Consumer staples shine as inflation soars – but can the boom last?

24th May 2022 09:33

by Sam Benstead from interactive investor

We explain why this part of the market is shining, and name fund and trust ideas to play the trend.

Consumer staples have been one of the best-performing investment sectors this year, as stock pickers flee to safe companies with reliable earnings even during economic downturns.

The iShares S&P 500 Consumer Staples ETF (LSE:ICSU) has fallen 8.5% in 2022, a relatively strong performance compared with the 18.5% drop for the S&P 500 index. The FTSE 100 has also performed well this year and is roughly flat, helped by its 18% allocation to staples, the largest sector in the index.

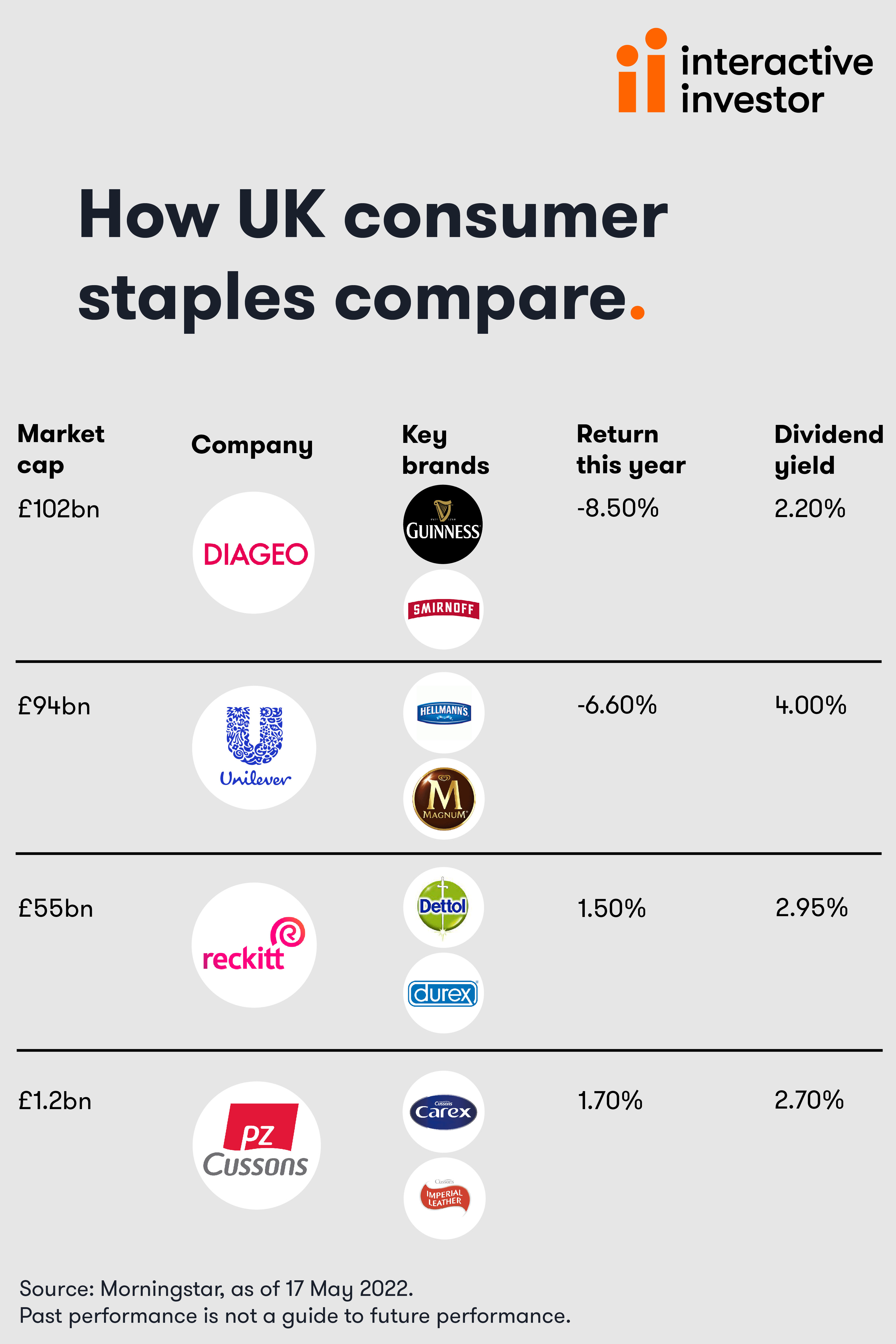

Consumer staples, from tobacco stocks Philip Morris International (NYSE:PM) and British American Tobacco, to drinks groups Diageo, Coca-Cola, and household goods firms such as Unilever (LSE:ULVR) and Procter & Gamble, are highly regarded by investors during bouts of inflation and economic contraction.

- Read about our: ii Super 60 Investments | Top Investment Funds | Transferring an Investment Account

The theory is that loyal customer make such stocks “defensive” as they can keep growing profits even when the economy is in a difficult position. While they may not deliver double-digit sales growth, it is unlikely that sales will fall.

James Harries, manager of the £700 million Trojan Global Income fund, certainly thinks so. His strategy has 37% invested in the sector, including UK stocks Diageo, Unilever, and Reckitt Benckiser.

- How to play the market rotation: fund, trust and ETF ideas

- Fund Finder: value versus growth investing

- How Terry Smith is investing as markets crash

Harries said: “They are called staples for a reason. They have very loyal customers who will buy their goods regardless of the economic situation. Chocolate and cigarettes see consistent demand through time.

“Inflation has reappeared, and faster-growing companies are now faltering but firms with predictable earnings are doing well. Staples can raise prices and keep profit margins intact.”

He adds that recent financial results from the sector had been very good, and his portfolio companies had successfully put up prices and grown sales.

“Input costs are now falling but prices have already gone up, and that is good for profits as it leads to bigger profit margins. We could be already at the peak of inflation from commodity prices,” he said.

Bank of America’s financial analysts recently moved to overweight the sector, saying: “The spectre of a recession looms and we thus shift defensive, double-raising consumer staples from underweight to overweight.

“The sector is near a record underweight by institutional investors, and lessening labour and input cost inflation could benefit profit margins.”

Nick Train, the star investor behind Lindsell Train Global Equity and Lindsell Train UK Equity, is also a big fan.

Writing to investors this month, Train said: “Their business performance has appeared pedestrian compared to that of technology winners and, more recently, to booming commodity companies.

“And on that point, the profitability of the consumer staples sector is seen, not unjustly, as being vulnerable to these spiking raw materials costs. There is also a sense that the brands that have created so much wealth for investors over many decades, in some cases centuries, are mature and losing relevance for 21st-century consumers.”

- Nick Train: The Richard Hunter Interview Podcast

- Video: The Richard Hunter Interview: Lindsell, Train…and Bullock

- What’s gone wrong at Lindsell Train?

However, he countered that they were more exciting than they looked. “We must believe the sceptics are wrong and that the brands are in fact not mature and can continue to deliver above inflation secular growth through the rest of this decade and further. Again, on this requirement, our staples have provided comfort in 2022,” he said.

Train argues that Diageo, Remy Cointreauand Fevertree are prime beneficiaries of consumers turning to more premium spirits. He also notes that Heineken, in addition to raising prices, had premium brands that were key in it growing revenues 25% in the first quarter of the year.

“Premium makes up 40% of Heineken’s business, including other brands such as Desperados, Kingfisher, Moretti and Tiger, and we expect this segment to help the parent grow steadily for the rest of this century,” said Train.

He added that Mondelez, the Cadbury owner, grew revenue 8% in the first three months of the year and increased its dividend 11%.

But the sector has become increasingly expensive relative to profits this year as share prices have risen. The S&P 500 Consumer Staples index now has a price-to-earnings ratio of 25. That’s around the same as the iShares Global Technology index, despite slower revenue growth than tech shares.

Harries brushes off that criticism, however, saying: “Staples have been brilliant businesses for decades and have had an extended period in the sun, not just three months of strong returns relative to the market.

“We value their predictability, high returns on investment and the sustainability of these business advantages. Some large tech stocks don’t pay dividends.”

Another concern is that high inflation will eat into profit margins and a coming recession will dampen demand for such goods.

- Listen to our interview with Scottish Mortgage

- Scottish Mortgage tops up Moderna, trims Amazon and sticks by Netflix

American retailers Target and Walmart reported last week that profits margin were falling because of rising fuel and freight costs, which caused investors to dump their shares. Consumer staples stocks fell in tandem, suggesting investors were concerned about their defensive characteristics.

What funds to buy

Four funds on interactive investor’s Super 60 recommended list have high allocations to consumer staples. The most concentrated bet comes from Lindsell Train Japanese Equity, which has 49% invested in the sector.

It has been managed by Michael Lindsell since 2004. He focuses on companies with sustainable business models and established brands. The top holdings include Nintendo, Shiseido and Kao Corp.

Nick Train’s Lindsell Train UK Equity fund also has a high weighting to consumer staples at 41% of the strategy.

Train also specialises in buying firms with enduring brands, including Diageo, Unilever and the London Stock Exchange.

However, his strategy is under pressure this year despite its high weighting to staples. The fund has fallen 11%, while the FTSE All-Share index is down just 1%. This is because Train is happy to pay a high price for shares, something which has worked against him as interest rates are increasing.

Terry Smith is also a big fan of staples, with 30% invested there in Fundsmith Equity. This includes cigarette firm Philip Morris International and McCormick & Company, which sell food spices.

Morgan Stanley Global Brands has 28% invested in the sector, including large positions in Reckitt Benckiser and Philip Morris International.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.