Does UK IPO market recovery have legs?

Following new listing rules, Kepler analysts highlight investment trust opportunities.

30th January 2026 14:06

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

2025 was the best year for new issuance on the London market since the Covid-inspired froth of 2021.

In total, 23 new companies joined the public markets, leading to total issuance of circa £2 billion, around a 150% increase on the year before. This was mainly a result of a strong final quarter, with just under half of all companies that IPO’d, and as much as 90% of assets, coming in the last three months of the year.

As such, the IPO market is coming into 2026 with good momentum and could be a welcome feature of not only the UK this year, but also the numerous investment trusts focused on the asset class due to the prevalence of numerous attractive discount opportunities. The way we see it, there are several factors to support an ongoing recovery in issuance.

Big bang 2.0?

First, there has been the recent liberalisation of listing rules designed to make the listing journey less complex. This includes lower prospectus requirements, a shortened timeline for retail investors and a move to a single, simplified process. This will not only lower the regulatory barriers for companies hoping to float but also reduce the upfront costs too, especially for smaller companies. While these changes are far from the Big Bang deregulation of the 1980s, it is a rare and notable reduction in the bureaucracy that has weighed on UK productivity in the past few years.

In addition, a three-year stamp duty holiday for new listings has been introduced. This means investors will not pay the 0.5% charge on secondary purchases during the first three years of stock’s listed life. This should increase their appeal after listing, and support demand in the crucial early few years as a publicly listed company. While a relatively minor change, this is at least a step in the right direction from the government, as they have not only acknowledged there are demand issues in the UK market, but have taken steps to address this. One more optimistic take is this could encourage a full review of stamp duty for UK shares should this holiday prove successful, which would improve the UK market’s global competitiveness, arguably fulfilling the current government’s early promise of being pro-business and pro-growth.

The final key point supporting a potential flurry of IPOs in 2026 is the backlog of firms looking to list. While the increase in IPOs in 2025 is encouraging, the reason for the big percentage change on the year prior is that the IPO market has been depressed for a number of years. Even with the flurry in the last quarter of last year, the amount raised is still considerably below the estimated £17 billion of issuance during the peak year of 2021, although this was heavily affected by the impact of the pandemic on markets. The low issuance since has been a result of weak markets and low investor sentiment, broadly a result of high interest rates to tackle the period of higher inflation. Now this period has seemingly passed, there are indications that a number of firms are revisiting plans to go public, leading to the potential flurry of new listings.

IPO PROCEEDS PER CALENDAR YEAR

Source: Dealogic

Should these factors come together and continue the IPO momentum into 2026, we believe there should be numerous positive effects for investors in investment trusts. For one, it would refresh the opportunity set in the UK for fund managers. The market has seen a reduction in the number of listed companies over the past few years as M&A, particularly among smaller companies, has been rife but IPOs to replace them scarce. A pick-up in new listings would help refresh this and improve choice for investors. In addition, it could bring in new investors and capital to the UK, looking to capture the new opportunities. This in turn could start to reverse the market’s liquidity issues of the past few years, as both domestic and international investors have been reducing their UK exposure. Should all this play out, it would provide a much-needed good news story for the UK, in turn attracting further investment and creating a positive feedback loop.

Clearly, this would be positive for existing investors and could put upward pressure on the very depressed valuations the market is trading on, particularly smaller companies. UK stocks continue to trade at a discount to most developed market peers on a forward P/E basis, especially the US, with smaller companies also notably lowly valued versus even their own history. As such, a UK rally could arguably have plenty of scope to run, leading to very strong returns for long-term investors.

Investor opportunities

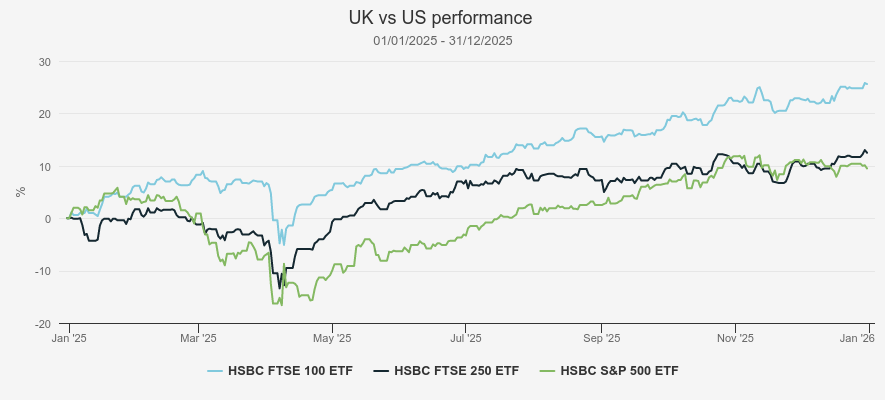

That said, the UK had a relatively good year in 2025. Calendar year returns for the FTSE All Share Index, which covers the broad UK market, were 24% in total return terms. This was ahead of the S&P 500 Index total return of 17.9% in local currency terms, although sterling based investors would have experienced a lower return of circa 9%. However, the UK rally was not even across the market-cap spectrum, with the large-cap FTSE 100 Index performing best, with a 25.8% total return, while the FTSE 250 Index lagged with just c. 13%.

UK performance

Source: Morningstar. Past performance is not a reliable indicator of future results.

As such, a trust focused on mid-caps may offer a strong value opportunity for the UK at present, as well as being well placed to capture some of the new opportunities, with two of the more noteworthy 2025 IPOs, Shawbrook Group (LSE:SHAW) and Princes Group (LSE:PRN), being admitted to the index at the first rebalancing opportunity in December. One example of this is Schroder UK Mid Cap Ord (LSE:SCP). Managed by Jean Roche and Andy Brough, they have constructed a portfolio of c. 50 names focused purely on the FTSE 250, which they believe offers a mixture of leaders from niche or growing industries, as well as a market that is regularly refreshed from promotions and demotions from other parts of the market as well as IPOs. Performance has been resilient over the past year, with a NAV total return in 2025 of 14.4%, slightly ahead of the FTSE 250 Index. Share price returns have been stronger though, with a 19.7% total return, leading to the trust’s discount to narrowing to c. 6% as at 21/01/2026. This arguably shows that investors are beginning to recognise the appeal in the asset class.

However, one mid-cap focused trust where the rating may not reflect the potential is Mercantile Ord (LSE:MRC). Managers Guy Anderson and Anthony Lynch predominantly invest in mid-caps, with historically around three quarters of the portfolio in FTSE 250 companies. They use a bottom-up process, which focuses on company fundamentals to identify high-quality businesses, generating positive momentum and available at attractive valuations. Performance in 2025 was marginally behind its benchmark, the FTSE All-Share ex 100 ex Investment Trusts Index, largely as a result of stock specific issues, with MRC delivering a NAV TR of 11.1%, versus the benchmark’s 12.4%. However, the trust currently trades at a c. 10% discount, one of the widest in the peer group and in line with its own five-year average. We believe this not only overlooks the longer-term outperformance of the strategy, which has five-year returns of 33.9% versus 31.8% of the benchmark, but also offers a compelling entry point to the recovery potential of the UK market.

A more direct beneficiary from an ongoing recovery in IPOs would be the London Stock Exchange Group (LN: LSEG) itself. The company’s revenue is directly linked to dealing activity, therefore a pickup in IPOs would lead to an increase in admission and listing fees, with the higher number of listed companies feeding through to better trading volumes. As such, if the IPO momentum carries on and has the expected spillover benefits, we would expect better operational performance for LSEG.

The firm is a sizeable holding for Finsbury Growth & Income Ord (LSE:FGT)and Lindsell Train Ord (LSE:LTI), two Nick Train managed trusts, at an 11.2% and 12.2% position respectively. In the latest annual report for LTI, Nick notes LSEG’s fundamentals are strong, with double-digit growth forecasts and high operating margins. Furthermore, he highlights the company has recently partnered with Microsoft to combine AI with the firm’s large data set to provide new insights for clients, which could generate additional revenue. Despite LSEG’s argued potential, shares were down c. 20% in 2025, meaning the share price remained essentially flat over five years, leading to an estimated forward PE ratio of c. 19×. Any recovery in this would have an outsized impact on both trusts as a result of the sizeable holdings.

In conclusion, the nascent recovery of the IPO market in the UK over the past few months is very encouraging, with a number of factors, ranging from regulatory to demand recovery, indicating this could continue into 2026. That said, the US remains the go-to market for companies looking to list, especially larger companies due to the typically higher valuations, and those in the technology sector due to the specialism of the Nasdaq index.

However, the recent recovery in the UK’s listing environment is still positive, and may well be the catalyst that reverses many years of negative sentiment and depressed valuations. With a number of investment trusts still trading at sizeable discounts, there are several exciting opportunities in the asset class for investors to not only capture the recovery, but to capitalise on this sentiment reversal further through discount narrowing.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.