End of an era for these FTSE 100 stocks?

There's no room for sentiment in the City, and these household names could follow M&S out of the door.

4th September 2019 11:05

by Graeme Evans from interactive investor

There's no room for sentiment in the City, and these household names could follow M&S out of the door.

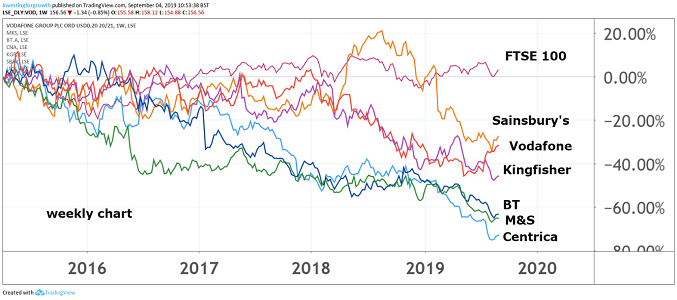

The blue-chip demotion of Marks & Spencer (LSE:MKS) is dominating the headlines this week, but the ailing retail giant is far from the only household name struggling in the FTSE 100 index.

The "end of an era" tag bestowed on M&S could just as easily apply to British Gas owner Centrica (LSE:CNA), B&Q chain Kingfisher (LSE:KGF) or supermarket Sainsbury's (LSE:SBRY) — all of whom have been hovering close to the Footsie trap door and may yet begin 2020 in the FTSE 250 index.

Several other well-known names have endured a miserable year in 2019, with the list of the biggest fallers in the top flight dominated by the likes of BT Group (LSE:BT.A), British Airways owner International Consolidated Airlines Group (LSE:IAG) and The Royal Bank of Scotland (LSE:RBS).

It's a wake-up call for investors, some of whom may have thought that having their money invested in familiar names would offer sanctuary in these uncertain economic times. Other investors are paying the price of inertia, which in some cases has lasted several decades.

The Tell Sid advertising campaign of November 1986 enticed hundreds of thousands of people to buy shares in British Gas, with their subsequent ownership of shares in BG Group, Centrica, National Grid (LSE:NG.) and Royal Dutch Shell (LSE:RDSB) reaping rich rewards. But, as far as Centrica is concerned, the shares are back trading at the lowest level since the company was created out of British Gas in 1997.

The writing has been on the wall for some time, with the shares down 47% so far this year and 72% over the past decade after two dividend cuts by boss Iain Conn left the proposed full-year pay-out at just 5p a share. Even if this still offers a 7% dividend yield, it's hard to find too many analysts prepared to overlook the unpredictability of Centrica's current business mix.

The company highlights the fear that the FTSE 100 is made up of too many “lumbering beasts” offering big yields that eventually trap investors enticed by a lowly share price.

Source: TradingView Past performance is not a guide to future performance

Vodafone (LSE:VOD) is one such high-profile example after CEO Nick Read cut the dividend for the first time with a 40% reduction earlier this year. BT is widely tipped to follow suit in order to meet its investment demands, having only recently woken up to the need to become more lean and agile.

For Vodafone, certainly, there is hope that the dividend 'reset' and possible IPO of its valuable phone masts business could mark a turnaround for the former tech boom star. Optimism around BT is harder to justify right now. New CEO Philip Jansen is cutting costs and restructuring, but there are just too many headwinds - increased regulation, fierce competition, rising costs, drop off in contribution from legacy products, and threat of a no-deal Brexit - to believe a sustainable recovery is possible yet.

And, while bumper special dividends from the likes of mining giant BHP (LSE:BHP) have inflated blue-chip income to record levels in the past year, other leading stocks have struggled to increase their dividends. GlaxoSmithKline (LSE:GSK) is a notable example, given that it shows no sign of upping the 80p a share it has paid investors ever since 2015.

Dividend payments are at least starting to grow again in the beleaguered banking sector, with RBS's recent special dividend propelling the current yield to 7%, Lloyds Banking Group (LSE:LLOY) yielding 6.5%, HSBC (LSE:HSBA) and Barclays (LSE:BARC) 5% and Standard Chartered (LSE:STAN) around 3%.

The general market view on prospects for the banks is a mixed bag, however, with Lloyds shares highly regarded but unlikely to be free of their Brexit paralysis anytime soon.

Where's the value?

After such a dismal performance from so many legacy FTSE 100 stocks this year, the question for investors will be whether some of them now offer compelling value at a time when quality growth stocks are becoming harder to come by.

But, as Centrica and Marks & Spencer show, there's the very real danger of catching a falling knife. Are the best days over for these stocks, squeezed out by more nimble competitors, advances in technology or structural changes in their industry?

- It's not just UK stocks that pay big dividends. Check out these ii Super 60 recommended income funds

ITV (LSE:ITV) is one such example as the commercial broadcaster battles a changing media landscape where there's now much more content and many more ways to consume it. It’s also proved impossible so far to halt a plunge in advertising revenue.

Marks & Spencer has been feeling the heat of intense retail competition for some time, with FTSE 100 rivals Next (LSE:NXT) and Primark owner Associated British Foods (LSE:ABF) apparently much better equipped to deal with the threat of online newcomers such as ASOS (LSE:ASC) or Boohoo (LSE:BOO).

A return to the top flight for M&S may well hinge on its high-stakes joint venture with Ocado (LSE:OCDO), in which it has agreed to buy 50% of its partner's retail business for £750 million. This has been funded by a £601 million rights issue alongside a 40% cut in its dividend. Only time will tell whether it can reclaim its place among the 26 founder members still in the blue-chip index.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.