Why this stock passes Share Sleuth's tests

This business has an attractive valuation and earnings yield, making it a buy for our companies analyst.

5th June 2019 10:34

by Richard Beddard from interactive investor

This business has an attractive valuation and earnings yield, making it a buy for our companies analyst.

This month, I have added RM (LSE:RM.), a company I profiled in the May issue's Share Watch pages, to the Share Sleuth portfolio. I was cautious about it back then, but digging into its history has emboldened me.

RM supplies schools with equipment and IT, and examination boards with e-marking software. These businesses are not obviously natural bedfellows, which means the company is complex and has to do lots of things well – one reason for my caution.

There are coherent aspects to RM's multifaceted strategy, though. All three parts of the business lower costs by using the company's Indian office for customer support and software development. RM Resources, which supplies everything from furniture to footballs, and RM Education, which supplies IT, share a customer base in UK schools.

RM Education is increasingly positioning itself as a supplier of software and services (as opposed to hardware), along the same lines as RM Results, the e-marking company. Most public exam scripts in the UK are scanned in and marked electronically, and RM Results appears to be the market leader. Since it has a good product and software is easy to export, RM Results has growth potential.

Another thing I had to get comfortable with before committing to the share was RM's profitability. RM is highly profiftable, but it has not always been so. The company was heavily dependent on Building Schools for the Future, a massive government-funded programme axed in 2010, and had to cope as the scheme wound down and revenues at RM Education fell dramatically.

It has also been extricating itself from unprofitable business contracted during the boom over the previous decade. I believe this process is substantially complete and the profitable core of RM is now exposed.

However, the shares remain attractively valued. RM's earnings yield is 10%, which is very high for a decent business.

I added 1,275 shares at a shade over 236p, a price quoted by a broker. Including £10 in lieu of broker fees and £15 in lieu of stamp duty, the transaction cost £3,038, just under 2.5% of the total value of the portfolio.

Coherent strategy

RM does not have the clockwork strategy I have valued so highly in recent additions. The trade is a step back to the thinking that led me to add shares in companies such as Dart (LSE:DTG) and Tristel (LSE:TSTL).

They were out of favour, but I could see glimmers of coherent strategy and their shares were cheap. Those companies turned out to have great strategies and are among the portfolio's best investments. Glimmers can disappear, though. They may have at System1 (LSE:SYS1), the portfolio's worst performer.

The trade has used up the portfolio's cash, so my next trade will necessarily be a sale. One company in the frame is Science (LSE:SAG), profiled in the June issue's Share Watch pages. I left the write-up of Science on a cliff hanger. The company is in good shape, it is embarking on a bold new acquisition strategy and its valuation is modest, but I am unmoved.

Science may, as planned, prosper as a cash cow – executive chairman Martyn Ratcliffe will use the cash to fund unrelated acquisitions – but this is not what I bought into when I added its shares to the portfolio many years ago. At the time, Science was a turnaround. It was a research and development consultancy that changed its business model from developing its own intellectual property to developing products for other companies.

As a gun for hire, it was more profitable, allowing it to expand through the acquisition of related consultancies. I thought the firm would grow this business, but its primary resource is scientists, and people businesses are not easy to scale. Now that Science is allowing itself to buy unrelated businesses, anything goes.

As well as turning around Science and some of its recent bolt-on acquisitions, Ratcliffe has had a hand in successful revivals before. One, ironically, was RM. He was executive chairman at RM between 2011 and 2013, and having done much of the surgery required, he left it a more coherent business.

Coherence is something I look for because I prefer judging strategies to assessing people. That is why our future probably lies with RM, the company Ratcliffe left, rather than Science, the company he is sticking with

Solid month for the Sleuth

RM adds profit potential

| Portfolio | Cost (£) | Value (£) | Return (%) | ||

|---|---|---|---|---|---|

| Cash | 269 | ||||

| Shares | 123,770 | ||||

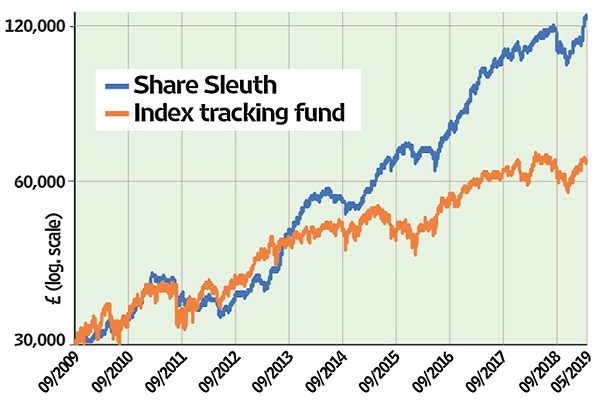

| Since 9 September 2009 | 30,000 | 124,038 | 313.00 | ||

| Companies | Shares | Cost (£) | Value (£) | Return (%) | |

| ALU | Alumasc | 938 | 999 | 868 | -13 |

| AVON | Avon Rubber | 192 | 2,510 | 2,703 | 8 |

| CFX | Colefax | 434 | 943 | 2,322 | 146 |

| CGS | Castings | 1,109 | 3,110 | 4,303 | 38 |

| CHH | Churchill China | 341 | 3,751 | 5,473 | 46 |

| CHRT | Cohort | 1,600 | 3,747 | 6,240 | 67 |

| DTG | Dart | 456 | 250 | 4,293 | 1,617 |

| DWHT | Dewhurst | 735 | 2,244 | 7,901 | 252 |

| GAW | Games Workshop | 198 | 568 | 7,983 | 1,306 |

| GDWN | Goodwin | 266 | 6,646 | 8,459 | 27 |

| HWDN | Howden Joinery | 748 | 3,228 | 3,894 | 21 |

| JDG | Judges Scientific | 252 | 5,989 | 7,825 | 31 |

| NXT | Next | 45 | 2,199 | 2,550 | 16 |

| PMP | Portmeirion | 349 | 3,212 | 4,188 | 30 |

| QTX | Quartix | 1,085 | 2,798 | 2,767 | -1 |

| RM. | RM | 1,275 | 3,038 | 2,977 | -2 |

| RSW | Renishaw | 92 | 1,739 | 4,013 | 131 |

| SAG | Science | 2,660 | 2,908 | 5,373 | 85 |

| SOLI | Solid State | 1,546 | 4,523 | 7,606 | 68 |

| SYS1 | System1 | 463 | 1,793 | 1,116 | -38 |

| TET | Treatt | 1,222 | 1,734 | 4,888 | 182 |

| TFW | Thorpe (F W) | 2,000 | 2,207 | 6,300 | 186 |

| TRI | Trifast | 2,261 | 3,357 | 5,200 | 55 |

| TSTL | Tristel | 750 | 268 | 2,400 | 795 |

| VCT | Victrex | 150 | 2,253 | 3,381 | 50 |

| XPP | XP Power | 339 | 6,287 | 8,746 | 39 |

Notes: New additions' transaction costs include £10 broker fee and 0.5% stamp duty where appropriate. Cash earns no interest. Dividends and sale proceeds are credited to the cash balance. £30,000 invested on 9 September 2009 would be worth £124,038 today. £30,000 invested in FTSE All-Share index tracker accumulation units would be worth £65,701 today. Objective: To beat the index tracker handsomely over five-year periods. Source: SharePad, as at 8 May 2019.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.