How investors in trusts can balance profit and principles

1st July 2022 14:10

With 'sin stocks' the success story of the year so far, investors with a sustainable mindset have had a challenging period. Kepler examines the issue and turns the spotlight on a new trust investing in renewable energy assets.

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

As we emerged from the pandemic, it seemed the world was gripped by a greater awareness of the fragility of our planet, and our place within it. Mirroring this, investors and fund managers started to explore what this increased focus on sustainability meant for investing. For many, the instinctive response was to follow their heart and ditch ‘dirty’ stocks from portfolios, such as oil companies. Hot on the heels of the likes of Shell (LSE:SHEL) and BP (LSE:BP.) cutting their dividends in 2020 – a result of Covid-19 lockdowns – the decision seemed a relatively easy one to rationalise.

Yet as Merryn Somerset-Webb accurately pointed out in March 2021, “there might be another way of looking at this, one that is just a bit hard to hear over the cacophony of ostentatious do-goodery”. Her point was from a sustainability perspective; it was better to hold on to these sorts of companies, that they remain public, and that their management teams are held to account on their plans to achieve net-zero in a way that would be impossible if ‘divestment’ were to take hold, and they were taken private by investors who were not necessarily as accountable as a public company’s board and management are. Merryn argued that “holding fossil-fuel firms is one of the most socially responsible things an engaged and financially aware investor can do now”.

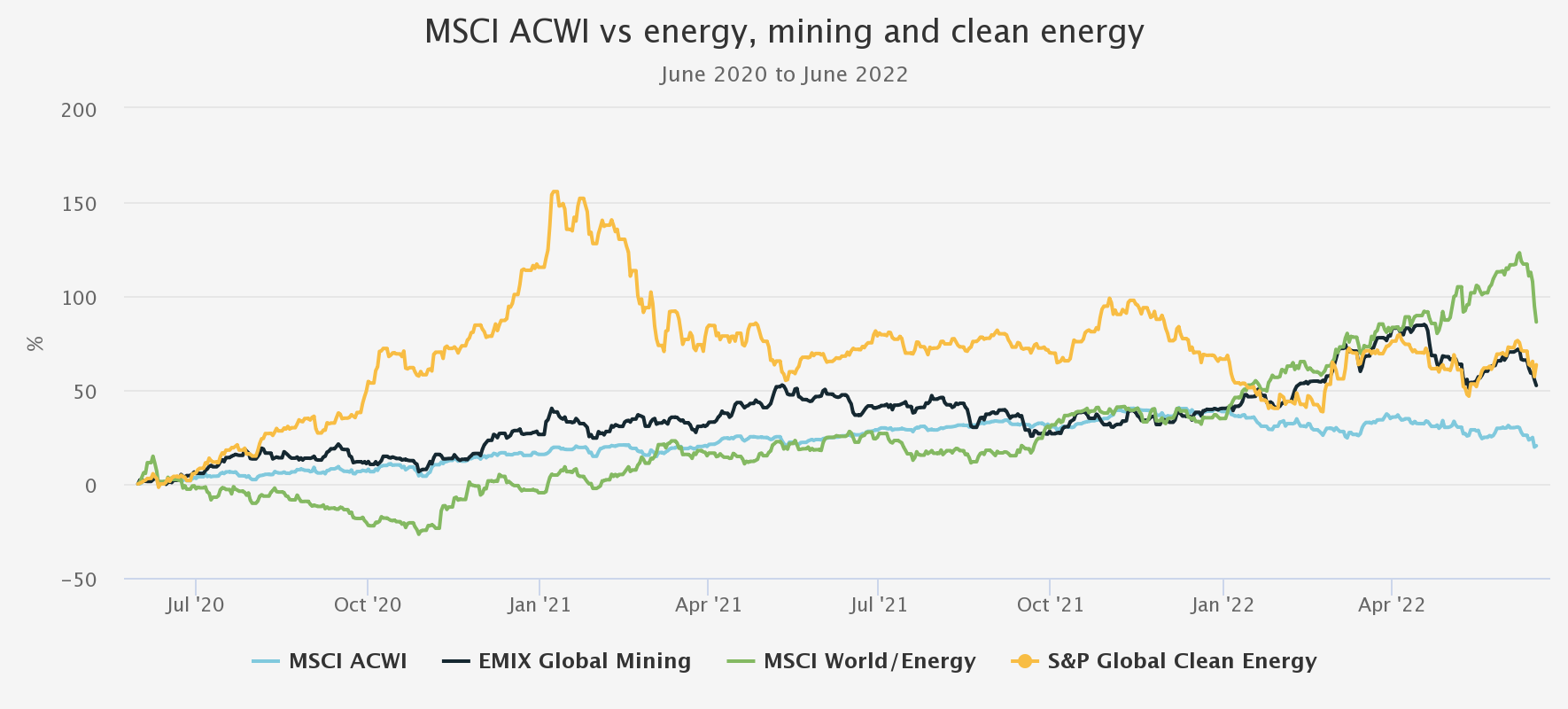

It turns out that it was the right thing to do, not just from a sustainability perspective. For as the graph below illustrates, it would have been a very smart thing to do from a financial perspective. Energy stocks bottomed in November 2020, before staging a huge recovery, which has clearly been given added impetus following Russia’s invasion of Ukraine. Clean energy stocks, on the other hand, have fallen significantly from their highs in January 2021. That said, over the past 24 months, clean energy, mining, and traditional energy have outperformed the wider equity market by quite some margin.

SUSTAINABILITY PAYS?

Source: Morningstar. Past performance is not a reliable indicator of future results

In some ways, the market’s willingness to embrace traditional energy companies reflects a wider and more sober reappraisal of the realities of the energy transition by the investment world. Certainly, when BlackRock CEO Larry Fink stated in his 2020 annual letter to CEOs that “climate risk is investment risk”, he observed that “with the impact of sustainability on investment returns increasing, we believe that sustainable investing is the strongest foundation for client portfolios going forward”. It was a sentiment that many investors shared, and some took a relatively extreme view, selling out of oil stocks and other directly polluting sectors.

Larry expanded on his views in the 2022 letter stating that “divesting from entire sectors – or simply passing carbon-intensive assets from public markets to private markets – will not get the world to net zero”. He makes a very good point that “companies must ensure that people continue to have access to reliable and affordable energy sources. This is the only way we will create a green economy that is fair and just and avoid societal discord. And any plan that focuses solely on limiting supply and fails to address demand for hydrocarbons will drive up energy prices for those who can least afford it, resulting in greater polarisation around climate change and eroding progress”.

Striking the right balance

When we caught up with Mark Hume recently, the co-manager of BlackRock Energy and Resources Income (LSE:BERI), he emphasised that this reality is something that he – as the energy specialist on this trust – has been very much aware of when constructing the portfolio since he took over as co-manager in March 2020. Around this time, BERI’s board modified the mandate from one of a balance between traditional energy stocks and mining companies, towards a mandate which embraces the need for the global economy to decarbonise, including ‘energy transition’ stocks. Mark observes that the valuations of traditional energy companies hit a low point in Q4 2020, a result largely of the market’s obsession for growth but also ESG and sustainability-linked investment flows. At the bottom, he estimated that oil companies offered free cashflow yields of 20%, meaning a five-year capital payback on an investment. BERI’s managers showed courage and conviction in November 2020 when the first announcement of a Covid-19 vaccine was made, by increasing the trust’s exposure to traditional energy stocks by 10% of NAV. This exposure has been increased yet further as their conviction in the investment thesis has become stronger, such that as at 31/05/2022, traditional energy companies represented c. 41% of the portfolio, nearly as high as it has ever been since the change in the mandate, and in-line with the exposure before the mandate evolved. Contrasting with funds more purely exposed to ‘sustainability’, BERI’s managers offer a more pragmatic and rounded exposure and BERI’s NAV and share price has, as a result, outperformed handsomely. We will be publishing an updated profile on the trust soon, please click here to be automatically notified when we do.

New solutions to an age-old problem

Energy is a resource, just like any other, and scarcity of resources in one region cannot exist alongside plenty in another without causing an imbalance. Imposing a ‘one-size-fits-all’ approach on the provision of energy would certainly create an imbalance between the richest countries in the world and the poorest, whose needs are very different.

Traditional energy companies, then, clearly have a central role to play in the energy transition, not least to ensure it is gradual, which is vital to ensure an uneven transition doesn’t cause societal breakdown. Dr. Scott Tinker, director of the Bureau of Economic Geology, illustrates in his lecture on Critical Thinking for Equitable Energy how a transition might evolve, weighing the conflicting needs from rich, developed countries, middle income and low-income countries. The former would like clean energy, middle income countries want cheap energy, and low-income countries need reliable energy. Each country will have different policies, events, and resources which will influence how they achieve a transition.

According to Dr Tinker, around the world there are around 5.5 billion people consuming almost no electricity. As Dr Tinker points out, you can have energy without being lifted out of poverty, but it’s impossible to be lifted out of poverty without energy. Reducing the carbon intensity of economies is a key challenge to the sustainability of these developing countries’ economic growth, but also the sustainability of the global economy, given the expected growth in electricity demand from developing countries, most immediately in Asia. He estimates that the 4 billion people living in Asia will be the main source of increased demand for electricity in the coming decades, of which 50% is currently generated by coal, and 25% by oil. His solution is a composite transition, calling for more natural gas for electricity generation, more nuclear, as well as distributed solar which provides a significantly cleaner, cheaper and potentially more reliable source of energy for the countries such as India. Investing in renewable energy here has the potential to satisfy both the heart and the head.

We hope to be initiating coverage soon on ThomasLloyd Energy Impact (LSE:TLEP), an interesting new trust that seeks to generate NAV total returns over the medium term of 10-12% per annum by investing in a portfolio of renewable energy assets in Asian fast-growing and emerging countries. The mandate is to invest in renewable energy projects, across solar, biomass and wind technologies, transmission infrastructure, energy storage and sustainable fuel production. Aside from the wide range of potential technologies the portfolio may be exposed to, the major difference from the renewable energy investment trust peer group is that the managers will be investing in developing markets, but also in construction stage and construction-ready projects which are expected to deliver higher returns and complement purchases of operational assets.

TLEI has launched within a relatively crowded investment trust peer group, yet in our view it occupies a clear niche of its own. ThomasLloyd’s triple return objective embodies TLEI’s differentiating characteristics: attractive financial returns, as well as measurable social and environmental benefits too. Fundamentally, ThomasLloyd believes it invests where capital creates the biggest impact. This underlies the reasoning behind investing in emerging markets in Asia, where economic growth is dependent on reliable and plentiful energy supplies. Energy generated through renewables is now significantly cheaper than that derived from coal in some locations, providing a social return alongside the additional return of creating new direct jobs of local people employed to construct and maintain these assets. Please click here to be alerted to when we publish the full profile.

Larry Fink states his belief that “decarbonising of the global economy is going to create the greatest investment opportunity of our lifetime”. We would tend to agree. Although, as we have highlighted, it is important that investors listen to their head as well as their heart when considering sustainable investments.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.