Geopolitical tension seen as core threat to investments...

...and investors say scrapping stamp duty on UK shares would drive interest in UK stocks. interactive investor publishes latest Retail Investor Sentiment Poll.

2nd February 2026 09:42

interactive investor, the UK’s leading flat-fee investment platform, outlines the results of its latest Retail Investor Sentiment Poll*. The poll gives a snapshot of how investors are positioning their portfolios, delving into the core themes on investors’ minds.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

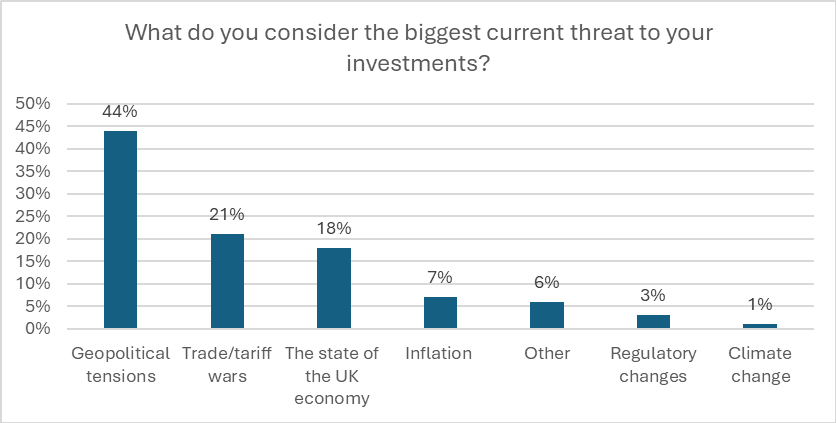

What do investors see as the main threat to their investments, coming into 2026?

Geopolitical tension was cited as the most significant threat to investments, with 44% of the vote. This is up by 11% since interactive investor last conducted the poll in June 2025.

More specifically, the threat of trade/tariff wars was the second-highest concern, according to respondents (21%). The next most popular answer was the state of the UK economy with18% of the vote. Inflation, however, took 7% of the vote. Regulatory changes (3%) and climate change (1%)were the least popular answers.

Despite macro political fears, it seems investors are sticking to their investment strategies. When asked: “How does the amount you’re investing this year compare to last year?” almost half of investors polled, 46%, said they are investing the same amount, and just over a quarter (27%) said they are investing more.

Camilla Esmund, Senior Manager, interactive investor, comments: “We’ve seen mixed, but resilient, markets coming into 2026. The start of January saw the FTSE 100 exceed historic milestones, but a lot of broader uncertainty remains, reflecting a multitude of global macro risks and ongoing trade uncertainty. Market jitters can understandably spark emotional reactions for investors, especially when they cast a shadow over pensions, individual savings accounts (ISAs), and long-term investments.

“It’s still very early in the year, so it’ll be interesting to see if investors’ strategies shift should these geopolitical tensions escalate in the coming months. But so far, our poll results are indicative of something deeper; retail investors are prepared to hold their nerve despite uncertainty and invest for the long-term. That is powerful. Investing is a long-term game, but the reality is that it is not easy to overcome our gut-reactions when we see markets go through peaks and troughs. However, we know from our ii Index data that interactive investor customers are connoisseurs at creating well-diversified portfolios and staying invested, and that is why we also continue to see such impressive performance from these self-directed investors.”

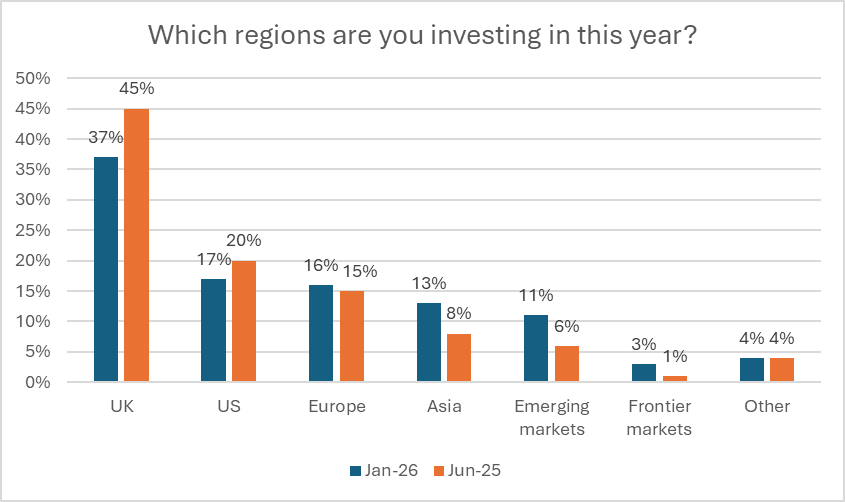

Whichregions are investors looking at?

When asked “Which regions are you investing in this year?” The UK continues to lead. In fact, over one third (37%) of investors polled said they are focusing on the UK.

By contrast, the US appears to be losing some traction with investors. 17% of respondents said they are focusing on the US from an investment perspective, and this is down from 20% in June 2025. Investor interest in Europe has stayed consistent and increased slightly, with 16% of the vote (versus 15% in June 2025).

Esmund adds: “The UK remains popular with investors. However, it seems that investors are broadening their horizons and looking for pockets of growth overseas as we come into 2026. In fact, interactive investor’s poll found that from a regional perspective, Asia and Emerging Markets are looking more interesting for investors.13% of investors said they are looking to invest in Asia versus 8% in June last year, and 11% said they’re investing in Emerging Markets, which only got 6% of the vote in June 2025.”

Which asset classes are investors looking at?

Over half of respondents said they’re investing in equities (53%), and commodities proved popular with 17% of respondents.

Fixed income took 12% of the vote, followed by cash-like investments (e.g. money market funds) with 10%. Cash only got 4% of respondents, and alternatives (e.g. crypto) had 3% of votes.

Esmund notes: “With geopolitical risk front-and-centre of investors’ minds, it’s no wonder that ‘safe havens’ such as gold and silver have been popular, as investors look to preserve capital. We’re seeing this in real-time in the first month of 2026, with gold surging to all-time highs. Other metals will also be benefiting from ongoing technological and infrastructure demand, as well as being a good hedge against inflation, so it’s likely that investors are seeing commodities as another way to diversify and weather-proof their portfolios as they continue to position their portfolios for the long term.”

Driving more interest in UK-listed stocks

The government has recognised that retail investors can be significant drivers of UK growth, so as part of this research, interactive investor asked investors about factors that could prompt more interest into UK-listed stocks.

In interactive investor’s poll, a staggering three-quarters (75%)of investors believe that removing stamp duty on UK shares and trusts would incentivise them to invest more in UK-listed stocks. In addition, one in 10 stated that simplifying the ISA landscape would help. These are two areas which interactive has long been vocal on, to structurally remove barriers for retail investors, reduce complexity, and get more Britons investing.

The ongoing impact of the Autumn Budget

interactive investor also wanted to understand how investors are thinking about the 2025 Autumn Budget’s impact on their personal finances and investments.

When asked: “What’s your biggest concern following November’s Autumn Budget?”‘All of the tax changes’ was the most popular answer,with 47% of the vote. Fiscal drag got 26% of votes, followed by dividend tax at 11%. Changes to the ISA allowance got 5% of votes and changes to salary sacrifice got 4%.

Esmund notes: “With tax thresholds frozen for even longer following Reeves’ Budget, the financial impact of this hasn’t gone unnoticed by retail investors. In fact, over a quarter (26%) of investors we polled said their key concern following the Budget was the impact of so-called ‘fiscal drag.’ It’s encouraging to see that investors are aware of the stealthy effect of this phenomenon, and the need for our money to work harder for us.

“Using tax-efficient wrappers such as Individual Savings Accounts (ISAs) and Self-Invested Personal Pensions (SIPPs) can be a great way to shield our wealth from being eroded by the ongoing individual tax-burden. And, of course, if you have a longer time horizon, investing in the markets can grow your money more effectively over time, albeit with risk, so it must make sense for each individual and their unique risk appetite.”

*The poll was conducted with 1,005 respondents on the interactive investor website between 22-26 January 2026.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information: Please remember, investment values can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.

Important information – SIPPs are aimed at people happy to make their own investment decisions. Investment value can go up or down and you could get back less than you invest. You can normally only access the money from age 55 (57 from 2028). We recommend seeking advice from a suitably qualified financial adviser before making any decisions. Pension and tax rules depend on your circumstances and may change in future.