The 10 hottest US stocks this past month

11th January 2019 11:45

by Lee Wild from interactive investor

There were bargains galore on Wall Street over the Christmas period. Lee Wild runs through the big winners and which stocks interactive investor customers were filling their stockings with.

US stocks have outperformed other global stockmarkets on the way up, so it's only logical that they would fall faster and further than other markets when the mood changed. And that they took a pounding in December is no surprise.

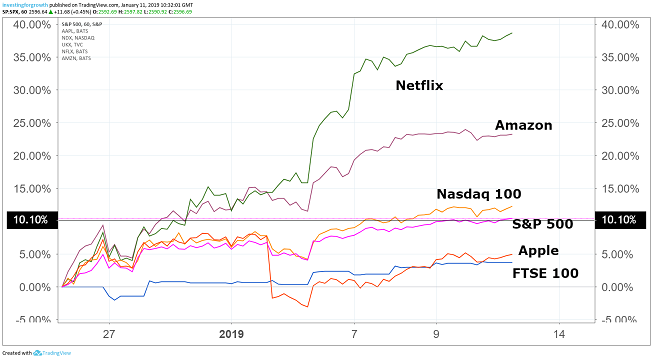

However, since bottoming out at a 16-month low on Christmas Eve, the big American star stocks are fighting back. Indeed, as at 10 January, the Nasdaq 100 is up 11.8% in just over two weeks, the S&P 500 is up 10% and Dow Jones only slightly less.

Standout performers since 24 December include Netflix (NASDAQ:NFLX), up 38%, General Electric (NYSE:GE) 26%, Amazon (NASDAQ:AMZN) 23% and Boeing (NYSE:BA) 19%. Even Facebook (NASDAQ:FB) has attracted buying interest below $125. Up 17% since, it’s still a third down on its late-July peak, however.

It's not all good news, though. Apple (NASDAQ:AAPL) stunned the market with a grim revenue warning amid slowing iPhone demand in China. Its stock is up less than 5% since Christmas as a result.

Source: TradingView (*) Past performance is not a guide to future performance

Apple chief executive Tim Cook admitted that iPhone customers are not upgrading their handsets as often as the company would like, raising fears that Apple will struggle to maintain its remarkable run of iPhone success.

But Apple now trades on a modest forward price/earnings (PE) ratio of 11.2 times and offers a prospective dividend yield of 2.2%. It also remains one of those companies that few would dare bet against over the longer term. UBS cut its 12-month price target from $210, but still thinks the shares are worth $180.

Certainly, investors are backing Apple to bounce back, with the iconic brand the most-bought US stock on the interactive investor trading platform in December.

Amazon has also rewarded those who remained alert to bargains over the Christmas period. The second most-popular US stock last month, not only rocketed more than a fifth since Christmas Eve, it was one of the best tech performers in 2018, ending the year up over 28% despite the Q4 sell-off.

Longer-term investors in Netflix will also be counting big profits. The streaming TV giant rose 39% in 2018. Elsewhere, Microsoft (NASDAQ:MSFT) rose 19%, Cisco Systems (NASDAQ:CSCO) 13%, and even volatile Tesla (NASDAQ:TSLA) made investors a calendar year profit of 7%.

- This US behemoth stock is worth tracking?

- Here's how Netflix could hit an all-time high

- Amazon stock: Buy or sell?

Payment processor Square has also repaid investor’s faith in spades. Floated in 2015 at just $9, the stock peaked at $101 in September last year. And even after a fourth-quarter slump to a low of around $50, the stock ended 2018 with a 12-month gain of 62%.

It’s also interesting to see Berkshire Hathaway breaking into the Top 10 from 15th in November. Given market volatility and uncertainty around outcomes in 2019, it’s understandable that investors are comfortable letting Warren Buffett make the tough decisions for them. There’s no arguing with his track record, and few have shown better investing discipline over such a long period of time.

Most-bought US stocks in December 2018

| Rank | Company | +/- on previous month |

|---|---|---|

| 1 | Apple | - |

| 2 | Amazon.com | - |

| 3 | Tesla | up 4 |

| 4 | Microsoft | up 1 |

| 5 | NVIDIA | down 2 |

| 6 | up 3 | |

| 7 | General Electric | up 3 |

| 8 | Berkshire Hathaway Class B | - |

| 9 | Netflix | down 5 |

| 10 | Square | down 2 |

Source: interactive investor

*Horizontal lines on charts represent levels of previous technical support and resistance. Trendlines are marked in red.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.