How our £10,000 income investment trust portfolio is faring

The 2019 portfolio includes three trusts which use capital reserves to support their dividends.

29th July 2019 10:44

by Helen Pridham from interactive investor

The 2019 portfolio includes three trusts which use capital reserves to support their dividends.

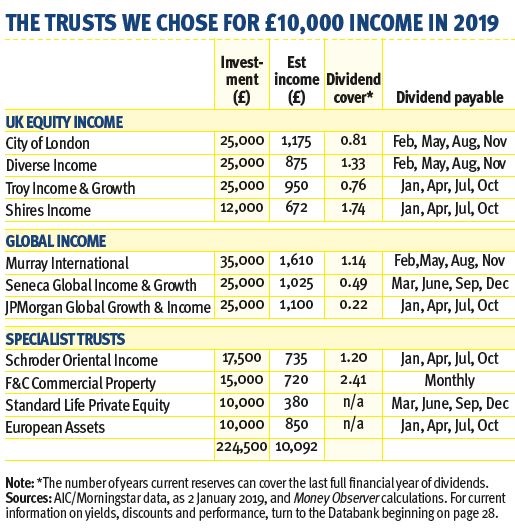

Each year for the past five years, we have put together a portfolio of income-producing trusts designed to provide a £10,000 income. We have always stressed that there is no guarantee that the portfolio will meet its objectives but so far it has always delivered over £10,000 income each year. Its capital value has been somewhat more volatile, rising in two years, and falling in two. This year so far the direction has been positive.

The 2019 portfolio includes three trusts which use capital reserves to support their dividends – European Assets (LSE:EAT) and JPMorgan Global Growth & Income (LSE:JPGI) both finance their dividend payments mainly out of capital. Standard Life Private Equity's (LSE:SLPE) yield of 3.8% is partly financed out of capital and its board has said it is committed to maintaining the real value of its dividends.

The first-named two trusts base their income payments on their net asset value (so they can fluctuate). European Assets pays a quarterly dividend of 6% of its year-end net asset value, while JPGI adopted a policy of paying a quarterly dividend equivalent to 4% of net assets in mid-2016.

European Assets is paying a lower income this year than last due to a decline in its net asset value. However, we still like its manager and the fact that it invests in medium and smaller European companies and think it has a good long-term outlook.

JPGI's current yield is paid around two-thirds out of capital. In March this year, it announced that one of its lead managers was retiring. But its investment approach will stay the same, backed up by JPMorgan's global research team, so we are happy to continue holding it in the portfolio for the time being.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.