Five Hong Kong stocks to watch

With the Hong Kong market picking up, our columnist and author has taken a closer look at five stocks.

10th April 2019 11:34

by Rodney Hobson from interactive investor

With the Hong Kong market picking up, our columnist and author has taken a closer look at five stocks.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

It's more than 20 years since Hong Kong ceased to be a British colony but it still exercises a strong attraction for British investors. Although it has come increasingly under Beijing's control, it retains its status as a link between the world's second largest economy and the rest of the world.

Consumerism has come late to China but it has arrived with a vengeance, until recently helping to produce annual economic growth of up to 10%. The slowdown to around 6% is disappointing but such a rate is impressive at a time when global growth has slowed to about half that level and Europe is in danger of tipping into recession.

- Invest with ii: Top UK Shares | Buy International Shares | Open a Trading Account

The Hong Kong Stock Exchange is properly regulated, is priced in a stable currency and offers a range of investment choices. It may pay to look now. Although yields can be generally quite low by London standards, the market has picked up nicely so far this year so the best chance to get in is disappearing.

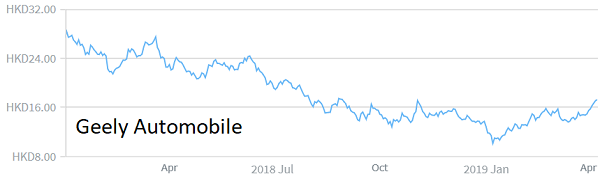

Geely Automobile (SEHK:175) is a Hong Kong-based company that makes and sells vehicles in China and various other countries across the globe.

The shares peaked at an unrealistic HK$29 at the start of last year before losing over 60% of their value in 12 months in an overcorrection.

They have picked up to $17.70 and should be testing HK$20 before long. The yield is admittedly thin at 1.7% but the price/earnings (P/E) multiple is decidedly undemanding at just above 10.

Source: interactive investor Past performance is not guide to future performance

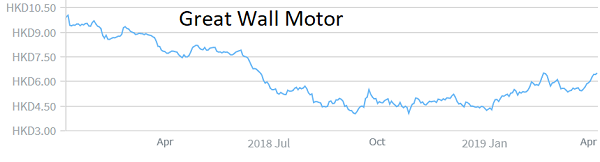

Great Wall Motor (SEHK:2333) is a possible alternative. It makes SUVs, sedans and pick-up trucks plus vehicle parts and components. The yield of 3.2% is much more attractive than Geely's and the P/E is slightly better.

The shares peaked at HK$27 in May 2015 and only an incurable optimist would hope to see that level again soon. However, at HK$7 now there is surely some upside, with HK$9.50 looking attainable.

Insurance has been a great growth area in the Asia-Pacific region, as shareholders in Prudential will testify. The Far East, with its rising middle classes needing, and increasingly able to afford, insurance for life, homes and cars has been the best part of the Pru's global business over the past decade.

Source: interactive investor Past performance is not guide to future performance

Ping An Insurance (SEHK:2318) trades at HK$93.35 and looks set to crash through its previous high of HK$96 achieved in January last year. It has had a great start to 2019, after sliding to HK$66.55. Five years ago it was below HK$30.

The P/E is an undemanding 13, which is actually similar to Prudential (LSE:PRU), although the yield at a respectable but unexciting 2.1% is not as good as for its London-based rival. Investors who fancy a punt need to act before the share price recovery goes too far.

Source: interactive investor Past performance is not guide to future performance

An alternative is China Life Insurance (SEHK:2628), whose shares have been less erratic. The recovery has not been as pronounced as at Ping An so there could be more to come.

China Life peaked at HK$38 way back in April 2015 and it has been as low as HK$16 but, like Pin An, it has been on the rise this year, reaching HK$22. It offers a yield of 2.2%.

Source: interactive investor Past performance is not guide to future performance

China Resources Pharmaceutical (SEHK:3320) is one of the largest drug distributors to hospitals in China. One advantage of being listed in Hong Kong is that it has been able to borrow at favourable interest rates to fund the acquisition of weaker rivals, a policy that is likely to fuel growth for years to come.

The shares stand at HK$11, giving a yield of 1% and a P/E of 17.

Source: interactive investor Past performance is not guide to future performance

Hobson's choice: I prefer Great Wall to Geely and China Life to Ping An on current valuations. Buy China Resources Pharmaceutical for the long term below HK$12.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.