Four shares considered for this portfolio

11th September 2018 10:50

by Richard Beddard from interactive investor

Each month Richard Beddard trawls through annual corporate results for candidates for his watchlist and the Share Sleuth portfolio of companies. Here's his latest analysis.

Motorpoint (MOTR) High performance, low margins

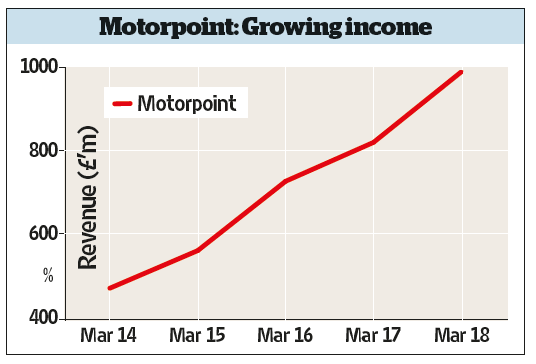

Independent motor dealer Motorpoint performed very well in the year to March 2018. Revenue increased 21% and profit increased 34% compared to the previous year, when it experienced a mini-slump after the Brexit referendum. Even that year, Motorpoint, which had only just floated on the stockmarket, was an impressive performer. Return on capital in the year to March 2017 was 13%. In 2018 it was 18%.

Motorpoint is a very profitable business, probably because of its unique position in the market. With 12 sites and revenue of nearly £1 billion, the UK's largest car supermarket only sells nearly new cars, almost always still covered by the manufacturer's warranty.

Size gives it purchasing power over the large fleets from which it buys cars, and the age of the cars is one of a number of factors that give car buyers confidence they're not buying a lemon. Like some other car supermarkets, Motorpoint checks the cars, services them, and provides a vehicle history check. It sells the cars at a fixed price, which means a haggle and often hassle-free experience.

Source: interactive investor Past performance is not a guide to future performance

Solid State (SOLI) Power trio's solid charge

In the year to March 2018, Solid State failed to turn 16% revenue growth into more profit, and profit declined slightly compared to the previous year. In short, the company sold more of its less profitable products.

While Solid State Supplies, a distributor of electronic components and the smaller half of the business, grew strongly, profit margins are lower than at its slightly bigger sibling Steatite – a manufacturer – which grew less rapidly. Within Steatite, sales of portable battery packs supplied by the power division – among Solid State's least profitable products – increased dramatically, while sales of more profitable rugged computers fell, and sales of military and meteorological antennae did not live up to expectations. An antenna sales drive in the US foundered, due to the US government’s hardening attitude to trade.

Even so, revenue grew fastest at Steatite's communications division, which supplies radios as well as antennae, but it had limited impact because communications is the smallest of Solid State’s businesses.

Despite poor profit growth, Solid State is still performing well. The company earned a return on capital of 18%, very close to its long-term average, and it has no borrowings.

Source: interactive investor Past performance is not a guide to future performance

At 280p, the share price values the enterprise at £27 million or about 10 times adjusted profit. The earnings yield is 10%. The business is working hard to make itself better, but it is already quite good.

Trifast (TRI) Profits in nuts and bolts

Fastener distributor and manufacturer Trifast says its products 'hold the world together'. In fact, the nuts, bolts, screws, washers and rivets it makes hold together a small proportion of the world’s vehicle dashboards, household appliances and telecommunications equipment. These components may be modest in size and value, but they can be critical in terms of reliability, weight and easy assembly.

In the year to March 2018, Trifast lifted revenue 6% and adjusted profit 8%. The company strikes a confident tone in its annual report, declaring this the optimum time to invest the equivalent of a year’s profit in a new software system that will integrate its operations on different continents. It brushes off the threat of tariff s and trade barriers due to Brexit as an opportunity to improve the efficiency of its supply chain, routing more products through Trifast’s European manufacturing and distribution businesses if necessary.

Trifast's strategy has been to target large manufacturers with exacting requirements in terms of both fastener specification and global supply -requirements that smaller local businesses often cannot meet.

To better serve these customers it has increased its product range and global footprint through acquisitions. Earlier this year it acquired PTS, located a few miles up the road from its Sussex headquarters. PTS distributes stainless steel fasteners in the UK. Three other acquisitions earlier this decade were in Malaysia, Italy and Germany.

Source: interactive investor Past performance is not a guide to future performance

Trifast has also adopted a policy of continuous improvement, evangelised by senior management since the company lost its way during the financial crisis. A new board, recruited in 2009 and 2010 from long-serving employees, put the emphasis on staff, fostering innovation, training and a sales-led culture that, along with a sustained period of growth in manufacturing generally, has delivered high levels of profitability. For the last four years, return on capital has exceeded 15%, higher than pre-crisis levels, suggesting perhaps that Trifast has not just recovered but is a better business.

A share price of 225p values the enterprise at £310 million, or about 16 times adjusted profit. The earnings yield is 6%. But while continued improvement has probably made Trifast more resilient, it still serves capricious markets that will inflict infrequent and temporary pain on the business and its shareholders.

Vp (VP.) Revenue up, debt up

Due in part to the acquisition of Brandon Hire in November 2017, Vp increased revenue by 22% and profit by 20% in the year to March 2018 compared to the previous financial year.

Vp is a group of specialist equipment rental firms. Brandon Hire joins Hire Station, Vp's tool hire chain, perhaps doubling it in size. It's Vp's biggest business by revenue. The acquisition also reverses the international direction taken the previous year when Vp acquired TR, an Australian firm that specialises in renting electronic testing and measurement, communications and audio visual equipment. Thanks to struggling Airpac Bukom, a supplier of equipment to mainly overseas-based oil and liquefied natural gas companies, Vp only earned 10% of revenue and a sliver of profit from its two international businesses.

Nevertheless it earned a 10% return on capital in the year to March 2018, very close to its long-term average and 1% lower than the previous year. Though the level of profitability is unremarkable, its consistency is noteworthy. Despite serving cyclical construction, infrastructure and energy markets, return on capital did not drop more than 1% or so below 10% even in the years following the financial crisis. This has encouraged the company to borrow, allowing it to grow faster and earn higher returns for shareholders.

The firm's reliance on external funding, bank borrowings and operating leases has been as consistent as its profitability, but that may have changed in 2018 when the acquisition of Brandon Hire required it to borrow even more. Now 85% of the money required to equip and operate its depots is financed by banks and landlords; typically Vp has kept this ratio at about 70%. Management may take the view it can sustain a higher level of debt, or it may have sufficient confidence to have calculated it can use profit to reduce borrowing to more normal levels before any major downturn strikes.

A share price of £11.20 values the enterprise just shy of £860 million or 19 times adjusted profit. The earnings yield is 5%.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.