Can shares in chemo drug firm Sareum double?

20th July 2021 07:48

by Alistair Strang from Trends and Targets

With the share price having already taken off, chartist Alistair Strang stirs the tea leaves for clues to future direction.

The last 18 months has seen us gradually lose fascination with drug companies. The root cause, obviously, Covid-19 and an almost distressing number of companies jumping on the “look at me” bandwagon, the general tell tale being dominant usage of “pandemic” and “Covid-19” on a pharmaceuticals front page. Perhaps it has proven a wise ploy, perhaps not, as the fortunes of rather a few companies appear to have waxed and waned quite vividly.

Sareum Holdings (LSE:SAR) is certainly not a new kid on the block. Founded 17 years ago, their listing on the AIM has shown the usual fits and starts, with the share price currently looking a bit “interesting”.

Obviously, the company have a finger in the Covid-19 pie, but our own interest is driven by personal experience of treatment for a type of leukaemia. Thankfully, companies such as Sareum are developing more targeted treatments, easier on the patient and substantially less likely to cause longer term issues.

Again, from personal experience, I remain with damaging effects (no immune system, etc) from chemotherapy in 2012 and again, during 2018.

One particular treatment being developed by Sareum is a type of chemo which is a “one a day” pill, aimed at stabilising the patient. Again, from personal experience since 2020, this regime has proven revolutionary, as once blood counts retreated to normal human levels, the strength of the drug was vastly reduced with hospital visits becoming substantially less. Hopefully, products of this type become the norm with chemotherapy as the fun of being plumbed into a chair in a treatment room wears off fairly quickly.

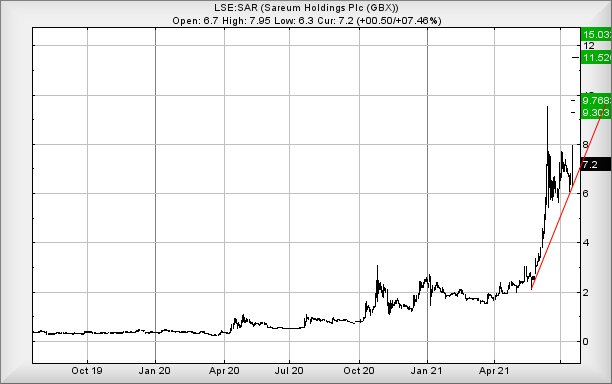

Currently trading around 7.2p, trades on Sareum above 8p should prove capable of an attempt at 9.3p. If bettered, our secondary calculation works out at 9.75p and, while this isn’t particularly exciting, will place the share price potentially in game changing territory.

The thing is, our software demands Sareum close a session above 9.45p, as the share price shall enter a brave new world for the longer term. While our calculations are necessarily vague, share price closure above 9.45p currently provides the potential of a longer term movement to 11.5p, with secondary, if bettered, at 15p. While we cannot calculate above 15p currently, this does not mean a price cannot go higher.

Source: Trends and Targets. Past performance is not a guide to future performance

Perhaps, of course, our enthusiasm is biased by the type of cancer drug this company focus on. We feel it is the future for chemo and, while Covid-19 may prove to be less intrusive in people’s lives, cancers look here to stay.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.