Where next for Versarien's share price?

Our chartist examines the AIM company's closing prices to see where things might lead.

3rd September 2019 09:28

by Alistair Strang from Trends and Targets

Our chartist examines the AIM company's closing prices to see where things might lead.

Versarien PLC (LSE:VRS)

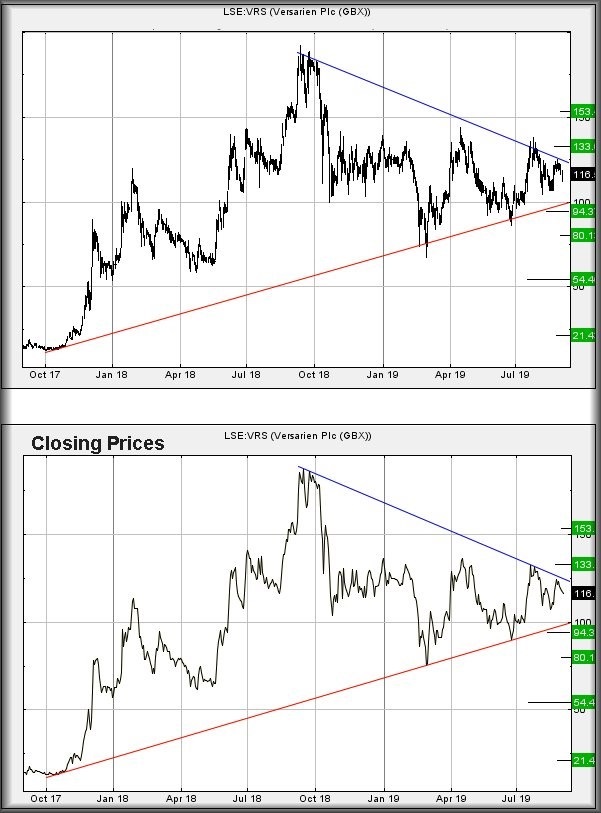

Sometimes, the glaringly obvious takes a while. In a return to "chart basics", Versarien (LSE:VRS) price movements remind us when trend lines might actually prove important. As the chart below highlights, at first glance it appears we've lost our minds.

Against most shares, a trend line is defined fairly easily. A downtrend maps the highs of each session. An uptrend maps the Lows of each session. And generally, these are the only two trend lines which matter, when trying to make sense of price movements.

On the other hand, there's Versarien.

When we review price movements since 2017, this share appears to be mapped by closing price with neither the high of the day or the low of the day getting a look in.

Hopefully the lower chart which simply shows closing prices serves to illustrate why this should prove interesting for the future. The implication is fairly straightforward.

If Versarien closes above blue or below red, it shall give a pretty solid clue the trend has actually changed with plans being made accordingly.

At present, closure below 100p would prove a poor show, taking the share into a region where reversal to an initial 94p makes sense. If broken, secondary is at 80p, along with the hope of a real bounce.

But the problem for the longer-term will come, if it ever closes below 80p. Such a calamity will open the door for reversal toward 54p initially with secondary an "ultimate" bottom of 21p. At present, nothing suggests this is possible.

The other side of the coin comes with closure above 125p as this should propel the price to an initial 133p. Secondary, if bettered, calculates at 153p.

For now, it's messing around and simply avoiding showing direction.

Source: Trends and Targets Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang, or interactive investor will be responsible for any losses that may be incurred as a result of following a trading idea.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.