FTSE for Friday and a look at Mitchells & Butlers

26th November 2021 07:35

by Alistair Strang from Trends and Targets

A share price move on Thursday afternoon gives independent analyst Alistair Strang hope for the FTSE 100 index today.

With the FTSE 100 staggering around like a drunk looking for a kebab shop, it makes some sense to take a quick glance at one of the majors in the hospitality industry. After all, thanks to FTSE behaviour since May, surely many traders must require refreshment?

Perhaps this shall not prove the case. Mitchells & Butlers (LSE:MAB) The owner of 1,600 venues reports improvements in profits, along with a few moans which point out footfall has improved in their suburban locations, while city centre establishments continue to find things tight. In addition, they claim Brexit has harmed trade and warn paying staff a reasonable wage from 2022 will damage their bottom line.

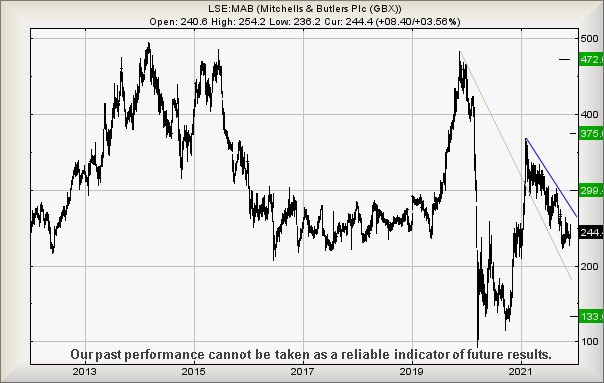

We’re curious whether the share price shall enjoy a return to normality. Presently trading around 244p, the share needs to exceed 264p to provide an early sign of hope, calculating with the potential of a journey to 299p initially. If exceeded (visually, we expect hesitation at this level, regardless) our longer-term secondary works out at 375p.

- Light at end of the tunnel for Mitchells & Butlers?

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

- Why reading charts can help you become a better investor

Achieving such a target as 375p is liable to be useful for the longer term. According to our software, if the company share price manages to close a session above 334p, a cycle should commence to 472p, challenging the high of 2019. As the chart illustrates, this appears to be a favourite level for the price, a glass ceiling forming since 2014.

Source: Trends and Targets. Past performance is not a guide to future performance

For everything to go wrong, the share needs to relax below 220p, as we’d need take another look at the tea leaves. At present, the best we can calculate is a dangerous plunge to 133p.

FTSE for Friday

With the FTSE 100 essentially marching on the spot, while the USA conducted turkey genocide, the market enacted a small but interesting movement from 3pm, producing a rare emotion called ‘Hope’ for Friday.

The market closed the day at 7,310 points and now needs only exceed 7,319 points to make an attempt at 7,335. While a 16-point gain is tame by any standards, our secondary at 7,355 is slightly more worthwhile.

In addition, we stumbled across an interesting number from a bigger picture potential. Apparently we are to believe the UK market is now on track to make an attempt at 7,375 points.

If bettered, we can calculate a longer term secondary at 7,550 points, and regular readers will be aware we regard this specific number as critical. This is exactly the level of the market before the pandemic drop in 2020. Good things tend happen to markets around the world when they finally exceed this Covid-19 point in time.

Source: Trends and Targets. Past performance is not a guide to future performance

If things intend to go horribly wrong, the FTSE now requires to trade below 7,265, risking reversal to 7,235 with secondary, if broken, at 7,202 points.

Have a good weekend. We won’t, thanks to Scotland's west coast promising 75mph winds along with snow and ice! It must be winter…

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.