Is this country a must-have in any portfolio?

Kepler analysts consider investment trusts offering exposure to this region as investors seek ways to reduce long-term exposure to the US.

26th September 2025 13:58

by Alan Ray from Kepler Trust Intelligence

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Two years, two analysts, one topic of conversation…

In the autumn of 2023, Kepler analysts Josef Licsauer and Alan Ray had a conversation about Japanese equities at a time when the Tokyo Stock Exchange had seized the initiative and driven through various requirements for Japanese-listed companies to improve their capital efficiency and governance in order to make them more investible, with a global audience in mind.

These reforms were first floated by the government in 2015 and encountered stiff resistance from corporate Japan, but with the TSE’s help, the reforms went live at the end of February 2023.

Licsauer took the position that the reforms would be very positive for markets, and Ray played the role of sceptic who had heard it all before. Broadly speaking, Licsauer won the argument, and it is true that Japanese equities seem to have been buoyed by the reforms. In local terms, the TOPIX is up about 67% since the end of February 2023, which is an impressive return.

However, in GBP terms, the market is up about 37%, which still puts it ahead of UK and European equities by a strong margin of about 10 percentage points, but doesn’t quite match the more than 50% return on the S&P 500 that GBP-based investors have enjoyed. It’s a reminder that currency, so hard to forecast, is always a risk factor when investing overseas.

Nevertheless, the returns in JPY terms are eye-catching and, with one of the investor themes of 2025 being the search for ways to reduce long-term exposure to the US, it’s a good time to revisit Japan and ask whether the best returns are behind us.

Investor sentiment

Alan Ray (AR): Before we get into the specifics of Japan, let’s focus on our own little world. Investment trust discounts can be somewhat linked to investor sentiment, but as we know, in recent years, they have been influenced by a range of technical factors that mean we can’t always assume investors are positive or negative on a particular underlying market. Nevertheless, the fact that discounts on some of the Japanese trusts are generally close to 10% tells us that investors haven’t all jumped on board the Japanese-equity story.

Josef Licsauer (JL): You’re right, one could argue that trust discounts, despite Japan’s strong run over the last few years, could suggest investors remain cautious. As we touched on in our very first piece together, investors have been quick to react to market wobbles, shaped perhaps by scars from the ‘Lost Decades’, fear of missing out on US gains, or simply a recent preference for the safety of cash when savings rates in the UK, for example, have sat at 5%.

While the latter has been a more recent development (although rates are now steadily falling), I feel the other arguments harder to sustain today. Japan is filled with exceptional, high-growth tech business, though they are less well known, and unlike the false starts of the past, Japan’s stock market recovery is supported by several structural shifts: negative interest rates are gone, deflation may finally be ending, and companies with large cash reserves are increasingly deploying capital, improving valuations, driving growth, and raising corporate standards.

At the same time, with US valuations stretched, political uncertainty rising, and signs of slowing growth, some investors are beginning to rotate out of expensive US equities in search of diversification and alternative sources of growth. Japan is well positioned to benefit, thanks to differentiated economic drivers and global leadership in areas like automation, AI, and healthcare innovation. Added to this, interest rate cuts in markets such as the UK, US, and Europe are eroding the relative appeal of cash.

Importantly for most investors, performance has also been supportive: the TOPIX has delivered annualised returns of around 16.5% over the past five years. Yet many Japanese investment trusts, despite capturing strong returns, still trade at wider discounts than their five-year averages. In my view, that disconnect reflects lingering caution rather than fundamentals, and it could present a discounted route into what looks like a multi-year opportunity. Japan’s story is still unfolding, but the direction feels increasingly like one of momentum rather than malaise.

INVESTMENT TRUST DISCOUNTS

| Current discount (%) | Five-year average (%) | |

| CC Japan Income & Growth Ord (LSE:CCJI) | -9.1 | -8.2 |

| Schroder Japan Trust Ord (LSE:SJG) | -11.4 | -11.3 |

| Fidelity Japan Trust Ord (LSE:FJV)* | -3.5 | -9.1 |

| JPMorgan Japanese Ord (LSE:JFJ) | -9.7 | -7.3 |

| Morningstar Investment Trust Japan | -9.3 | -7.7 |

| AVI Japan Opportunity Ord (LSE:AJOT) | -0.3 | -1.3 |

| Baillie Gifford Shin Nippon Ord (LSE:BGS) | -9.8 | -7.3 |

| Nippon Active Value Ord (LSE:NAVF) | -1.5 | -5 |

| Morningstar Investment Trust Japanese Smaller Companies | -4.3 | -5.7 |

Source: Morningstar as of 17/09/2025. *Undergoing a merger with AVI Japan Opportunity Trust.

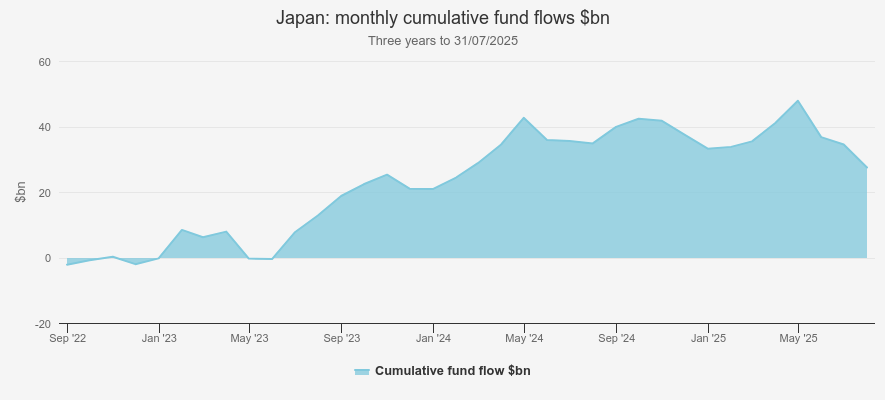

AR: As you know, I like to look at fund flows as a wider measure of investor sentiment. The chart below shows cumulative flows in and out of all Japan specialist funds on Morningstar’s database, no matter where the funds are domiciled. This doesn’t capture every last penny of money flowing in and out of Japanese equities, but it’s a big sample size, and I think we can be confident that the shape of the graph is correct, even if the exact figures are not. What I like about this chart is that, yes, investors did put money to work in Japan around the time we last spoke, and on average, they seem to have stuck around. But there hasn’t been a continual flow into Japan ever since. Whilst positive investor sentiment is obviously a good thing, I start to get nervous when money keeps flowing into a market year after year. So, on the one hand, one could say that investor sentiment has therefore stabilised or even waned slightly, but on the other hand, I would say this might be of comfort to investors like me who are worried that they might be chasing a speculative market with lots of ‘hot money’ washing around. This doesn’t appear to be the case. If that turns out to be correct, I think that marks a big change from previous cycles.

JAPANESE EQUITY MONTHLY FUND FLOWS

Source: Morningstar

JL: What stands out to me is that investors have put meaningful money to work in Japan and, importantly, largely stayed the course, although there have been some outflows this year . That feels consistent with the broader picture: investors are recognising the reforms and structural improvements taking place, but not to the point where valuations or sentiment look overheated.

In fact, I think the pace of flows mirrors Japan’s gradual transformation. The governance and capital-efficiency push is one of the most significant shifts in decades, but it was never going to be an overnight story. If we were seeing a surge of consistent inflows, I’d be more cautious, as that could signal hot money chasing momentum. Instead, the steady accumulation of assets points to building confidence, with plenty of room for further participation if reforms continue to deliver and global investors increasingly seek alternatives to the US.

Valuations

AR: With the market having risen over the last couple of years, it would be good to look at valuations now. While it seems unlikely that every listed Japanese company has addressed all the requirements the TSE has put in place, presumably, the most forward-thinking and high-profile companies have. Have valuations been reshaped as a result? And because the story centres around companies releasing their cash hoards, it would be interesting to know how this cash is being used. I’m sure investors will be very happy if some of it is returned to them, but is it also resulting in more investment in growth by companies?

JL: On your first point, there have been tangible changes. For reform to be durable, it must be sustainable, and that momentum is clearly building. The TOPIX ended 2024 on a P/B of 1.4×, up from 1.1× in 2022, and at the time of writing, it has edged up further to 1.6×. That’s meaningful progress, even if still below global peers and far from the 4× multiples of Japan’s 1980s market peak. In relative terms, the market still looks attractively valued compared to developed peers — even the UK.

PRICE-TO-BOOK MARKET COMPARISONS

| Current P/B | Five-year average | |

| TOPIX | 1.6 | 1.3 |

| MSCI World | 3.9 | 3.2 |

| MSCI USA | 5.5 | 4.6 |

| MSCI Europe ex UK | 2.3 | 2.1 |

| FTSE All-Share UK | 2 | 1.8 |

Source: Bloomberg & MSCI factsheets as at 17/09/2025.

I think this rerating reflects greater compliance with the TSE’s requirements, i.e. improving valuations, improved growth, and a commitment to returning value to shareholders, but perhaps also a shrinking market. For the first time in years, the number of listed companies is falling, with weaker firms delisting under growing scrutiny. Stricter liquidity rules for TOPIX inclusion from 2026 should reinforce this trend. As Richard Aston, lead manager of CC Japan Income & Growth Ord (LSE:CCJI), highlights, these reforms are creating a more competitive and investible universe. A growing scrutiny on weaker firms is resulting in the desilting of ‘zombie’ companies long sustained by ultra-loose policy. And the firms that are left are the ones making real progress.

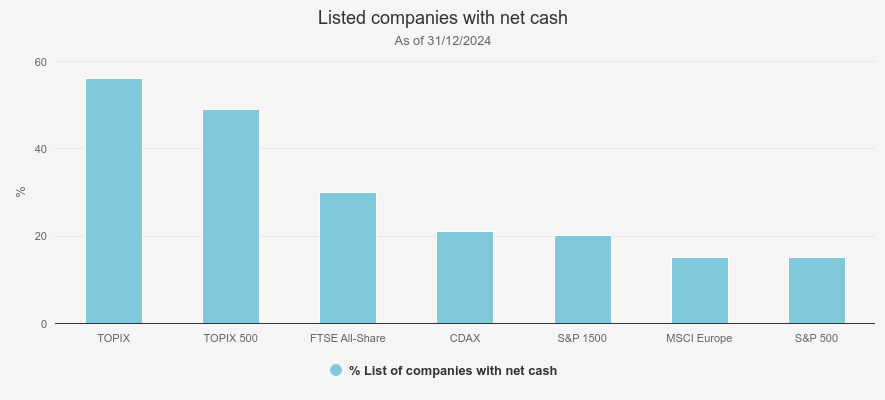

On your second point, Alan, ‘where is the cash going?’. Since 2022, dividends and buybacks have surged to record levels. In 2024 alone, buybacks exceeded ¥18 trillion (around £94.8 billion), more than double the previous year, fuelled by corporate ambition and shareholder pressure. While this is significant, huge scope for growth remains, as around 56% of listed companies still sit on net cash, far higher than in other developed markets, meaning there is plenty more capital in the wings to be deployed. Encouragingly, even companies already above the P/B and ROE thresholds are deploying capital, showing that reform momentum is spreading beyond just the initial laggards.

LISTED COMPANIES WITH NET CASH

Source: Daiwa based on FactSet, MSCI, FTSE, Bloomberg data

Crucially, cash isn’t just being deployed by those not currently meeting the TSE’s requirements. To me personally, this is quite striking, as companies above the P/B and ROE requirements do not technically need to do anything right now. The TSE has said that the purpose of the initiative is to encourage all companies to be more conscious of the cost of capital and the allocation of resources, with the goal of companies to meet expectations of investors, and to achieve sustainable growth and enhancement of corporate value over the mid to long term. So, my guess is they want to get on the front foot but have also seen the positive impact it is having on companies already.

Tokio Marine Holdings, a CCJI holding, illustrates this well. Despite an ROE in the low 20s and a P/B of 2.5×, it has launched a ¥110bn buyback while also reinvesting internationally, including acquisitions in Canada and the US. Similarly, Nihon Kohden, held by Schroder Japan Trust Ord (LSE:SJG), is a company consistently hitting a 10% ROE, yet management want to drive growth and have been reinvesting capital into areas such as generative AI and factory upgrades. At the smaller end of the market cap, SJG’s position in Miura, a boiler manufacturer, has leveraged its strong balance sheet to acquire a US business, proactively diversifying its revenues despite not being directly pressured by reform thresholds.

Of course, many smaller companies remain slower to act, and Nihon, at least for the time being, is a bit of an anomaly, but that in itself creates opportunity as reforms and stricter liquidity standards nudge them to adapt or risk exclusion. Clearly, a wide-scale change of this magnitude is going to take time. But with corporate balance sheets still flush with cash, and the TSE’s governance agenda set to continue, I expect more examples of Japanese companies recycling capital into growth, shareholder returns, and overseas expansion. These would be steps that make the market steadily more investible over the long run.

Corporate governance story

AR: We’ve already referenced some of the progress made since 2023, and I think it’s really interesting that companies aren’t simply returning capital to shareholders but investing for their growth. How much more is there to do in terms of companies implementing reforms, and do some still need the extra encouragement of shareholders to take these seriously?

JL: We’ve touched on some of the key developments already — stronger dividends and buybacks, the decline of listed ‘zombie’ companies, and the upcoming 2026 TSE reforms that will impose stricter liquidity requirements for market inclusion — but I’d also emphasise that despite a slower uptake or reaction, reforms are genuinely starting to filter further down the market-cap scale.

One clear example is through AVI Japan Opportunity Ord (LSE:AJOT), managed by Joe Bauernfreund. The trust takes an activist stance, targeting deeply discounted small caps where governance reforms can help unlock value. Joe argues that regulatory momentum is making boards more receptive, and AJOT has already seen success in cases like NC Holdings, which was taken private. Buyouts and privatisations, once rare in Japan, are becoming more frequent, creating fertile ground for activists willing to take meaningful stakes and drive the change themselves. AJOT has returned almost 2.5x the sector average over the past five years, driven by big gains in large positions and a detailed approach to constructive activism.

We’ve also seen progress in the unwinding of cross-shareholdings. Aisin Corp, a Toyota Group company that produces automotive components, is a good case in point. With Toyota controlling around 40%, Aisin had historically acted in step with its parent and given little thought to minority investors. Under pressure from reforms and the TSE, however, it has completely exited its cross-shareholdings and ramped up shareholder returns through dividends and buybacks.

Looking ahead, there is still more work to do, but it’s less about a fixed amount of jobs and rather about a steady evolution and the ability to adapt amid changing economic environments. From my conversations with Japanese fund managers over the years of covering Japan, one of the recurring opinions is that a key driver behind this is the ongoing progress in corporate reforms, including efforts to bring laggards into compliance. Stagnation here would be a big negative.

The TSE’s plan to publish a monthly list of firms that voluntarily disclose capital allocation improvement plans, effectively naming and shaming those that do not, could be particularly effective in Japan, where corporate pride and reputation carry significant weight. Whilst this is a relatively soft approach, additional support or oversight may be needed for companies that have had time and opportunity but continue to fall short, particularly smaller firms that may lack the resources to act quickly.

Activist shareholders will also play an important role. Managers of activist investment trusts in Japan — AJOT and Nippon Active Value (NAVF) — have noted that management are increasingly open to change, but progress is uneven across the market. Therefore, sustained pressure, guidance, and oversight will be crucial to ensure that the momentum seen in larger and more high-profile firms filters through across the market.

Undoubtedly, there will be periods when progress is slower or external factors, such as trade tariffs, temporarily redirect focus. However, continuous, steady progress, particularly being able to adapt as markets or economies evolve, should allow these long-term results to unfold positively.

Looking at the bigger picture

AR: Let’s turn to some bigger picture issues. What’s Japan’s position in the evolving system of US trade tariffs? We know that Japan is the largest foreign owner of US treasuries and, as such, could be considered to have a good hand in any negotiations, but it has been very careful in its statements about this. What is the current position in terms of tariffs? Are there any other macro updates to note?

Further, whilst we know that foreign companies with US manufacturing facilities aren’t all experiencing plain sailing, it would be good to know to what extent Japanese manufacturers already have facilities in the US. We know from the UK’s experience that some Japanese manufacturers choose to manufacture in local markets, so we probably already have a good idea that the same is true in the US, but is it enough to feel less worried about tariffs?

And does Japan have a stable government in a good position to negotiate at this crucial time? There has been a swift succession of prime ministers in Japan recently. Are there any signs that this is stabilising?

JL: The US and Japan reached a framework deal this summer that has eased some tariff pressures but kept conditions tight. Most Japanese auto and parts exports now face a 15% tariff, lower than before but still well above pre-Trump levels, whilst Japan has also pledged to expand imports of US agricultural, energy, and defence goods. The agreement also commits Japan to major US investment, particularly in semiconductors and advanced industries, with the US retaining leverage if pledges fall short. For Japanese exporters, the deal reduces immediate uncertainty, but the combination of lingering tariffs, recent yen strength versus the dollar, and political pressure means the trade backdrop remains challenging.

The trajectory of interest rates will also be key for investors. The BoJ has held rates steady at 0.5% since January 2025. I view this pause not as capitulation but as caution, reflecting the difficulty of assessing the full impact of US tariffs despite the recent framework agreement. The BoJ appears to be balancing support for domestic recovery with navigation of external pressures, including trade tensions.

At the same time, recent political developments add another layer of complexity. Prime Minister Ishiba’s resignation after election losses has cast some doubt over the pace of future policy measures. That said, Japan’s domestic economy remains resilient, with wages rising and growth forecasts revised higher. Export-dependent sectors, particularly autos, remain exposed to tariffs and currency strength, creating a mixed outlook. For investors, this suggests a backdrop that continues to favour domestically oriented companies, whilst exporters face greater uncertainty.

Where next?

AR: In recent years, the opportunity for investors in Japan has been framed in terms of the value opportunity, centred around the low valuations that have resulted from decades of corporate conservatism in terms of hoarding cash. That’s been discussed for years, of course, but as you’ve shown, this is changing. And isn’t it interesting that one of the investment trusts, AJOT, is regularly referenced in the Japanese financial press as one of the instigators of corporate changes. With so many listed companies in Japan and decades of ‘this is the way we’ve always done it’ to overcome, it seems likely that the value opportunity will persist for a long time, but perhaps for an investor looking at the higher profile Japanese companies that have already implemented mandated changes, ‘what’s next?’ seems like a fair question for investors to ask.

JL: The corporate governance story is far from finished and is likely to remain the dominant driver of improvements, dialogue, and intrigue in Japan. Around 70% of TSE Prime companies have now disclosed plans to enhance shareholder value, but smaller firms are lagging, and with over 3,000 listed companies, that means the runway for progress is long. Japanese companies still hold substantial cash on their balance sheets, and the old guard mindset shaped by deflation will take time to fully shift. This means we’ll likely be revisiting these developments in a few years, but when we do, I reckon the story will still be one of momentum, not a peak that has already passed.

Beyond governance, I’d note a couple of other factors that are worth highlighting. First, the domestic investor base. Revamped NISA accounts and rising wages are nudging households to deploy parts of their vast $7.5trn savings pool. Even small reallocations could be transformative for equities. Second, the small-cap space. Whilst large caps have largely rerated, smaller companies, often under-researched and under-owned, may represent the next leg of opportunity for active investors with resources on the ground. Finally, given recent wobbles in US tech, investors may be more willing to explore alternatives elsewhere, including Japan. Some Japanese firms are innovating rapidly, strengthening supply chains outside the US and, in certain cases, deepening collaboration with it.

Overall, the easiest gains from corporate reform may be behind us, but Japan’s market remains broad, deep, and continues to evolve. For active investors, particularly through dedicated investment trusts, the alpha potential remains very much alive.

Final thoughts

AR: It’s really interesting to hear how the Japanese stock market has regained some of its mojo after a significant intervention by the government. As a capitalist, I’m always a bit wary about government intervention, but I can’t help wondering if there is a lesson here for the UK, not in terms of specifics, but in the broader sense that sometimes a big, bold intervention might be worth considering. After all, the UK stock market’s decline as a venue for raising capital could be attributed to creeping government and regulatory interventions over the last two decades, so why couldn’t a reverse intervention help? It’s easy to forget that the stock market’s fundamental contribution to the economy is in providing growth capital for businesses, and the London Stock Exchange is struggling to do that right now. In contrast, Japan has maintained a very good rate of IPOs, particularly for smaller companies that need growth capital, even as other ‘zombie’ companies have been delisting. I think the bigger point for the UK is that Japan’s reforms are succeeding because they are aimed at making companies more attractive to invest in, rather than compelling investors to invest in them. I think that’s really the key point: compelling investors to allocate to a market only goes so far and may lead to unexpected behaviour and clever ways to dodge regulations, whereas finding ways to make companies more investible to a wider international audience would get to the heart of the problem.

Rather than ending on the hypothetical, though, let’s conclude by saying that there really has been progress in Japan in addressing some of the issues that have put investors off in the past, with more corporate activity and balance sheets being managed in a way more suited to a listed company. This is incredibly helpful because underneath these structural issues, Japan has a really interesting and unique investment story to tell.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.