eyeQ: this drug giant now looks overvalued

Experts at eyeQ use AI and their own smart machine to analyse macro conditions and generate actionable trading signals. Risk-reward favours waiting for pullbacks at this stock.

3rd February 2026 09:59

by Huw Roberts from eyeQ

“Our signals are crafted through macro-valuation, trend analysis, and meticulous back-testing. This combination ensures a comprehensive evaluation of an asset's value, market conditions, and historical performance.” eyeQ

- Discover: eyeQ analysis explained | eyeQ: our smart machine in action | Glossary

Pfizer

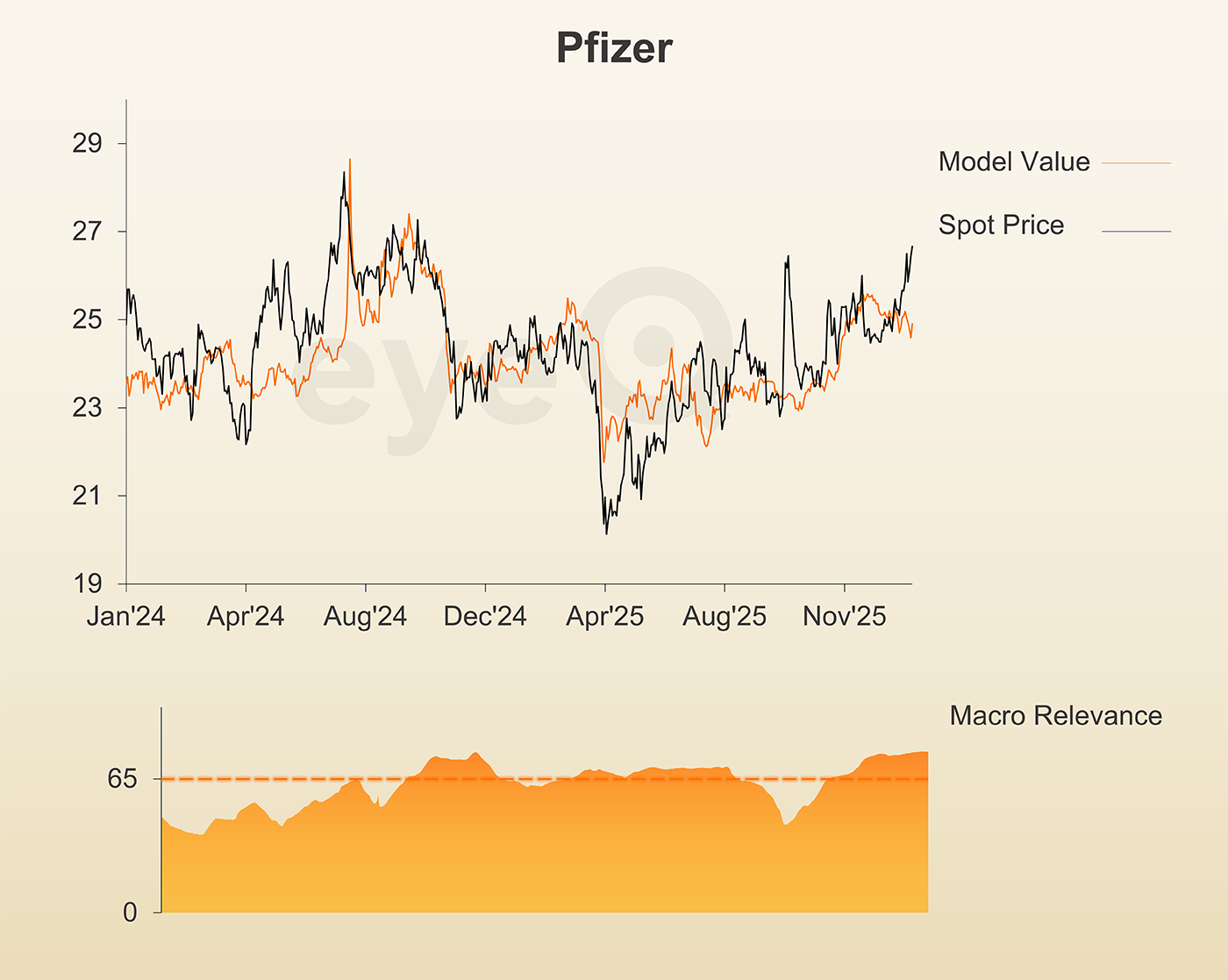

Macro Relevance: 78%

Model Value: $24.91

Fair Value Gap: +6.58% premium to model value

Data correct as at 3 February 2026. Please click glossary for explanation of terms. Long-term strategic model.

It’s a big few days for earnings from the pharmaceutical giants.

Today Pfizer Inc (NYSE:PFE), tomorrow GSK (LSE:GSK). GSK’s macro relevance score is 44% and there’s no valuation gap of note - the stock is trading close to where macro says it should. Pfizer, however, is more interesting from a macro perspective.

First, the stock is in a macro regime. eyeQ’s macro relevance score rose back above our 65% threshold in October and today big-picture stuff such as growth, inflation and the Federal Reserve explain 78% of price moves.

Second, eyeQ model value rose strongly at the end of 2025. In Q4, it was up nearly 8.5% thanks mainly to falling US inflation expectations. But now, the tide has shifted somewhat, especially on the inflation front. Inflation expectations have increased around 20 basis points over January as the markets fear higher commodity prices, delayed tariff effects plus a “run-it-hot” economy could prompt a resurgence of price pressures.

Thus far, the impact is small. eyeQ model value for Pfizer is down around 1%.

But the market has ignored this re-pricing around inflation and pushed the stock higher, focusing instead on a raft of analyst upgrades in the pharma sector more broadly.

That divergence leaves the stock around 6.5% rich to eyeQ model value, which is sufficient to fire a bearish signal. From our perspective, the bottom-up news has pushed the stock price to levels not justified by macro conditions. From here, the risk-reward favours waiting for pullbacks.

Source: eyeQ. Past performance is not a guide to future performance.

Useful terminology:

Model value

Where our smart machine calculates that any stock market index, single stock or exchange-traded fund (ETF) should be priced (the fair value) given the overall macroeconomic environment.

Model (macro) relevance

How confident we are in the model value. The higher the number the better! Above 65% means the macro environment is critical, so any valuation signals carry strong weight. Below 65%, we deem that something other than macro is driving the price.

Fair Value Gap (FVG)

The difference between our model value (fair value) and where the price currently is. A positive Fair Value Gap means the security is above the model value, which we refer to as “rich”. A negative FVG means that it's cheap. The bigger the FVG, the bigger the dislocation and therefore a better entry level for trades.

Long Term model

This model looks at share prices over the last 12 months, captures the company’s relationship with growth, inflation, currency shifts, central bank policy etc and calculates our key results - model value, model relevance, Fair Value Gap.

These third-party research articles are provided by eyeQ (Quant Insight). interactive investor does not make any representation as to the completeness, accuracy or timeliness of the information provided, nor do we accept any liability for any losses, costs, liabilities or expenses that may arise directly or indirectly from your use of, or reliance on, the information (except where we have acted negligently, fraudulently or in wilful default in relation to the production or distribution of the information).

The value of your investments may go down as well as up. You may not get back all the money that you invest.

Equity research is provided for information purposes only. Neither eyeQ (Quant Insight) nor interactive investor have considered your personal circumstances, and the information provided should not be considered a personal recommendation. If you are in any doubt as to the action you should take, please consult an authorised financial adviser.