Pension stories

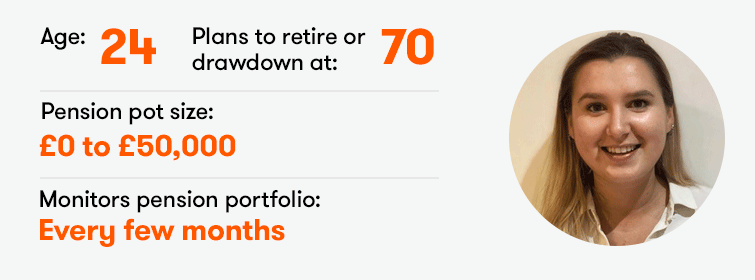

Natasha Melunsky

Important information: The ii SIPP is for people who want to make their own decisions when investing for retirement. As investment values can go down as well as up, you may end up with a retirement fund that’s worth less than what you invested. Usually, you won’t be able to withdraw your money until age 55 (57 from 2028). Before transferring your pension, check if you’ll be charged any exit fees and make sure you don't lose any valuable benefits such as guaranteed annuity rates, lower protected pension age or matching employer contributions. If you’re unsure about opening a SIPP or transferring your pension(s), please speak to an authorised financial adviser.

Did you find it easy to start investing for a pension?

Yes, in the sense that my job automatically takes out a percentage of my wage. I started investing for a pension at 18. It was hard to work out which funds to invest my personal savings in. I did a bit of research, looking at funds’ past performance and I spoke to family about their investments.

What current pension contributions do you make, either monthly or otherwise?

I contribute 7.1% of my wages monthly, and on top of this £75. My employer contributes 1/54th of my earnings.

Have you ever taken a break from pension saving?

No.

What do you invest in for your pension?

Funds, ready-made portfolio.

What are your five largest holdings?

I have only three. Vanguard’s US Equity Index fund is the largest, followed by its Emerging Markets Stock Index fund, and the LifeStrategy 80% Equity fund.

My pension is currently (as of 1 December 2020) invested internationally, with 52% in North America, 34% in Asia-Pacific, 3% in Central/South America and 3% in the Middle East/Africa. I would not consider investing in individual international stocks because my investment strategy involves funds [and] individual shares are too risky.

What is your investment objective/target pension pot or annual retirement income?

My target pension pot is around £500,000.

I do worry that I am not saving enough and not investing my money in the right funds.

Do you have any pension savings tips?

Invest a lot early because of compound interest and you will end up with a lot more money than if you started investing later on.

How do you feel about your pension?

I have always wanted to invest money in a pension to be able to live comfortably later on in life. I have investigated the performance of various funds recently, to determine where I should invest. I do worry that I am not saving enough and not investing in the right funds. I also worry that by putting money in my pension, it will mean that I won’t have enough to buy a house, or that this goal will take me much longer. At the moment, I am investing as much money as I can afford, and I have to just trust that in 30 years it will have been worth it.

Pensions can be a party pooper topic, but not at ii. We want to know more about the retirement hopes and fears of the nation. Please help us paint the fullest picture yet by taking part in our annual Great British Retirement Survey

Our expert’s view

Victoria Scholar writes...

Having begun investing in a pension at 18, Natasha has made a great start – most people do not invest in a workplace pension until they are 22, when auto-enrolment kicks in. Those extra four years could be worth more than £10,000 extra on her pot when she retires.

To make even more headway, Natasha could increase her contributions even further. It’s hard when you are young to justify higher pension contributions to yourself, because you might think that saving for buying a house is more important for any spare cash. Ideally, you want to be able to save for a house and contribute as much as possible to a pension, using the Lifetime ISA for your home purchase savings and your work pension for retirement. You can contribute 100% of your income up to a maximum of £60,000 a year into a pension (although most people contribute less than £10,000) – you don’t have to stick with the minimum contributions set by your employer when you start a job.

Natasha can afford to take a decent amount of risk with her pension as she has more than 40 years until her state pension entitlement age to ride out stock market lows and benefit from long-term growth. It might be worth reviewing whether the risk level of her investments is right for her age.

Dzmitry Lipski suggests a fund which might interest an investor in their 20s

A young investor with a long-term investment horizon could consider active funds investing in global smaller companies. The Montanaro Better World Fund invests globally in small and mid-cap companies that make a positive impact on the world.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.