Model Portfolios review: growth roars back with double-digit returns

As Money Observer's six growth model investment portfolios bounce back with a vengeance, the six income …

20th July 2020 09:26

As Money Observer's six growth model investment portfolios bounce back with a vengeance, the six income portfolios are strengthened for storm clouds ahead.

The hope we expressed in the last review that “indiscriminately savaged holdings will rebound when risk appetite returns” has borne fruit, particularly for our growth-focused model portfolios. That has vindicated our decision at the time not to tinker with their holdings.

Aside from reassuringly good performance at a portfolio level – more than half of the 53 funds that made up our models during the three months to end-June are in the first or second quartiles of their peer groups – there has also been a recovery in the share prices of investment trust holdings.

Returns over the quarter follow the pattern we like to see: in the medium risk models, returns range from 10.6% for the short-term Alpha portfolio to 16.4% for longer-term Charlie, while in the higher-risk models returns range from 15.7% for Delta to 27.7% for Foxtrot, with longer-term investors reaping the rewards of the potentially greater volatility they accept.

Having gained the most over the past three months, our punchiest proposition Foxtrot has now surpassed the level it stood at before volatility struck, and has handed investors a near 150% gain since the inception of our 12 models in January 2012.

Sadly, the income portfolios have not recovered to the same extent. Their performance has followed a similar pattern, however: the higher the equity content and risk level, the stronger the recovery in value. Returns range from 6.7% for Golf to 14.2% for Lima.

While a relief to see, it may take a while for the income-focused models to fully regain their lustre, given the well-documented dividend cuts. We are taking some action in this review to ensure our income portfolios are not over-exposed to cyclical value strategies.

Value-focused funds that focus on income are susceptible on two fronts: a slow economic recovery and a broader dividend reset among some of the companies they invest in. ‘Normal’ service with regards to dividend payments from companies with low dividend cover may take some time to resume if it returns at all. Essentially, companies may prioritise bolstering their balance sheets over keeping a previous commitment to distribute a high level of income.

Value strategies

That said, we feel it is beneficial to retain some exposure to value-focused strategies, particularly in the portfolios that aim to deliver income growth. As an investment style, value has lagged the market rebound, making such strategies arguably better placed to withstand investor nervousness over a second wave of Covid-19 and the economic fallout from the virus, which remain big unknowns.

Pleasingly, all bar two of our models, Golf and Juliet, have outperformed their benchmarks. These both seek to produce an immediate income stream and are suffering from their exposure to UK property. BMO Commercial Propertyis the only one of our constituents to end the quarter in the red, with a decline of 15.4%.Its dividends are paid monthly but were suspended in April due to Covid-19. However, the relaxation of lockdown restrictions can only help this trust. We would be surprised if dividend payments do not resume before the end of the next quarter and are reluctant to sell at this very depressed level.

These portfolios also hold Schroder Income Maximiser, whose capital performance has been adversely affected by the collapse in UK dividends. The underlying value-driven strategy remains out of favour, but the near 7% yield is valuable to investors seeking immediate income.

It is based on quarterly valuations (a 1.75% payment based on the quarterly net asset value), so actual income has been falling in line with the NAV. However, the underlying portfolio has scope for considerable upside. For managers Nick Kirrage and Kevin Murphy, “you make all your money in a bear market”, and this is the third severe sell-off experienced by this seasoned duo. We are confident that this fund still deserves its place.

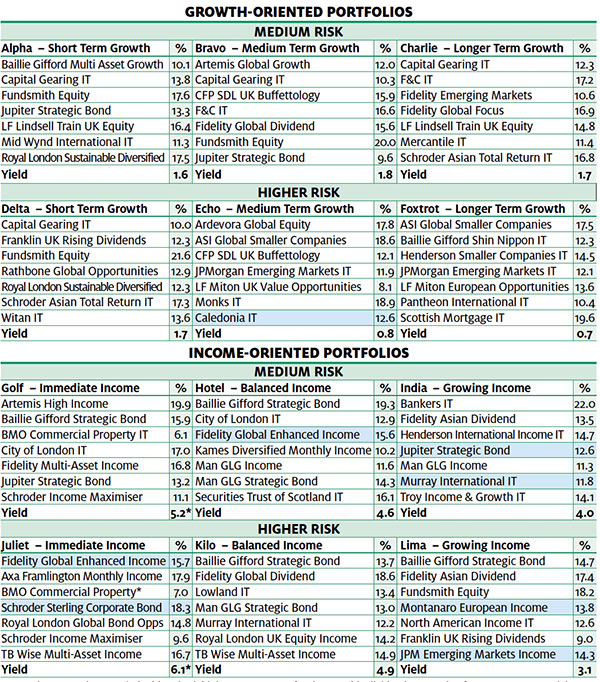

Portfolio constituents and new weightings†

Please click here to see larger version of table

Notes: † As at 3 July 2020. *The historic yield does not account for the monthly dividend suspension from BMO Commercial Property since April 2020. Holding with blue stripes indicate new holding or adjusted weighting. See here for more information. Data source: FE Analytics.

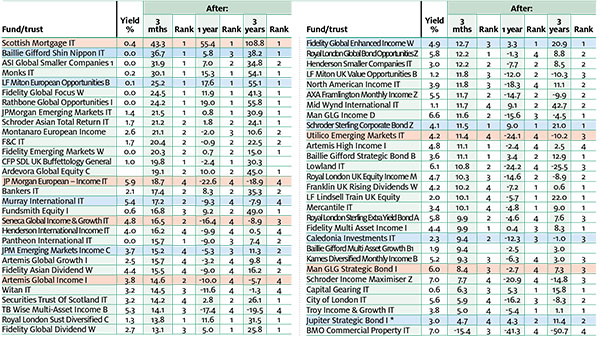

Most portfolio members post a strong recovery

Please click here for larger version of table

Notes: Table shows performance, with income reinvested, of model portfolio constituents to 1 July 2020, ranked over three months and their quartile rankings in official sectors. Not all constituents have been members of portfolios over the time periods stated. Funds with blue tint: added to a model portfolio or weighting increased. Funds with pink tint: fund removed from a model portfolio or weighting reduced. Data source: FE Analytics.

Growth portfolios

Medium risk

The only constituent among our medium-risk growth portfolios that gives us cause for concern is Artemis Global Growth in Bravo. It flounders in the fourth quartile of its peer group over shorter and longer time periods.

Manager Peter Saacke has stepped down as chief investment officer of Artemis to focus on the fund. We recognise the importance of retaining a value strategy in the portfolio, so will continue to monitor for signs of improvement.

Higher risk

The stellar performance of Scottish Mortgage – our best-performing constituent this quarter with an impressive gain of 43.3% – saw its weighting in Foxtrot rise to more than 25%.

We are taking profits – reducing the holding by six percentage points and re-allocating 3% extra each to Baillie Gifford Shin Nippon and LF Miton European Opportunities. Both have recently performed with credit, up 36.7% and 25.2% over the quarter respectively, but are underrepresented in the portfolio.

Foxtrot and Echo have also benefited from holding ASI Global Smaller Companies, up 31.9% since the last review. Fund manager Alan Rowsell and analyst Imogen Harris recently left Aberdeen Standard Investments but the fund remains in experienced hands. Harry Nimmo, manager of the strategy alongside Rowsell at launch in January 2012, has been re-instated as co-manager alongside Kirsty Desson.

We are only making one fund change within our growth portfolios. Seneca Global Income & Growth has continued to disappoint, despite some of its previously unquoted holdings (AJ Bell) and alternative assets (Hipgnosis Songs Fund) contributing strongly to performance. Caledonia, which boasts a highly diversified portfolio that includes a good slug of unquoted holdings, replaces it.

The trust regularly trades on a useful discount (currently 22.6%) and pays relatively modest dividends which have nevertheless risen for more than 50 years. The current yield is 2.3%.

Growth models post double-digit returns

| Total return, income reinvested (%), to 1 July 2020 after: | |||||

|---|---|---|---|---|---|

| 3 mths | 1 year | 3 yrs | 5 yrs | Inception* | |

| Alpha: Short Term Growth, Medium Risk | 10.6 | 4.2 | 25.8 | 65.0 | 111.8 |

| Bravo: Medium Term Growth, Medium Risk | 14.7 | 2.4 | 24.0 | 64.1 | 138.5 |

| Charlie: Longer Term Growth, Medium Risk | 16.4 | 1.4 | 11.7 | 39.7 | 110.2 |

| Delta: Short Term Growth, Higher Risk | 15.7 | 3.3 | 16.8 | 53.7 | 120.1 |

| Echo: Medium Term Growth, Higher Risk | 22.5 | 1.4 | 20.5 | 43.3 | 95.7 |

| Foxtrot: Longer Term Growth, Higher Risk | 27.7 | 11.3 | 24.7 | 65.8 | 147.9 |

| Benchmark indices | |||||

| FTSE UK Private Investor Growth index | 13.5 | 3.1 | 17.9 | 48.2 | 108.2 |

| FTSE UK Private Investor Balanced index | 11.2 | 3.3 | 16.3 | 42.8 | 94.6 |

| FTSE All Share index | 10.2 | -13.0 | -4.6 | 15.2 | 62.9 |

Notes:*Inception date of our Model Portfolios is 1 January 2012. Data source: FE Analytics as at 1 July 2020. Data source: FE Analytics.

Income portfolios

Medium risk

Our income portfolios are subject to several changes this review: we are introducing five new funds at the expense of four outgoing funds, and using one existing constituent in its fourth model.

Artemis Global Income has been ousted from all our models, having been held in Hotel, India and Juliet. Poor stock selection has exacerbated weak relative performance due to its value-focused portfolio. We are also placing its Rated Fund status under review, given recent analysis of its strategy and how this has impacted performance. It has lost 10% in the past year, putting it in the fourth quartile of its peer group.

In medium-risk Hotel and higher-risk Juliet, which target balanced and immediate income respectively, Fidelity Global Enhanced Incomehas taken its place. It ranks in the first quartile, having eked out a modest positive return over the past year. The fund’s portfolio is based on that of Fidelity Global Dividend, a relatively cautious, capital preservation-minded fund run by Dan Roberts that we hold in Kilo and Bravo. Like the Schroders fund, Fidelity Global Enhanced Income uses an options overlay to enhance income, which is distributed monthly. It currently yields 4.9%.

In India, our medium-risk portfolio that targets income growth, Murray Internationalis our choice to succeed the Artemis fund. It meets the criteria of rising income and retains some exposure to value strategies as well as significantly boosting exposure to Asia and emerging markets, where underlying economic growth surpasses the West and stands to do so for the foreseeable future.

Royal London Sterling Extra Yield Bondalso departs India, with Jupiter Strategic Bond, already a constituent of Alpha, Bravo and Golf, stepping into the breach. Its presence is primarily designed to offset against broader equity weakness, but the Royal London fund has behaved more like an equity fund due to the sensitivity of its holdings to the stock market.

Higher risk

The departure of the Artemis fund reduces exposure to value strategies in Juliet, though it retains staunch value proposition TB Wise Multi-Asset Income. It ranks in the third quartile over the past quarter and fourth over longer time periods, but we are encouraged by moves by its managers to replenish lost income while not sacrificing potential capital upside. They have added to British Land and Taylor Wimpey, where they see a material valuation opportunity and which they expect to be early returners to the dividend list.

High-yield bond funds Royal London Global Bond Opportunities (12.2%) and Man GLG Strategic Bond (8.4%) have recovered strongly for Juliet, but we are reducing high-yield exposure given global economic uncertainty. While our balanced income portfolios Hotel and Kilo retain the Man GLG fund, Schroder Sterling Corporate Bond, a newcomer to our models, replaces it in this immediate income portfolio. It is this year’s highly commended choice in our fund awards for the second time, for its consistently strong risk-adjusted returns and solid yield of 3.5%.

Lima, which aims for income growth, is also subject to two changes. Our European and US income plays were badly hit in the sell-off and are slowly climbing back up the performance charts. We retain our conviction in the North American Income investment trust, although capital values might take a while to recover.

But we are not so sure about recovery prospects for the income share pool of JPMorgan European, and are switching to Montanaro European Income, which focuses on quality small and medium-sized companies. The yield is lower, 2.6% versus 5.7%, but this trust offers better income growth prospects.

In emerging markets, Utilico Emerging Markets continues to suffer from large exposures to Brazil and India. The trust is unlikely to grow its income this year. The board has committed to maintain the dividend but may have to dip into its capital reserves to do so. We are replacing it with theJPM Emerging Markets Incomefund, which is more diversified. It has outperformed its sister investment trust, JPMorgan Global Emerging Markets Income; although the tables could turn due to the latter being able to benefit from gearing in rising markets, the fund is the safer option.

Income portfolios make up some lost ground

| Total return, income reinvested (%), to 1 July 2020 after: | |||||

|---|---|---|---|---|---|

| 3 mths | 1 year | 3 yrs | 5 yrs | Inception* | |

| Golf: Immediate Income, Medium Risk | 6.7 | -9.6 | -4.4 | 9.3 | 59.9 |

| Hotel: Balanced Income, Medium Risk | 10.9 | -6.7 | -0.8 | 20.7 | 74.5 |

| India: Growing Income, Medium Risk | 13.1 | -5.5 | 5.8 | 35.7 | 118.6 |

| Juliet: Immediate Income, Higher Risk | 9.1 | -14.6 | -11.2 | 7.8 | 66.2 |

| Kilo: Balanced Income, Higher Risk | 12.1 | -9.6 | -8.8 | 12.3 | 84.2 |

| Lima: Growing Income, Higher Risk | 14.2 | -12.4 | -0.7 | 29.4 | 127.0 |

| Benchmark indices | |||||

| FTSE UK Private Investor Income index | 9.1 | 4.3 | 15.5 | 38.2 | 79.4 |

| FTSE UK Private Investor Balanced index | 11.2 | 3.3 | 16.3 | 42.8 | 94.6 |

| FTSE All Share index | 10.2 | -13.0 | -4.6 | 15.2 | 62.9 |

Notes:*Inception date of our Model Portfolios is 1 January 2012. Data source: FE Analytics as at 1 July 2020.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.