MTI Wireless Edge Ltd: here's how the share price can double

5G involvement has been a catalyst for this tech company. Our chartist looks for potential upsides.

18th November 2020 09:48

by Alistair Strang from Trends and Targets

5G involvement has been a catalyst for this tech company. Our chartist looks for potential upsides.

MTI Wireless Edge Ltd (LSE:MWE)

Thankfully, a couple of emails asked about MTI Wireless Edge (LSE:MWE), saving us the hardship of exploring numerous shares in an attempt to find something interesting to write about today!

To be fair, a few throwaway comments regarding 5G tech had already suggested we should take a hard look at this share price, and now movements in November justify the effort.

A visit to MTI's website to explore why their 5G involvement is worth paying attention to was fascinating.

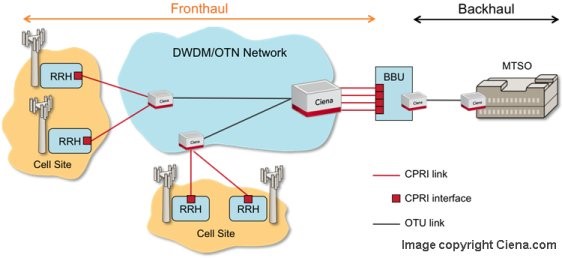

Two terms, which caused immediate confusion were 'fronthaul' and 'backhaul', clearly buzzwords which mean a lot to people in the industry but are otherwise pretty meaningless.

MTI regard their work in the field as pretty revolutionary, but despite visiting several publications to try and clarify what the heck we were reading the concept remained mercilessly obscure.

Eventually, we decided 'fronthaul' engineers could get rained upon, working outside. Whereas 'backhaul' engineers stay dry...

Rather more importantly than the dodgy graphic, MTI's share price is looking capable of some positive movement.

Near-term, growth above 54p calculates as capable of 58p next, a relatively useless (and fairly tame) ambition but there's an important feature should such a twitch occur.

The share price needs only to close above 54.5p to present a new all-time high, entering a region where a viable long-term aspiration of 107p works out at possible.

At present, the share price is right on the edge of greatness. Despite three quite separate and distinct criteria pointing at 58p (this sort of thing generally suggests the target shall be achieved), we're far more interested in the longer-term potentials of the price almost doubling.

Perhaps MTI are worthy of some research, though good luck trying to understand anything about their specialist field.

Source: Trends and Targets Past performance is not a guide to future performance