Wild’s Winter Portfolios 2025: plenty of time to bounce back

This six-month seasonal strategy has had a difficult start, but it’s early days and there have been encouraging signs from some of the constituents. A lot can happen between now and April.

5th December 2025 10:02

by Lee Wild from interactive investor

When this 12th edition of the winter portfolios was launched a month ago, I warned that stocks would face several headwinds during the six-month seasonal strategy. Not least of these was a strong summer, given the incredible rally from the tariff-crash lows in April that put many stocks on lofty valuations. Well, those fears were confirmed by stock market performance during November.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Valuations were one of the key drivers of a sell-off not just among expensive tech stocks, but companies across sectors that had outperformed over the past six months. With the US government still in shutdown and few obvious catalysts for the bulls, investors were happy to trouser significant profits.

Between the 12th and 20th November, the Nasdaq tech index slumped 5.7% and the S&P 500 fell 4.6%. The German Dax, Hang Seng, FTSE 100 and French Cac were all down between 3.2% and 4.5%.

In the UK, 3i Group Ord (LSE:III) fell 19% in those eight days, Burberry Group (LSE:BRBY), JD Sports Fashion (LSE:JD.) and Marks & Spencer Group (LSE:MKS) lost around 9% each, and high-flying banks such as Lloyds Banking Group (LSE:LLOY), NatWest Group (LSE:NWG) and Barclays (LSE:BARC) were down 7% or more. Vodafone Group (LSE:VOD), miners and star stock Rolls-Royce Holdings (LSE:RR.) also suffered sharp losses.

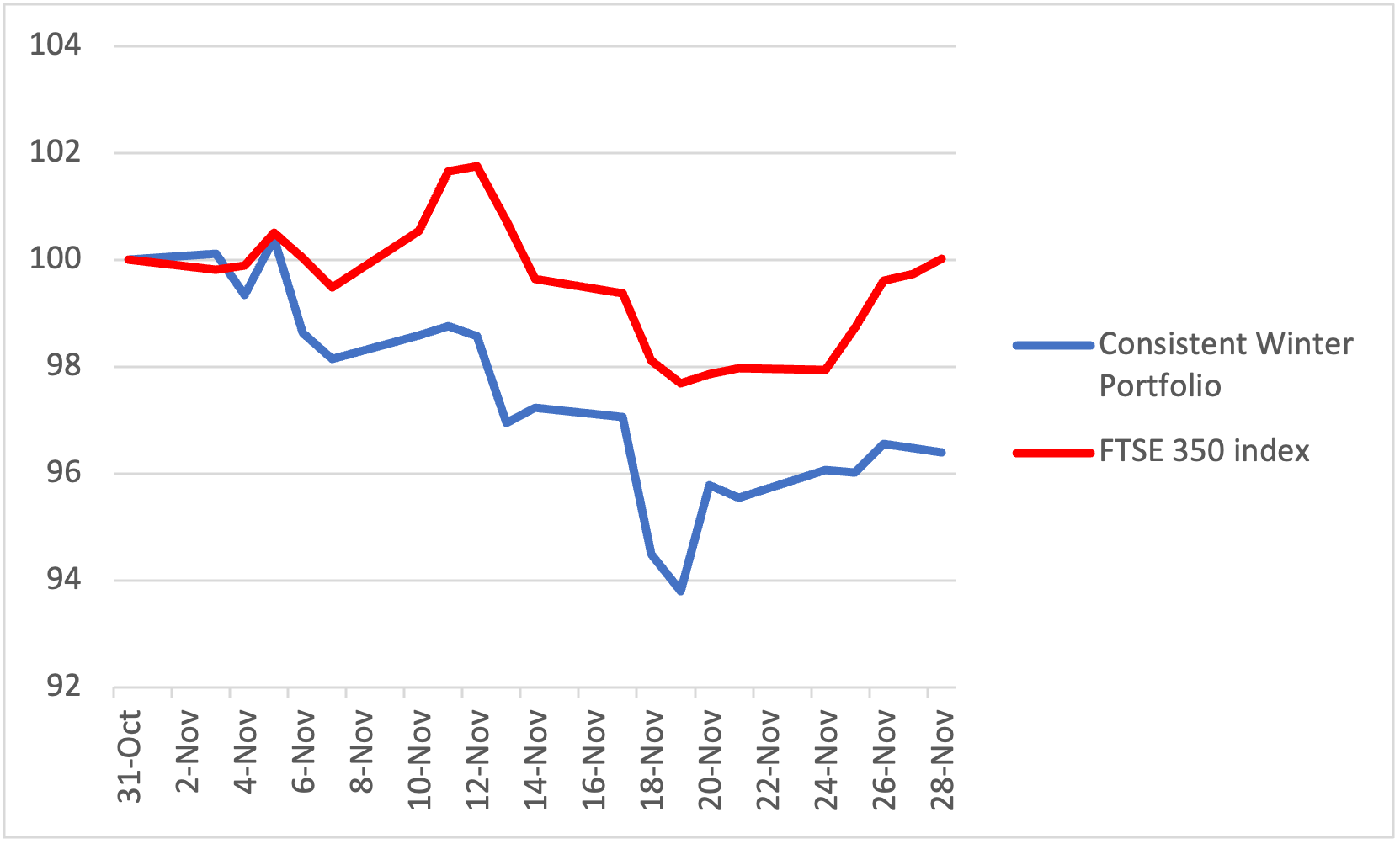

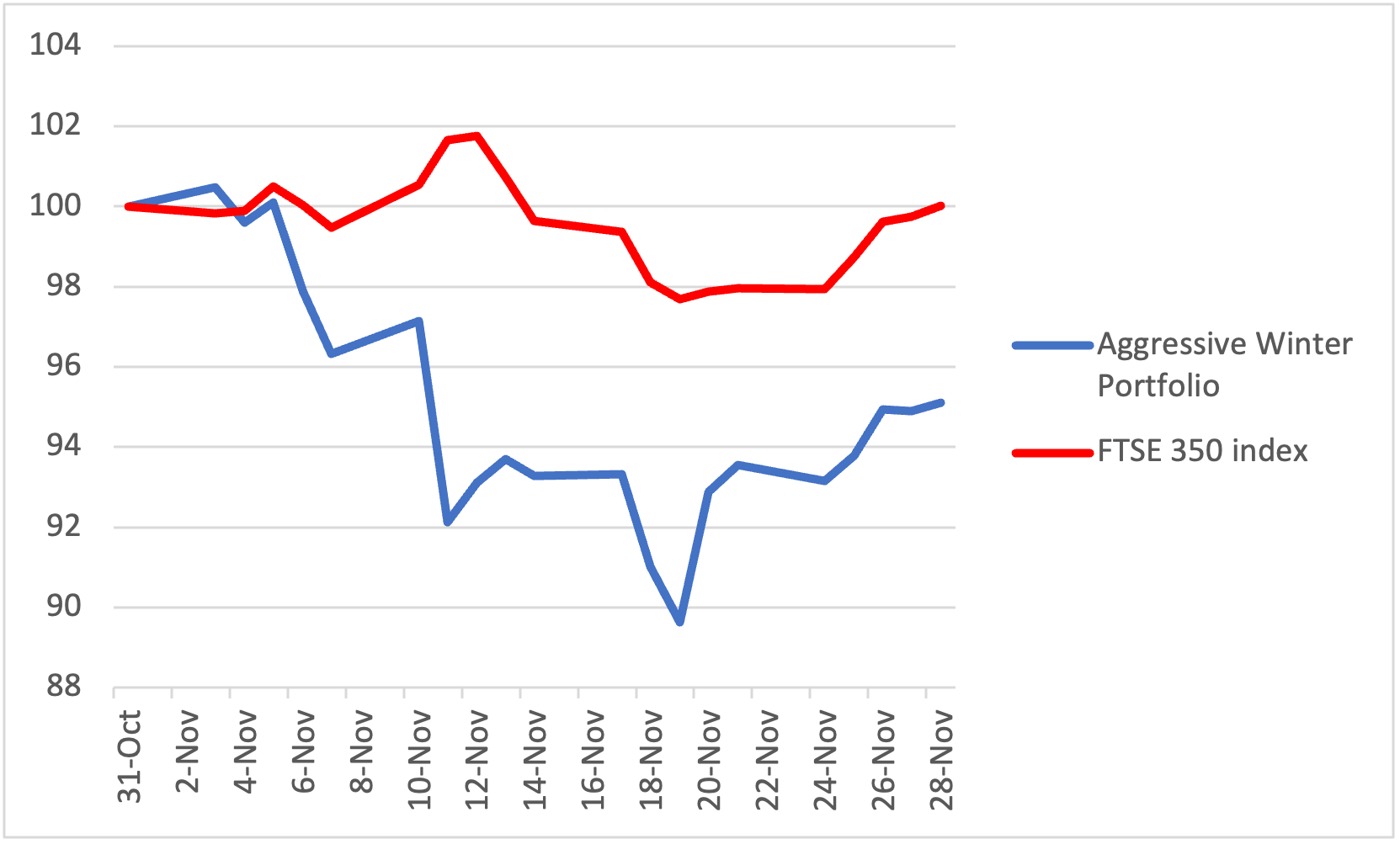

Sure, markets have recovered some ground, with investors seemingly comfortable buying the dip, but it meant Wild’s Winter Portfolios got off to a poor start. While the FTSE 350 benchmark index ended the first month of our investing winter flat at 5,299, the consistent portfolio shed 3.6% and the aggressive basket of shares fell 4.9%.

As a reminder, Wild’s Consistent Winter Portfolio is made up of the five FTSE 350 companies that have risen the most winters (between 1 November and 30 April) over the past decade. Entry criteria is relaxed slightly for Wild’s Aggressive Winter Portfolio, giving up some consistency in return for potentially bigger profits. Still, all constituents must have risen in at least eight of the previous 10 winters.

These data-driven portfolios are based on 10-year performance, so clearly there is a propensity for these stocks to outperform the wider market. Of course, markets get nervous from time to time; it’s natural. But there are also lots of potential positive catalysts – probable interest rate cuts soon, a strong third-quarter earnings season, and stocks still trading below peak valuations. A lot of analysts on Wall Street and in the Square Mile are optimistic about 2026, too. That’s no guarantee of success, but the fact that sell-offs have been shallower and shorter is a positive sign.

Historic Winter Portfolio Performance each November | |||

Year | Consistent Portfolio (%) | Aggressive Portfolio (%) | FTSE 350 benchmark index (%) |

2025-26 | -3.60 | -4.90 | 0.03 |

2024-25 | -4.39 | -2.49 | 2.14 |

2023-24 | 5.22 | 11.6 | 2.46 |

2022-23 | 7.94 | 17.9 | 6.80 |

2021-22 | 0.30 | -3.50 | -2.50 |

2020-21 | -2.03 | 2.10 | 12.3 |

2019-20 | 7.25 | 7.34 | 1.79 |

2018-19 | 6.48 | -4.44 | -2.11 |

2017-18 | -3.97 | -2.90 | -2.06 |

2016-17 | 4.97 | 4.49 | -2.06 |

2015-16 | 6.42 | 1.31 | 0.23 |

2014-15 | -1.69 | 5.04 | 3.98 |

Source: interactive investor using Morningstar data. Past performance is not a guide to future performance.

Wild’s Consistent Winter Portfolio 2025-26

Past performance is not a guide to future performance.

If FirstGroup (LSE:FGP) hadn’t issued a profit warning, the consistent portfolio would have ended the month flat. But it did, and the consistent basket of shares bears the scars of a 15.9% slump in the share price.

The bus and train operator faces an increase in employer National Insurance costs, continued inflationary pressures and lower commercial passenger volumes at the bus business. And despite upgrading forecasts for annual profits, there is no new share buyback programme as funds are used to repay debt.

Insurance firm Admiral Group (LSE:ADM) had traded sideways for much of the summer but drifted lower in the absence of any company news or inspiration from elsewhere. Shares were 3.2% easier for the month.

- ii view: FirstGroup shares driven lower by mixed results

- ii view: Halma breaks records amid data centre boom

It was a similar case at AG Barr (LSE:BAG), which fell 3% in November. The soft-drinks maker typically issues an update around the end of January where we’ll hopefully find out more. We may have to wait until March for the next scheduled update from Admiral.

On a brighter note, IT services firm Computacenter (LSE:CCC) delivered a positive return for the month of 3.6%. It published a third-quarter trading update just days before our portfolio launched. Otherwise, a buy note from UBS in which the broker upgraded its price target to 3,250p from 2,750p was the highlight of the month.

Safety products conglomerate Halma (LSE:HLMA) had been trading at record highs shortly before the month began. It was caught up in the mid-month sell-off but recovered all its lost ground following another guidance upgrade alongside half-year results. Profits beat City forecasts, offsetting concerns about the stock’s heady valuation. But quality isn’t cheap, and Halma shares rose 0.4% in November.

Wild’s Aggressive Winter Portfolio 2025-26

Past performance is not a guide to future performance.

It’s great to start this look at the aggressive portfolio with one of the biggest winners in any month in the 12 years of winter portfolios. Fantasy wargames company Games Workshop Group (LSE:GAW) jumped 21.9% to a record high following a typically short but very well-received trading update.

It said half-year profit will likely rise by at least another 6% to no less than £135 million, and that the dividend had increased to 100p, payable on 28 January. Analysts at Jefferies think the licensing success of the Space Marine 2 video game shows just how the Warhammer universe can reach a more mass-market customer. The broker raised its price target to 21,000p from 18,300p. Interim results are due on 13 January.

Engineering contractor Keller Group (LSE:KLR) added 2.3% in November, rebounding from a mid-month low. It ended at a one-year high and not far off an all-time best. It said it’s on track to deliver full-year underlying operating profit in line with market expectations of £214 million. Results are due on 3 March.

- 2026 look ahead: CHAOS or CALM?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

That’s where the good news ends. The remaining three constituents all suffered double-digit losses, including FirstGroup, which this year appears in both winter portfolios.

I was already worried about defence giant BAE Systems (LSE:BA.) given that the share price had already factored in a lot of good news ahead of the winter period. They’d rocketed 80% from the start of 2025 to their record high early October, much of that due to a promised increase in NATO military spend.

Despite a confident update mid-month, the shares continued to drift, ending November down 11.8%. Annual results are still seen matching figures upgraded at the half-year numbers, so watch for sales growth of 8-10% and increase in underlying operating profit of 9-11%. BAE has also secured orders of more than £27 billion in 2025 so far.

I’ve saved the worst till last. Hilton Food Group (LSE:HFG) tumbled 21% after issuing a second grim update in just over two months. After a mixed set of half-year numbers in September, the food packager has now warned that the wider UK seafood division continues to be impacted by softer white-fish demand. It blamed ongoing high raw material inflation and cautious consumer spending.

Still, it believes the normal seasonal uplift in Q4 will support overall performance in the near term. Fingers crossed.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.