Investment trusts have kept dividend promises amid Covid storm

17th December 2021 15:33

by John Dowie from Kepler Trust Intelligence

Closed-ended funds have held up admirably during the pandemic, and delivered income investors dividend growth.

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

“A cow for her milk, a hen for her eggs, and a stock, by heck, for her dividends.” This ditty was written by John Burr Williams, a foundational thinker in the theory of investment valuation and one of the foremost influences on another investor also known for his pithy investing wisdom, Warren Buffett. In markets, attention is often grabbed by glamorous and exciting opportunities for investors looking for the next big thing, so it is all too easy to forget that there is a large, more sober cohort of investors who are not looking for a quick, speculative profit but a steady and reliable stream of income. Pensioners funding their well-earned retirements are the paradigmatic income investors, but there are other important groups that need dependable income, such as charities.

For many years UK equities have been a staple of income investors’ portfolios, and although alternative sources of income for investors have broadened through the years, the persistently low interest rate environment since the global financial crisis has meant that the high dividends paid by UK stocks (relative to global peers) have remained crucial for income investors. Hence, numerous income investors will hold funds in the UK Equity Income sector, be they of the closed- or open-ended variety.

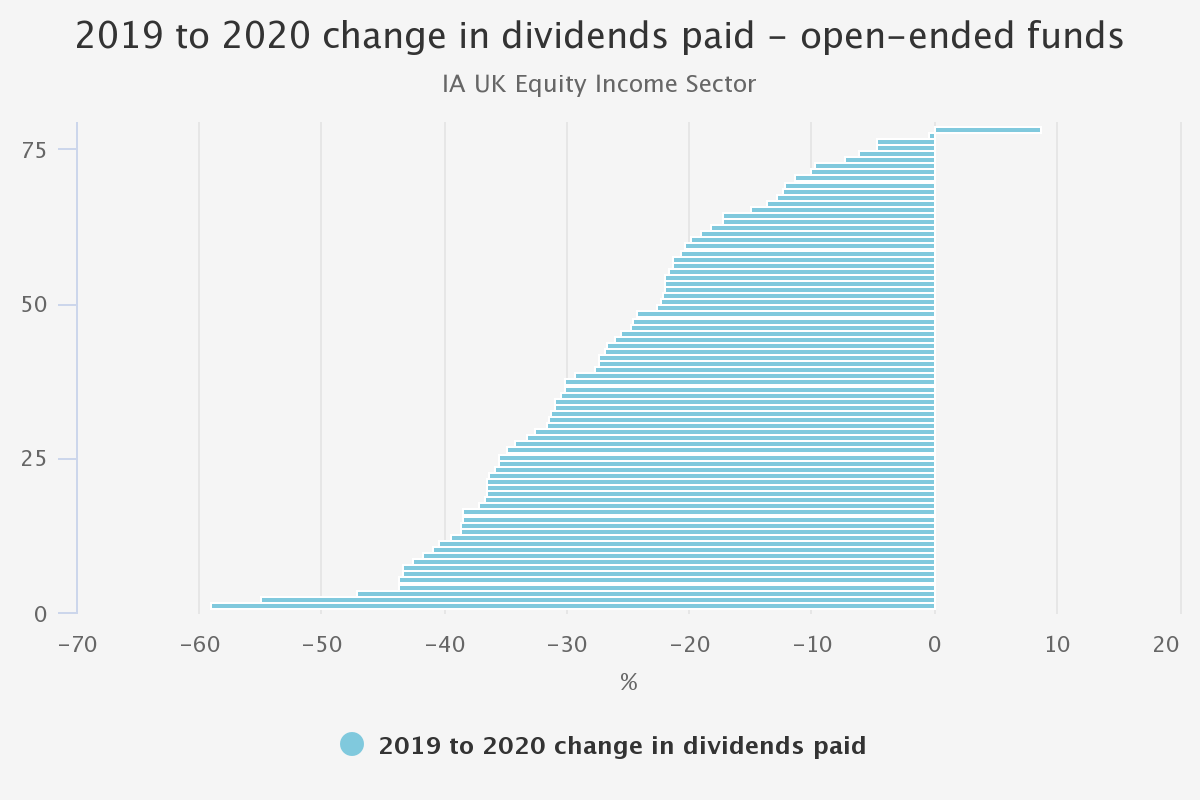

Income investors with long-term time horizons, well-diversified portfolios and a patient mindset have often had the luxury of ignoring market volatility, instead being content to watch dividends roll in year after year. Yet this changed when the coronavirus outbreak struck in early 2020 and UK companies began cutting or suspending dividends, with income investors suddenly seeing rapid falls in dividends received. By the end of 2020, the worst point in the decline, the dividends paid by listed UK companies had fallen circa 43% peak to trough on a 12-month basis (Source: Link Group). This resulted in a circa 27% fall in the average dividends paid in 2020 (versus 2019) by the open-ended funds in the Investment Association UK Equity Income sector. As per the below chart, of the 78 funds we analysed, only one avoided a year-on-year decline in dividends between 2019 and 2020 (and we note that this outlier suffered a circa 44% fall in dividends between 2018 and 2019).

2019 TO 2020 CHANGE IN DIVIDENDS PAID – OPEN-ENDED FUNDS

Source: FE Analytics, Kepler Partners. Past performance is not a guide to future performance.

Versus the same period in 2020, year to date (as at 31/10/2021) 47 of these 78 funds have posted further dividend declines, the median being a fall of c. 4%, with 35 of the funds posting declines greater than 10%. 60% of open-ended funds have therefore delivered two consecutive years of dividend cuts – pretty disastrous for those investors who depend on them.

For some of those invested in open-ended UK Equity Income funds, the fall in dividends has been a double whammy as their income requirements rose during the pandemic, with numerous institutions like charities seeing a rise in demand for their services and a fall in other sources of revenue, as was also the case for certain individual investors. This is a particular problem for charities as they often have covenants in place regarding their investment reserves which only permit the use of income. With the benefit of hindsight, is there a way that income investors could have been better prepared for this once-in-a-century storm? For long-term readers of our research, our answer to this question will be somewhat unsurprising: we think that income investors could have been better prepared through investing in investment trusts.

Investment trusts are only required to pay out a minimum of 85% of income generated from their holdings, unlike open-ended funds which are required to distribute all income. This provides the board of a trust with the option to use strong years to build a revenue reserve, whereby undistributed income is reinvested in the trust’s portfolio. This element of a trust’s portfolio is, from an accounting and regulatory perspective, ring-fenced so that it can immediately be sold and the proceeds distributed to support the dividends paid by the trust. In response to the fall in portfolio earnings seen during the 2020 lockdowns, the boards of UK equity income trusts deployed these ‘rainy day’ funds to support the dividends paid to investors.

In the below table we have presented the dividends paid in the 2019, 2020 and 2021 financial years for the 21 trusts in the AIC UK Equity Income sector with a market capitalisation greater than £10m. Looking over these three financial years allows us to look at what we believe (and hope!) will be essentially the whole pandemic period, at least in terms of the slump in dividends and recovery on the FTSE. Turning first to the 2019 and 2020 financial years, of these 21 trusts, only three failed to maintain or increase their dividend: Diverse Income Trust (LSE:DIVI)with a modest decrease from 3.81p to 3.7p per share, Chelverton UK Dividend Trust (LSE:SDV) and Temple Bar (LSE:TMPL). The decline in SDV’s dividends is something of a technicality as we have presented total dividends paid, and in 2019 SDV paid a large special dividend of 2.5p per share which accounts for the decline; the ordinary dividend in fact increased 7%. TMPL posted the worst decline in dividends, with the payout falling c. 25%. TMPL suffered particularly badly during the pandemic, with its value style leading to portfolio earnings falling 68% during 2020. Whereas its board did deploy significant reserves to cushion the fall in dividend, that was not enough to maintain its 2019 level.

UK EQUITY INCOME TRUST DIVIDENDS BY FINANCIAL YEAR

| TRUST | TICKER | FY 2019 (PENCE PER SHARE) | FY 2020 (PENCE PER SHARE) | FY 2019 / 2020 CHANGE | FY 2021 | FY 2021 DIVIDENDS PAID / ANNOUNCED | FY 2020 / 2021 CHANGE |

| Aberdeen Standard Equity Income (LSE:ASEI) | ASEI | 20.50 | 20.60 | 0.5% | 15.60 | 3/4 | - |

| BlackRock Income and Growth (LSE:BRIG) | BRIG | 7.20 | 7.20 | 0.0% | 2.60 | 1/2 | - |

| BMO Capital & Income (LSE:BCI) | BCI | 11.40 | 11.50 | 0.9% | 11.60 | 4/4 | 0.9% |

| BMO UK High Income (LSE:BHI) | BHI | 5.04 | 5.21 | 3.4% | 5.30 | 4/4 | 1.7% |

| Chelverton UK Dividend (LSE:SDV) | SDV | 11.47 | 9.60 | (16.3%) | 10.27 | 4/4 | 7.0% |

| City of London (LSE:CTY) | CTY | 18.60 | 19.00 | 2.2% | 19.10 | 4/4 | 0.5% |

| Diverse Income Trust (LSE:DIVI) | DIVI | 3.81 | 3.70 | (2.9%) | 3.75 | 4/4 | 1.4% |

| Dunedin Income Growth (LSE:DIG) | DIG | 12.45 | 12.70 | 2.0% | 12.80 | 4/4 | 0.8% |

| Edinburgh Investment (LSE:EDIN) | EDIN | 28.00 | 28.65 | 2.3% | 28.65 | 4/4 | 0.0% |

| Finsbury Growth & Income (LSE:FGT) | FGT | 16.60 | 16.60 | 0.0% | 17.10 | 2/2 | 3.0% |

| Invesco Select UK Equity (LSE:IVPU) | IVPU | 6.60 | 6.60 | 0.0% | 6.65 | 4/4 | 0.8% |

| JPMorgan Claverhouse (LSE:JCH) | JCH | 29.00 | 29.50 | 1.7% | 21.00 | 3/4 | - |

| JPMorgan Elect Managed Income (LSE:JPEI) | JPEI | 4.45 | 4.70 | 5.6% | 4.75 | 4/4 | 1.1% |

| Law Debenture Corporation (LSE:LWDB) | LWDB | 26.00 | 27.50 | 5.8% | 13.75 | 2/4 | - |

| Lowland (LSE:LWI) | LWI | 59.50 | 60.00 | 0.8% | 45.00 | 3/4 | - |

| Merchants (LSE:MRCH) | MRCH | 26.00 | 27.10 | 4.2% | 27.2 | 4/4 | 0.4% |

| Murray Income (LSE:MUT) | MUT | 34.00 | 34.25 | 0.7% | 34.50 | 4/4 | 0.7% |

| Schroder Income Growth (LSE:SCF) | SCF | 12.40 | 12.60 | 1.6% | 12.80 | 4/4 | 1.6% |

| Shires Income (LSE:SHRS) | SHRS | 13.20 | 13.20 | 0.0% | 13.20 | 4/4 | 0.0% |

| Temple Bar (LSE:TMPL) | TMPL | 51.39 | 38.50 | (25.1%) | 29.25 | 3/4 | - |

| Troy Income & Growth (LSE:TIGT) | TIGT | 2.75 | 2.78 | 1.1% | 1.96 | 4/4 | (29.5%) |

Source: AIC, Kepler Partners. Past performance is not a guide to future performance.

Turning now to 2021, of the 21 trusts being analysed, 15 have so far declared or paid their final dividends for this financial year. Of these 15, only one has cut dividends versus 2020: Troy Income & Growth (LSE:TIGT). As we discussed in depth in our recent note on TIGT, the reduction in dividends was a purposeful strategic decision to reduce the current yield of the trust in order to invest in higher-quality companies with better growth prospects in terms of both capital growth and dividend growth, rather than being down to the impact of the pandemic.

Looking across the range of trusts that have successfully grown their dividends, many are designated as ‘AIC dividend heroes’, a title which is awarded to trusts that have raised their dividends for 20 consecutive financial years. The most venerable member of this exclusive club is City of London (LSE:CTY). As of 2021 the trust has now successfully grown its dividend for 55 years (see our latest note). Another AIC dividend hero is closing in on half a century of dividend growth: JPMorgan Claverhouse (LSE:JCH), which has raised dividends for 48 consecutive years. As discussed in our recent note, JCH’s manager has achieved the income objective of the trust by adopting a barbell approach of mixing higher-yielding value stocks with growth stocks to deliver both a healthy dividend and consistent outperformance versus the FTSE All-Share Index. With regards to JCH’s total dividend for 2021, there is still the final dividend to be announced. At the time of the half-year report (published in August), the board stated it intended to pay a higher total dividend for 2021 than 2020. So far, the three interim dividends declared in 2021 have been increased versus 2020, from 6.5p to 7p per share. If the board simply matched last year’s final dividend of 10p the total dividend for 2021 would be 31p, an increase of circa 5% year-on-year. This would result in JCH being one of the two trusts in the sector to increase its ordinary dividend above the rate of inflation in 2021.

The newest member of the AIC dividend hero club is Aberdeen Standard Equity Income (LSE:ASEI), having earned this distinguished status in 2020 when it delivered its 20th consecutive dividend increase. At the time of writing (08/12/2021) ASEI has a yield of 5.9%, the highest in the AIC UK Equity Income sector, but has yet to announce its final dividend. Yet given its ample reserves, the manager reporting portfolio earnings as being relatively robust and the likely reluctance of the board to surrender the newly won AIC dividend hero status (all factors discussed in our latest note), we suspect the final dividend for the year will result in at least a modest increase in the total dividend for 2021 versus 2020.

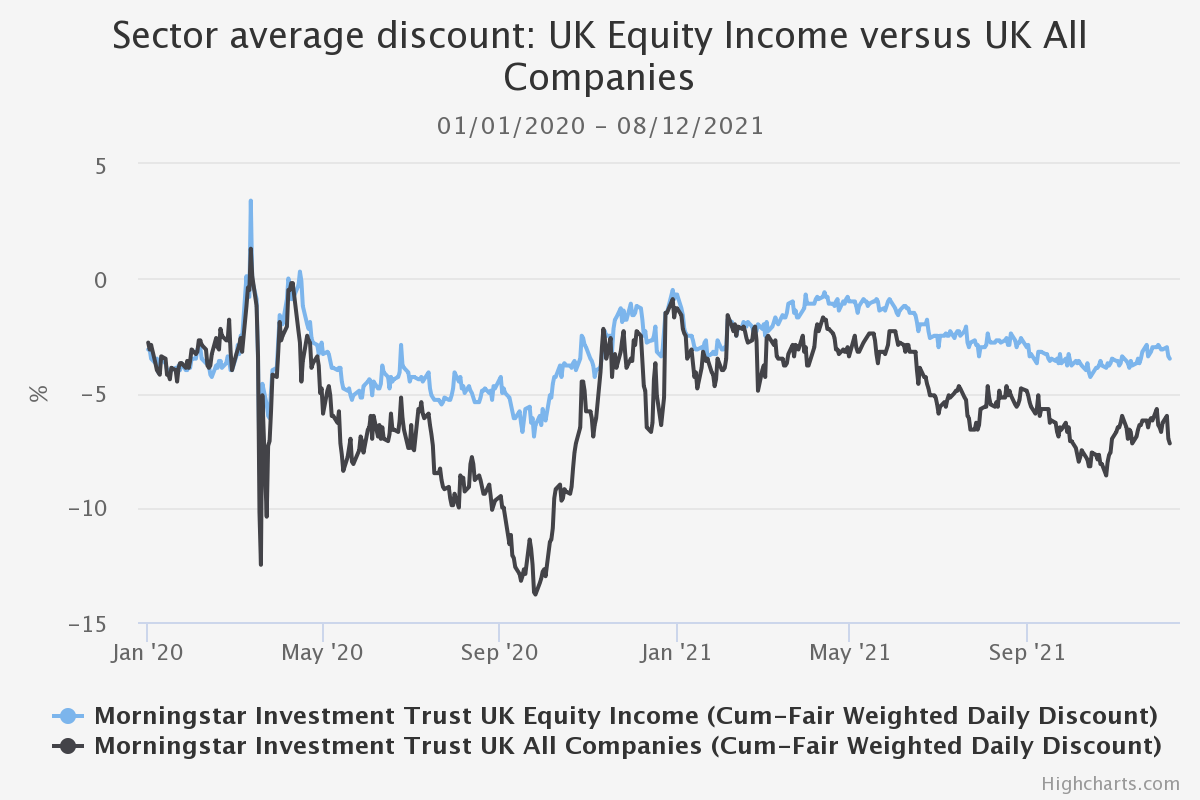

Overall, the robustness of dividends from the AIC UK Equity Income trust sector during the pandemic has been rewarded with a premium rating during the crisis. The sector has tended to trade on a narrow discount, with a number of trusts trading on premiums and issuing shares. This contrasts with the fate of the AIC UK All Companies sector, which has been much more volatile, as can be seen in the graph below.

PEER GROUP AVERAGE DISCOUNT: UK EQUITY INCOME VERSUS UK ALL COMPANIES

Source: Morningstar. Past performance is not a guide to future performance.

The stability of distributions over the last two years has demonstrated to us the value of the flexibility of the closed-ended structure in smoothing payments via the use of revenue reserves. In fact, the situation is even better than this, as legislation in 2012 allowed all investment trusts to pay dividends out of the capital account (subject to shareholder approval). Boards thus have extreme flexibility when it comes to maintaining or growing dividends, subject to their other investment objectives. As discussed, this makes trusts especially attractive to income investors that require reliable dividends come what may. We are led to believe that John Burr Williams would have approved: “An orchard for fruit, bees for their honey, and stocks, besides, for their dividends.”

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.