Have gold funds lost their sparkle?

Our Saltydog analyst is considering taking profits in Ninety One Global Gold.

26th October 2020 13:01

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Our Saltydog analyst is considering taking profits in Ninety One Global Gold.

As active investors we believe that you need to adjust your holdings in response to market conditions.

We do not try to predict what is going to happen in the future, we just look at what is going on at the moment and determine the best-performing market sectors. We then drill down and find the leading funds in these sectors. We provide this information to our members every week.

To show how the data can be used to manage a balanced portfolio, we also run a couple of demonstration portfolios with our own money.

Each week, we review the latest performance reports and decide whether to make any changes. We do not make changes every week, in fact, we have not made any in the last three weeks.

- These fund portfolios have never been better

- The fund winners powering our performance

- Will top 20 fund winners of last six months keep up their fine form?

Deciding which funds to buy is relatively straightforward. We group the sectors according to their historic volatility to give an indication of how “risky” we think they are. We can then hold a balance of funds that are low risk, medium risk and high risk. Within each of the groups it is then just a case of looking for the best-performing funds in the best-performing sectors.

Having selected which funds to buy, we then have to determine when to sell them. This is not so easy. As a trend develops, there are often minor setbacks along the way. It is not unusual for a fund to have a couple of poor weeks before picking back up again. We track the funds using a ranking system that compares all the funds in each of our groups. We will usually wait until a fund has had three consecutive weeks in the bottom half of the rankings before taking any action.

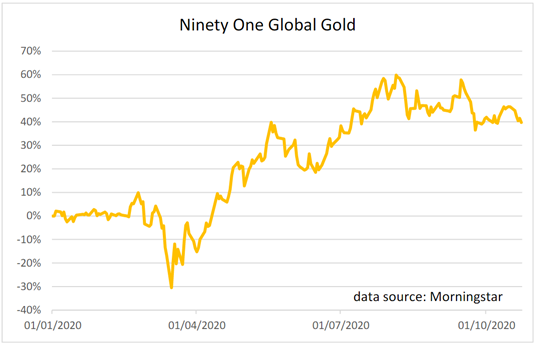

At the end of February, we bought the Investec Global Gold fund, which has subsequently changed its name to Ninety One Global Gold.

When we decided to sell all of the other funds that we were holding at the beginning of March, this was the only one that we kept.

With stock markets in freefall, we hoped that gold funds would benefit as investors looked for safe-haven investments. To our surprise, the opposite happened. Within a few weeks, our holding was showing a loss of 24%. We did not sell and it soon started to recover.

Past performance is not a guide to future performance.

It then had another wobble at the end of May, before recovering and going on to a new high in August.

- Read more articles by Saltydog investor

- Funds and trusts four professionals are buying and selling: Q4 2020

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Over the last few weeks, it has dropped back again. Our ranking rule has not yet been broken, but it has been close.

If we do not see another upturn fairly soon, we will have to consider taking the profit and moving on to another sector.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.