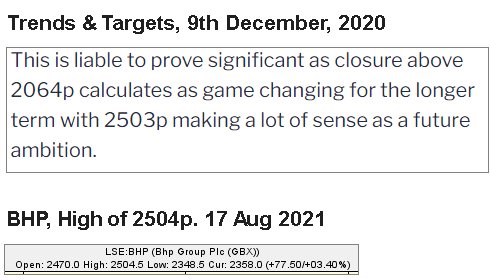

In a stunning movement, BHP Group (LSE:BHP) shares reached a high of 2,504p on 17 August. It was stunning for various reasons.

When we reviewed the share nine months ago, our secondary target was at 2,503p. Being just 1p out in target logic for a 25 quid share is quite pleasing. Also, this represented a new post-pandemic high for the company, well deserved given their reported boost in profits and payment of a decent dividend.

- Invest with ii: Top UK Shares | Share Prices Today | Open a Trading Account

Of course, we’d wondered if the announcement of the company intending to delist from the FTSE in London and fleeing to the Sydney exchange would foul things up.

On paper, this shouldn’t be an issue for shareholders, but there may prove to be a problem with funds which only track FTSE 100 components. Perhaps a bunch of shares may require sold, prior to BHP moving house. But for the FTSE itself, losing BHP may not be a bad thing. The massive capital size of BHP ensures mining sector price movements can disproportionately affect the FTSE, and the loss of the biggest may redress the balance. Then again, if this is so with BHP enjoying such a rally, why the heck is the FTSE in such a dire state, especially when compared to other countries and their national indices.

The chart below certainly presents a pretty picture with BHP “only” needing trades now above 2,505p to trigger further growth to 2,575p. If bettered, our longer term secondary calculation comes out with a future 2,751p as a major ambition.

- ii view: BHP shares soar after commodity portfolio revamp

- Why reading charts can help you become a better investor

For everything to go pear-shaped, BHP's share price currently needs to weaken below 1,980p. Such a movement looks capable of inspiring greater terror than being offered Vegemite in Australia.

Initially, if this level triggers, we’re looking for reversal to 1,793p which is a problem from our perspective. The trend break circled in red on the chart shows the current growth cycle triggered from 1,800p. Anything capable of driving the price below such a level has dire implication for the longer term, suggesting a painful reversal cycle to 1,558p shall become probable.

Given the companies record profits and stated aims for reorganisation, we’re not currently convinced by any threat of weakness.

Source: Trends and Targets. Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.