Beat inflation with these investment trusts

When pitting annualised returns for trusts over 20 years against RPI inflation, there's no competition.

21st February 2019 11:51

by Kyle Caldwell from interactive investor

When pitting annualised returns for trusts over 20 years against RPI inflation, there's no competition.

The minimum aim of every investor should be to ensure the returns they receive from their investments are above and beyond the rate of inflation, and on this front investment trusts more than hold their own, research by Money Observer has found.

We looked at annualised returns for investment trusts over the past 20 years and pitted them against inflation in the shape of the retail prices index (RPI), which over the period has risen by an average 2.5% per year.

The RPI rate of inflation has not been considered a national statistic since 2013; it is higher than the consumer prices index (CPI), which has run at 1.8% annualised since October 1998, principally because it includes mortgage interest payments.

Despite the misgivings of the Office for National Statistics that RPI is "awed" due to its methodology, however, it is still widely used and influences rail fares, student loan repayments and ‘gold-plated’ final salary pension schemes. Moreover, it is used by the UK government as a reference point for the index-linked bonds it issues.

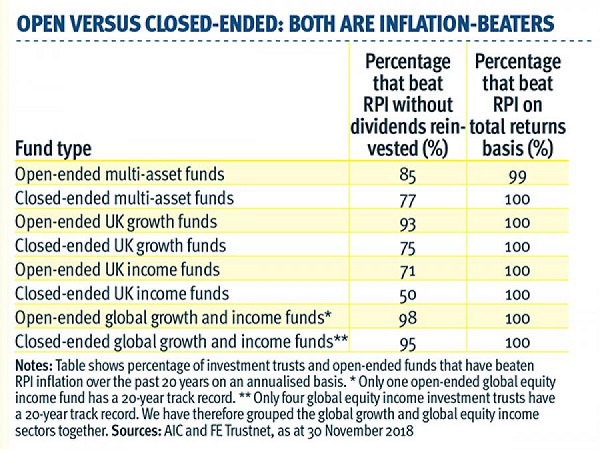

After crunching the numbers, we found the vast majority of investment trusts with a 20-year track record comfortably beat the RPI inflation measure. Focusing on key sectors – multi-asset trusts, UK growth trusts, UK income trusts and global growth and income trusts – all the trusts achieved annualised share price total returns that outstripped RPI. When we eliminated reinvested dividends, 15 of the 59 trusts in the various sectors shown in the table failed to beat RPI over the period – but the success rate of 75% is still high.

Open-ended funds also put in a good showing against RPI, with the number of outperformers highlighted in the table by sector. The only fund to underperform RPI on a total return basis was Janus Henderson Multi-Manager Diversified, but it had an annualised return of 2.4% so it only fell short by 0.1%.

Not a smooth ride

The last decade has been a relatively comfortable backdrop for investors; with this in mind, we opted for a 20-year period as it encompasses the full extent of the global financial crisis, and also the spectacular tech boom and bust in the early noughties. Therefore, it has not been a smooth ride for equities.

Nonetheless, while average inflation has been relatively benign over that period, the high number of investment trusts and funds that have beaten RPI provides strong evidence that the best way to keep ahead of inflation in real terms is by investing in risk assets, principally equities.

"The ultimate first aim for any investor is to stay ahead of the cost of living," says Ben Willis, head of portfolio management at Chase de Vere. "But if you are not invested and are instead leaving investable assets in a bank or building society, this growth is difficult to generate: the days of savings rates offering 5% or 6% on deposit, which they did prior to the financial crisis, are long gone." Indeed, beating inflation has become much harder in recent years as savings accounts linked to inflation have been disappearing, with no such product available at the time of writing.

Interest rates to rise

Moreover, the decade-long era of loose monetary policy has drawn to a close; barring a Brexit-led economic meltdown, interest rates are expected to rise in the coming years, which in theory will lead savings rates gradually higher. Increases, though, are unlikely to be notable, as the big banks are less competitive than they used to be on this front.

In any case, Adrian Lowcock, head of investment at Willis Owen, points out that rates are likely to remain below the Bank of England's 2% inflation target for the foreseeable future.

"I cannot envisage the day when interest rates will 'normalise'; it is going to be a long and steady process that takes several years, as both households and businesses have got used to interest rates being as low as they currently are."

Therefore, Lowcock says, in the next 10 to 20 years the stockmarket will remain the best route to beat inflation. But Willis anticipates trickier times ahead, particularly for retirees who are using their investments to help fund their lifestyle. Those in this boat should focus on income-generating investments and look to take the natural yield being produced by the portfolio.

Willis says:

"After such a strong decade for equities, I expect the direction of travel from A to B will be bumpier over the next decade, but those who invest for the long term will still do much better than two of the other main alternatives to protect against inflation: cash or bonds."

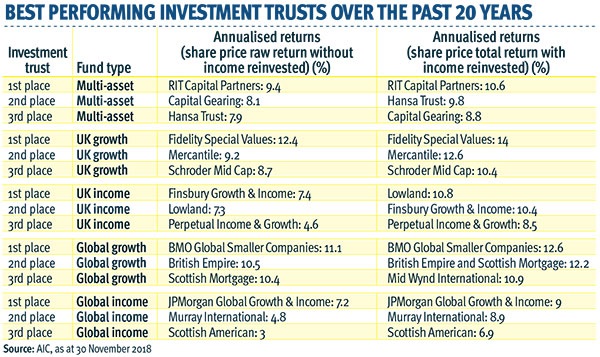

Overall, as our table below shows, for investment trusts the top performer out of the sectors examined was Fidelity Special Values (LSE:FSV), producing an annualised total return of 14%. Seven other trusts have produced annualised returns of 10% plus on a total return basis over the past 20 years: BMO Global Smaller Companies (LSE:BGSC), British Empire (LSE:BTEM), Scottish Mortgage (LSE:SMT), Mercantile (LSE:MRC), Mid Wynd International (LSE:MWY), Lowland (LSE:LWI) and RIT Capital Partners (LSE:RCP).

Another key takeaway is the power of dividend reinvestment. For the AIC UK equity income sector as a whole, the average return over the period if dividends are not reinvested stands at 2.5% – the same as RPI. But on a total return basis, with the compounded growth of reinvested dividends added into the mix, the sector average return leaps to 6.9%. In some cases, this phenomenon can almost double an investor's return, with Perpetual Income & Growth a case in point, returning 4.6% annualised without dividends but 8.5% in terms of total returns.

China and India out ahead

On the whole, global trusts put in a stronger showing than UK-focused trusts. The global sector average was 8.9% annualised on a total return basis, versus 5.4% for UK all companies.

Overall, looking across all AIC sectors, the standout performer over the period was Country specialists: Asia Pacific. This sector mainly includes trusts that invest in either China or India. The average trust's annualised total return stood at 13.8%. The worst-performing equity sector was UK equity income.

But as Lowcock points out, as things stand today, with the FTSE 100 offering a yield of almost 5%, UK equity income investment trusts and funds are perhaps the most interesting buying opportunity in town. He adds:

"The UK is arguably the most unloved stockmarket at the moment. But it is at times like these, when it feels uncomfortable to invest, that attractive opportunities can present themselves to patient long-term investors."

Trusts that keep inflation at bay

Some investment trusts explicitly target inflation as a benchmark for their performance, with the standout example being RIT Capital Partners (LSE:RCP), chaired by Lord Rothschild. The trust's formal aim is to beat the RPI measure by 3% per year. The cautiously managed trust has easily achieved this feat over the 20-year period, producing an annualised total return of 10.6%.

In addition, other investment trusts aim to grow their dividends at a faster rate than inflation, two examples being Bankers (LSE:BNKR) and Scottish American Investment Company (LSE:SCAM). Both trusts are 'dividend heroes', having raised payouts every year for 51 years and 38 years respectively.

Furthermore, real asset such as infrastructure and property have historically acted as impressive long-term hedges against inflation.

Infrastructure offers investors exposure to high-quality inflation-linked cashflows. In our January 2019 Wealth Creation Guide, The Renewables Infrastructure Group (LSE:TRIG) was tipped. This trust invests for a high and consistent income stream in wind, solar and battery storage projects. Tim Cockerill of Rowan Dartington likes it because managers InfraRed Capital Partners are very experienced. "It works well as a diversifier in a portfolio, with the majority of the return coming from income," he says.

For property, TR Property (LSE:TRY) was favoured. Sandy Cross of Rossie House Investment Management picked the trust as his preferred choice.

He adds:

"The manager is highly regarded; the trust is a good option for those wishing to hold property."

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.