ii Tech Focus: stock crash, AMD, Coreweave, Nvidia

With US technology stocks grabbing headlines, ii’s head of investment has the latest sector news, most-bought tech stocks on the ii platform, and forecasts for upcoming results.

14th November 2025 10:27

by Victoria Scholar from interactive investor

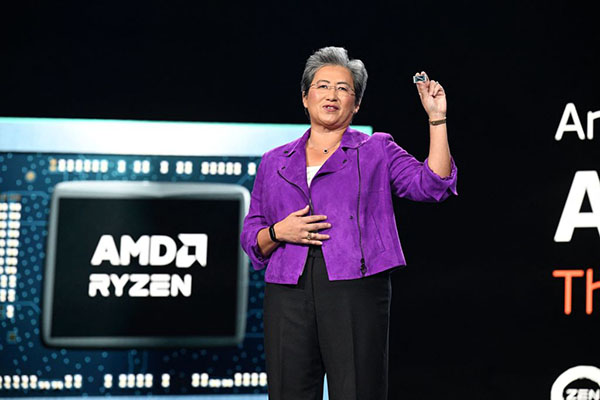

The CEO of AMD Lisa Su during the Consumer Electronics Show in 2023 in Las Vegas. Photo: Robyn BECK/AFP via Getty Images.

Wall Street’s phenomenal rally since April’s tariff low has come off the rails. While all the major indices are down, it’s the Nasdaq Composite tech index that has suffered most.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Nasdaq had returned over 62% from the low of 14,784 in April to a record high of 24,019 at the end of October. And while there have been regular pullbacks on the way up, this is one of the biggest. While not quite as severe as a similar sell-off a week ago, which attracted bargain hunters, last night’s close at 22,870 is a 4.8% retracement from the high.

It remains to be seen whether there’s buying on the dip, or if this turns into a correction – a 10% drop from the high would leave the Nasdaq Composite at 21,617. The outcome will very much depend on the artificial intelligence (AI) trade and greater confidence in a US interest rate cut next month.

Softbank

Japanese investor Softbank reported second-quarter net profit of 2.5 trillion yen ($16.6 billion) thanks to its large investment in OpenAI, which helped earnings more than double. It also announced a four-to-one stock split to make its shares more accessible to a wider pool of investors after a sharp rally pushed up its share price this year.

Softbank has benefited from the hype around AI, which reportedly pushed OpenAI to a private market valuation of $500 billion (£380 billion) last month at a secondary share sale. However, while Softbank remains bullish about OpenAI, it sold its remaining shares in NVIDIA Corp (NASDAQ:NVDA) for $5.83 billion to finance other AI investments. Shares in both Softbank and Nvidia fell in response.

Nonetheless, Softbank shares have still had an incredible run this year, rallying around 130% since the start of January. Analysts are unsurprisingly bullish towards the company with a consensus buy recommendation on the stock.

AMD

Shares in Advanced Micro Devices Inc (NASDAQ:AMD) soared by 9% on Wednesday after investors cheered its ambitious annual data centre revenue target of $100 billion.

CEO Lisa Su estimates that the data-centre chips market will hit $1 trillion by the end of the decade. Shares have had a stellar run this year, gaining close to 100% with the rally accelerating since mid-October when AMD announced a deal with OpenAI. AMD is looking to play catch up with rival Nvidia, the current market leader in the AI chip race.

Intel AI chief and Meta AI chief

According to the Financial Times, Meta Platforms Inc Class A (NASDAQ:META)’s chief AI scientist Yann LeCun is leaving Facebook’s parent company to build his own start-up. The FT says LeCun is in early talks to raise funds for a new venture.

Meanwhile, Intel Corp (NASDAQ:INTC)’s chief technology and AI officer, Sachin Katti, is also leaving after just six months in the role. He is moving on to a job at OpenAI instead where he will be working on “designing and building our computer infrastructure”, says OpenAI president and co-founder Greg Brockman.

10 most-bought tech stocks on the ii platform

Source interactive investor, 10-13 November 2025.

Coreweave

Shares in CoreWeave Inc Ordinary Shares - Class A (NASDAQ:CRWV) fell on Tuesday after the company cut its annual sales forecast. It now anticipates revenue of between $5.05 billion and $5.15 billion, below analysts’ consensus for $5.29 billion. However, third-quarter revenue more than doubled to $1.36 billion, with losses down to 22 cents per share versus $1.82 year-on-year. The AI cloud computing infrastructure company was hit by a delay at a third-party data centre partner.

CoreWeave is backed by Nvidia and has signed multi-billion dollar deals with Meta and OpenAI, having evolved from an Ethereum miner into a graphics processing units (GPU) infrastructure and AI cloud platform. It went public in March this year in the largest US tech IPO since 2021. Initially priced at $40 per share, the stock traded as high as $110 this week before dropping back to $78 on Thursday. There are concerns that rising chip costs and competition could pressure profitability.

- US tariffs or AI: which is the biggest risk for S&P 500?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

According to Refinitiv, there is a consensus buy on the stock and an average target price of $136.99. However, it has faced a series of price target cuts this week including from Mizuho, Bank of America Global Research, Jefferies, Barclays and Evercore. Plus, JPMorgan downgraded its rating on the stock from overweight to neutral, reducing its target price from $135 to $110.

CoreWeave has been one of the most-bought tech stocks on the ii platform so far this week, even though shares have shed more than 25% over the past five trading sessions.

Week Ahead

Nvidia in focus

The AI excitement has been a blessing for Nvidia, but it could also become a curse. Shares have had a stellar run of late, rallying by more than 40% over the past six months, extending a multi-year bull run for the stock, fuelled by a prolonged period of AI excitement. The chipmaker became the world’s first $5 trillion company last month just three months after pushing above the $4 trillion milestone.

However, with growing concerns about an AI bubble and fears of a crash or correction in the sector, AI poster child Nvidia finds itself on the front line and if the sector takes a hit, Nvidia looks set to suffer. From $211 at the start of November, the stock is already trading down at $186 after latest market jitters.

- Watch our video: how we’re playing AI theme, latest view on Nvidia, and recent buys

Big Short investor Michael Burry recently disclosed a bearish view towards Nvidia, expressed via the purchase of $187 million of put options, while Japanese investor Softbank just offloaded its entire $5.8 billion stake in the company. Therefore, there is a lot riding on next week’s financial results, with a strong quarterly scorecard likely to help provide Nvidia’s investors with the confidence that its steep valuation is justified.

Some Nvidia bears have raised concerns about a possible web of so-called circular deals where Nvidia invest in partners such as OpenAI and AMD which subsequently then invested those funds back into Nvidia’s chips, with critics arguing that this artificially inflates the sector. This has sparked comparisons with scenarios seen during the dotcom bubble.

At the same time, there are still plenty of loud Nvidia bulls including Dan Ives, tech analyst at Wedbush, who wrote, “Nvidia's earnings next week will be another major validation moment for the AI Revolution and be a positive catalyst for tech stocks into year-end as investors continue to underestimate the scale and scope of this transformational spending trend over the next few years”.

In another sign of confidence, Citigroup, Susquehanna and Jefferies raised their target price on the stock this month to $220, $230 and $240 respectively.

Nvidia will report earnings on Wednesday 19 November.

For more on what to expect from Nvidia’s earnings, please see my latest Must Read column.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.