Best and worst shares and markets in April 2020

After losing their shirts in March, investors had a chance to make spectacular profits a month later.

5th May 2020 15:18

by Graeme Evans from interactive investor

After losing their shirts in March, investors had a chance to make spectacular profits a month later.

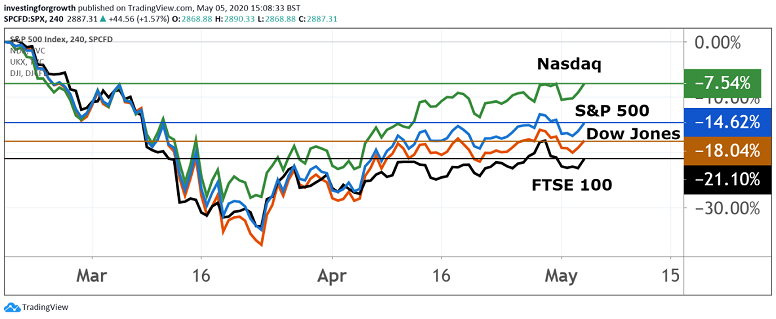

April 2020 will not be forgotten in a hurry by investors after markets rebounded in spectacular fashion, despite dividend cuts, an oil price collapse and big surge in US jobless figures.

The remarkable turnaround saw the Nasdaq jump by 15% in the month, with London's mid-cap FTSE 250 index 9% higher and the basket of top 100 stocks in the AIM junior market up by 18%. All this happened while the global Covid-19 death toll continued to rise, with economists forecasting a 30% or more drop in second-quarter GDP for some leading nations.

- Economist interview: recession, stocks and recovery

- Economist interview: have stock markets overestimated Covid shock?

The key to the recovery from the depths of March's market turmoil has been the support of central banks, with Wall Street placing big bets on the US Federal Reserve continuing to underpin the financial system.

Ultra-low interest rates look set to be around for years to come, meaning investors will need somewhere to get a return.

This has helped the so-called FAANG group of stocks on Nasdaq, with Facebook (NASDAQ:FB), Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), Netflix (NASDAQ:NFLX) and Alphabet (NASDAQ:GOOGL) (Google) up by as much as 25% in the month.

The ongoing support of policymakers also gave investors the confidence to push the FTSE 100 index back above the 6,000 barrier at the end of April, having rallied more than 1,000 points from as low as 4,900 on the day Britain went into lockdown on 23 March.

Source: TradingView. Past performance is not a guide to future performance

Much of this sudden return to bull market territory happened during the tail-end of March, with the month of April only seeing a 4% improvement in the top flight. This reflected the impact of tumbling oil prices on heavyweight BP (LSE:BP.) and Royal Dutch Shell (LSE:RDSB), whose shares were 9% and 5% lower respectively.

Shell saved the biggest blow of all for income investors until the final day of the month when it surprisingly cut its dividend for the first time since the Second World War. More than a third of FTSE 100 companies have so far deferred or cancelled their payouts, with shares in high-yielding Aviva (LSE:AV.) and RSA Insurance (LSE:RSA) more than 10% lower in April following such cuts.

- FTSE 100 dividend stars step in after Shell shocker

- Stockwatch: what to do with Shell and Sainsbury’s shares

Some of the strongest share price performances in the FTSE 100 followed reassurance from company bosses that their balance sheets will be strong enough to cope through the pandemic. That encouraged bargain-hunting investors to return to the housebuilding sector, particularly with construction sites preparing to reopen.

Taylor Wimpey (LSE:TW.) rose 25%, Barratt Developments (LSE:BDEV) was 18% higher and Persimmon (LSE:PSN) added 15%, although the trio were still a long way short of their highs seen in mid-February. The same was true for British Land (LSE:BLND) and Land Securities (LSE:LAND), which rose more than 20% in the month.

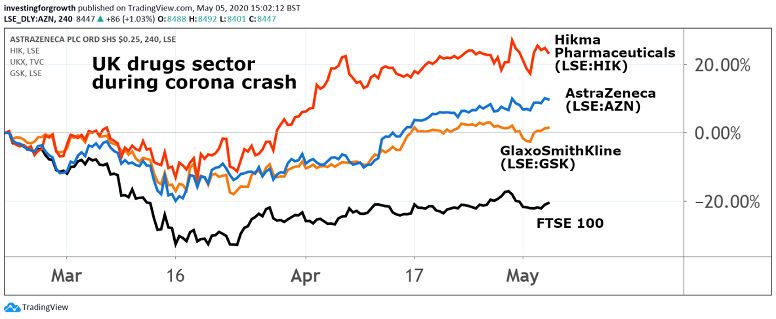

Some FTSE 100 stocks have been largely unaffected by the crisis, with AstraZeneca (LSE:AZN) shares up 15% in the month after becoming one of the few blue-chip companies to issue forward guidance on the back of a 16% jump in first quarter revenues. Hikma Pharmaceuticals (LSE:HIK), another popular stock with ii customers, was 16% stronger.

Source: TradingView. Past performance is not a guide to future performance

The lockdown has been good for business at Just Eat Takeaway (LSE:JET) and food delivery company Ocado (LSE:OCDO), which rose 31% and 33% respectively, while Paddy Power and Betfair owner Flutter Entertainment (LSE:FLTR) was up 33% after benefiting from a surge in demand for online gaming.

This diversification has helped the company to weather the loss of sporting fixtures and the closure of betting shops since March. Flutter's shares have been on a remarkable run in the past six weeks, climbing 79% to above where they were prior to the start of the crisis.

William Hill (LSE:WMH) set the pace in the FTSE 250 index with a 67% rise during April, ahead of the 34% improvement secured by its big rival, Ladbrokes owner GVC Holdings (LSE:GVC).

Investors who bought transport companies during the depths of the coronavirus market plunge were also well rewarded in April, with Go-Ahead the second biggest riser in the FTSE 250 after a 62% rise. National Express shares were up by a third.

In the FTSE All-Share, Tullow Oil (LSE:TLW) pulled off a remarkable feat in April by rising 140% as developments in the company's debt-reduction push helped offset falling oil prices.

There was no respite for travel company TUI (LSE:TUI), whose shares fell another 13%, while Marks & Spencer (LSE:MKS) was down 7% after dashing hopes for a dividend return in the 2020/21 financial year.

In contrast, there were some handsome profits on offer for investors who backed the growing number of AIM-listed companies involved in the fight against coronavirus. These include testing firms Omega Diagnostics (LSE:ODX) and Genedrive (LSE:GDR), up 641% and 289% respectively.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.