The one name Saltydog keeps returning to

Baillie Gifford American is an example why this investment house is so popular with Saltydog Investor.

27th July 2020 13:43

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Baillie Gifford American is an example why this investment house is so popular with Saltydog Investor.

From time to time you get a fund manager who seems particularly in tune with the times. We have also seen it happen with certain investment houses. Soon after launching Saltydog Investor, almost ten years ago, there was a period where funds from Invesco Perpetual were continually appearing at the top of our tables.

At the moment it looks like Baillie Gifford are ‘in the zone’. As one of our members recently commented: “Surely we should buy every product these guys ever make. They are making everybody else look like chumps.”

Back in March our two demonstration portfolios were almost 100% in cash. Our only holding was the Investec (now Ninety One) Global Gold fund which accounted for less than two per cent of the Ocean Liner.

We started reinvesting in April and have been gradually increasing our exposure to the markets.

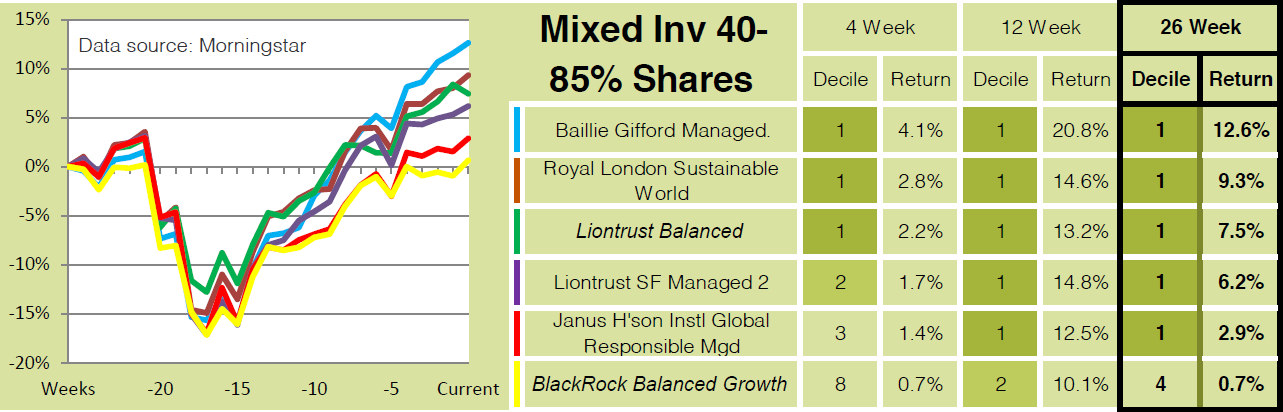

Early on in the process we went back into three funds that we had been in for most of 2019. They are Royal London Sustainable World, Janus Henderson Institutional Global Managed, and Liontrust Sustainable Future Managed; they are all from the Mixed Investment 40-85% Shares sector.

A few weeks ago, we added another fund from this sector into the Tugboat portfolio. We selected the Baillie Gifford Managed fund. When we reviewed our holdings last Wednesday it was already showing a profit of 2.6%, and it was also the best performing fund in the 'Slow Ahead' Group over four and 12 weeks.

We decided to add it to our Ocean Liner portfolio as well.

Here’s a shortlist from last week’s data showing the leading funds from the Mixed Investment 40-85 % shares sector based on their cumulative returns over the last 26 weeks, with the Baillie Gifford fund at the top of the list.

Past performance is not a guide to future performance.

This is not the only Baillie Gifford fund that we are invested in.

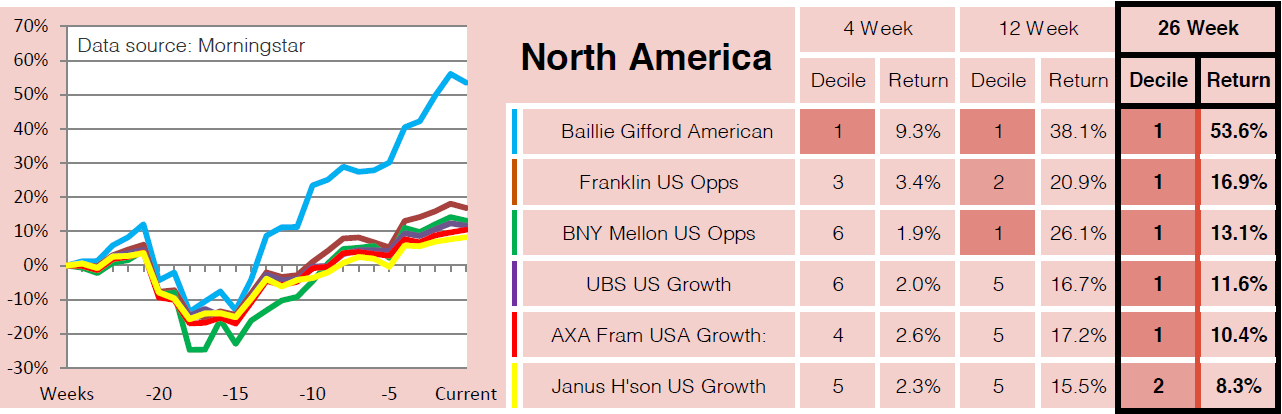

The best performing fund in our ‘Full Steam Ahead Developed Group’, over the last six months, has been Baillie Gifford American. We went back into this fund in April and since then our investment has gone up by over 40%.

Past performance is not a guide to future performance.

Somehow, in the last 26 weeks this fund has managed to go up by more than three times as much as the next best performing fund in our table.

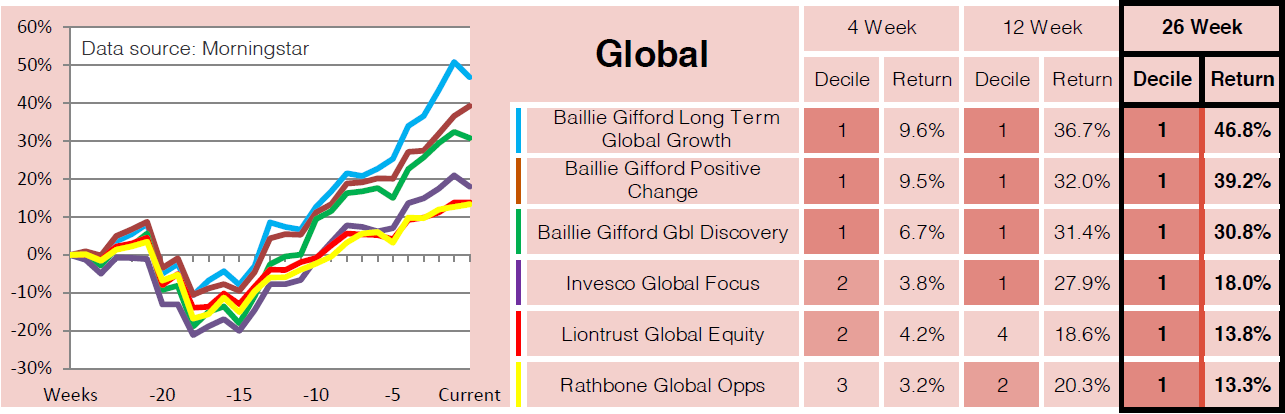

If we had not chosen this fund, we would almost definitely have picked one of the Baillie Gifford funds from the Global sector. Here they have also significantly outperformed the other funds that we are comparing them with.

Past performance is not a guide to future performance.

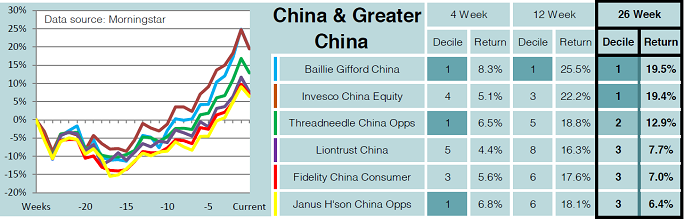

Earlier this month we invested in a fund from the China & Greater China sector, and once again picked a fund provided by Baillie Gifford.

Past performance is not a guide to future performance.

As well as the funds shown above, Baillie Gifford also have funds which have made our shortlists in the £ High Yield, UK All Companies, UK Smaller Companies, European, Japanese, Global Equity Income, Global Emerging Markets, and Asia Pacific sectors.

They definitely seem to have their finger on the pulse at the moment.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.