Where next for new UK cannabis stock?

Time will tell, but US ‘pot stocks’ tend to come off their highs very quickly.

3rd March 2021 08:47

by Alistair Strang from Trends and Targets

Time will tell, but US ‘pot stocks’ tend to come off their highs very quickly.

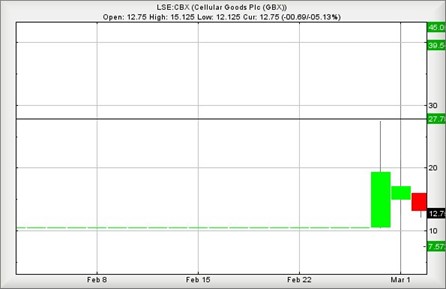

Cellular Goods Plc

The period since 2018 saw the launch of several cannabis-focussed listings in Canada and the US. Virtually all of them followed similar share price trajectories, with incredible highs followed by incredible lows when the markets realised there was some distance to go in terms of regulation.

Cellular Goods (LSE:CBX), a UK listing, appears to be taking advantage of proposed changes to Financial Conduct Authority rules, allowing companies to list on the UK stock market if their products have a medical application.

In one respect, Cellular Goods differs from other companies in the field. Its products are synthetic and produced in a lab. It is interesting the company website suggests focus on beauty and skincare first, then athletic recovery products. This, doubtless, is where the medical application can be found.

Cellular Goods’ listing is effectively only three sessions old. If we opt to review the course plotted by Tilray on the Nasdaq or Canopy Growth, the initial launch saw the share price flutter downhill. Only once the earliest high was exceeded thereafter did things became very interesting.

For Tilray, this meant an eventual rise from $34 (£24.34) to $300 two months later. Then it fell off a cliff. For Canopy Growth, we saw a rise from $25 to $56. Then it also fell off a (smaller) cliff.

Should Cellular Goods intend a similar route, it's fairly key the price find sufficient excuse to trade above 27.5p.

- Chart of the week: high time for marijuana stocks?

- Revealed: the ETFs charging active manager fees

- Why reading charts can help you become a better investor

At present, this looks visually improbable. Currently trading at 12.75p, the share need only fall below 11.25p to doubtless discover a bottom of around 7.5p. For the brave, if such a level appears, it will doubtless serve as an ideal entry point for a punt for the longer term.

If we review the first few days of trading, the share price needs to exceed 16.75p currently, a movement theoretically capable of 27.75p and a nudge above its initial high price.

As a result, we can calculate a secondary potential of 39p. The price would need to trade above 45p to enter a world where the sky is the limit.

Do remember that Canadian and US cannabis prices, while doing extremely well in the months following launch, all tend to come off their highs quite brutally.

Source: Trends and Targets. Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.