The 21 high-yield trusts for bargain hunters

31st August 2018 16:00

by Holly Black from interactive investor

High-yielding investment trusts can be an attractive option for investors willing to take equity risk. Holly Black names some great options here.

Income-seeking investors can secure a yield of more than 6% at a discount if they pick the right investment trust.

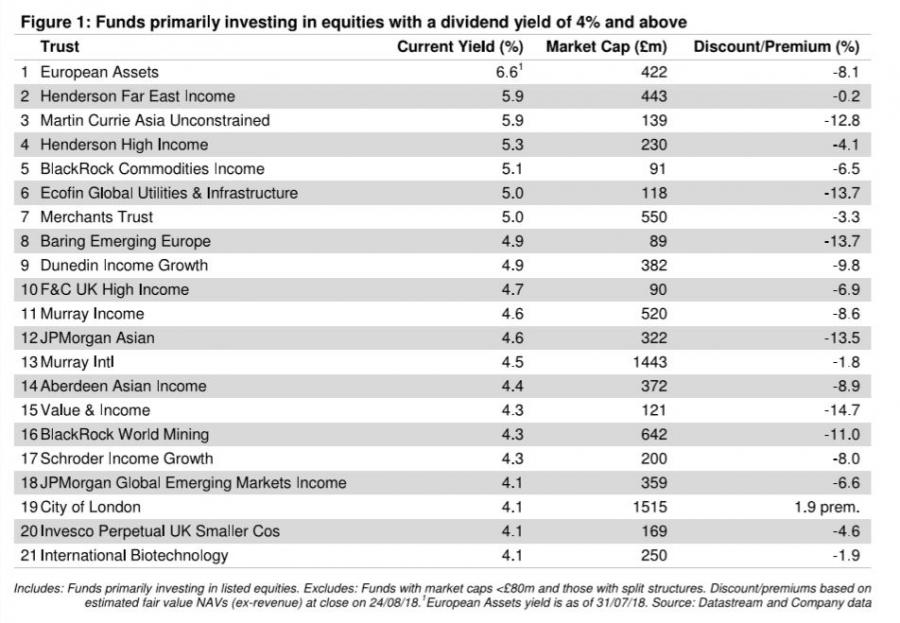

Research from stockbroker Stifel reveals there are 21 investment trusts currently offering a yield of at least 4%, many of which are trading at significant discounts to their net asset values, meaning that investors may be able to snap up a bargain too.

European Assets has the highest dividend yield at a hefty 6.6% and is trading at a discount of 8.1%. In April the shares were trading at a premium of 3.1%. The £422 million trust invests in small and medium-sized firms in Europe, excluding the UK, with investments include Hungarian airline group Wizz Air Holdings and German ticketing firm CTS Eventim AG & Co. KGaA.

Shares in the Money Observer Rated Fund have underperformed in recent years, delivering a return of 33.2% over three years compared to an average of 69% in the European Smaller Companies sector, and are down 4.5% over the past year. However its net asset value return over one year has grown by 3.2%.

A further six trusts have a yield of 5% or more including Henderson Far East Income Ord, Martin Currie Asia Unconstrained Ord and BlackRock Commodities Income Ord. These are just three examples of how investors seeking income may do better to look further afield than the UK.

Value And Income Ord has the widest discount among the group of high-yielding trusts at 14.7%. The trust has underperformed the UK equity income sector over the past year with a return of 1.4% compare to a sector average of 5.5%, but is a second-quartile performer over three years. The unusual trust invests in UK equities as well as direct property assets.

Just one trust in the group is trading at a premium. City of London Ord has garnered attention because of its excellent track record of dividend growth; the trust, which yields 4.1%, has increased its pay out for an impressive 51 years in a row. The Money Observer Rated Fund trades at a premium of 1.9%.

Stifel says investors prepared to take equity risks may find the higher-yields on offer from these trusts particularly attractive at a time when interest rates remain low. It adds that many of these trusts have substantial dividend reserves and a good record of delivering dividend growth year after year.

You can find the full list of high-yielding trusts picked by Stifel below.

Past performance is not a guide to future performance

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.