Stockwatch: time to upgrade after this CEO’s buying spree

A new highly regarded chief executive is stakebuilding and the struggling shares have perked up. While still speculative, analyst Edmond Jackson believes the mood is improving.

23rd September 2025 10:54

by Edmond Jackson from interactive investor

In June I noted the appointment of Tjeerd Jegen, a highly-experienced retail CEO at B&M European Value Retail SA (LSE:BME) – a potential turnaround situation after much of 2024 and 2025 saw like-for-like declines in the UK retail business constituting over 80% of group revenue.

A new CEO can be the single most powerful fact in a turnaround. However, I concluded: “Let him get settled in and see as and when a substantial share option grant is made, at what price. Call me cynical but the longer this takes the greater chance he prescribes tough medicine.”

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

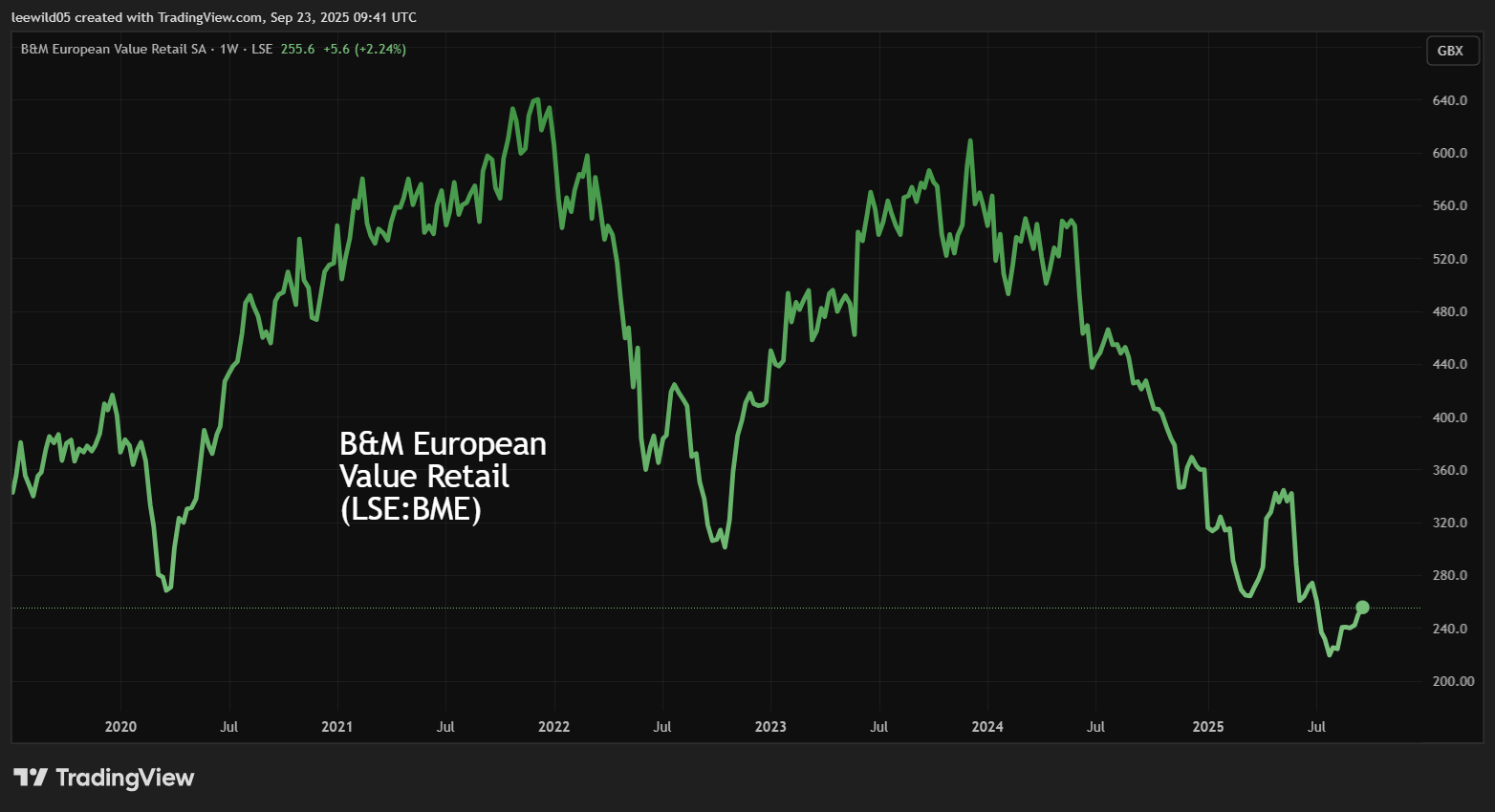

That was correct in the short term given the share fell from around 280p to 240p after July’s first-quarter results to end-June when the company withdrew previous guidance for the full year to March 2026. The share price even hit an early August low of 216p, but has risen to over 250p this month after Jegen has made a string of share purchases worth near £1.3 million.

Source: TradingView. Past performance is not a guide to future performance.

Upon his 15 May appointment, effective 16 June, the board said that with 25 years’ experience in leadership roles at international retailers, Jegen “stood out from a strong list of candidates due to his strategic insight, customer-centric approach, and strong track record of driving growth and transformation”.

Determined accumulation of equity at recent prices

On 13 June, Jegen bought £523.6k worth of B&M shares at 264.6p as a non-executive director also spent £19.9k at 262p on 11 June and the CFO almost £20k worth at 265.5p on 18 June.

September has seen a flurry of sizeable buying: on the 3rd, £265.9k at 234.5p; on the 9th, £198.4k at 249.6p; and the 12th, £148.8k at 241.9p. On that last date, chairman Oliver Tant also bought £4.8k worth at 241.6p after £21.4k at 285.3p last February.

Yesterday, Jegen’s buying news continued: £129.9k worth on 17 September at near 250p, taking his total so far to £1.267 million.

This is the biggest buying by a CEO I can recall for a long while in a world where share options are the norm for equity ownership but put managers and shareholders in different boats as regards to risk.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Retail sector stocks to buy, hold and sell

Mind, no director, however experienced, is immune to decisions becoming overtaken say by a recession. There has also been the example of John Wood Group (LSE:WG.) where in 2024 the CEO spent nearly £600k buying shares at prices around 130p to 190p. The shares are currently suspended at 18p as a rescue takeover plays out. Yet Wood is a complex contractor with a history of low margins and a major troublesome acquisition, whereas B&M, while indebted, has delivered operating margins better than Tesco (LSE:TSCO) and its strength of cash flow supported special dividends.

Perhaps B&M’s dilemma can be summarised as its lower-income customers being affected by the higher cost-of-living - the operation requiring a better marketing mix and execution.

Even if the UK faces recession, as a long-term project there should be plenty that a truly capable CEO can initiate. Jegen’s share-buying would appear to suggest he has the confidence for it.

B&M European Value Retail SA

Year end 29 March

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

| Turnover (£ million) | 2,035 | 2,431 | 3,030 | 3,273 | 3,813 | 4,801 | 4,673 | 4,983 | 5,484 | 5,571 |

| Operating margin (%) | 8.6 | 8.4 | 7.9 | 9.7 | 8.7 | 12.8 | 13.1 | 10.8 | 11.1 | 10.2 |

| Operating profit (£m) | 174 | 205 | 240 | 319 | 333 | 613 | 610 | 536 | 608 | 566 |

| Net profit (£m) | 125 | 143 | 186 | 194 | 90.0 | 428 | 422 | 348 | 367 | 319 |

| EPS - reported (p) | 12.4 | 14.3 | 18.6 | 19.8 | 20.4 | 42.7 | 42.1 | 34.7 | 36.5 | 31.8 |

| EPS - normalised (p) | 13.2 | 14.8 | 19.1 | 19.8 | 17.7 | 43.1 | 42.2 | 34.7 | 37.0 | 32.0 |

| Operating cashflow/share (p) | 14.3 | 17.9 | 19.8 | 37.5 | 54.9 | 82.5 | 49.0 | 77.9 | 74.3 | 67.1 |

| Capital expenditure/share (p) | 5.7 | 5.2 | 11.5 | 10.6 | 12.4 | 8.8 | 10.0 | 9.8 | 12.5 | 13.2 |

| Free cashflow/share (p) | 8.6 | 12.7 | 8.3 | 26.9 | 42.4 | 73.7 | 39.0 | 68.1 | 61.7 | 53.9 |

| Ordinary dividends/share (p) | 4.8 | 5.5 | 7.2 | 7.6 | 8.1 | 17.3 | 16.5 | 14.6 | 14.7 | 15.0 |

| Covered by earnings (x) | 2.6 | 2.6 | 2.6 | 2.6 | 2.5 | 2.5 | 2.6 | 2.4 | 2.5 | 2.1 |

| Return on total capital (%) | 12.8 | 13.8 | 14.8 | 12.0 | 12.8 | 23.3 | 21.2 | 19.6 | 21.5 | 18.8 |

| Cash (£m) | 91.1 | 156 | 90.8 | 86.2 | 428 | 218 | 173 | 237 | 182 | 217 |

| Net debt (£m) | 349 | 396 | 530 | 1,814 | 1,640 | 1,814 | 2,093 | 2,018 | 2,085 | 2,350 |

| Net assets (£m) | 802 | 800 | 912 | 992 | 867 | 733 | 746 | 720 | 734 | 752 |

| Net assets per share (p) | 80.2 | 80.0 | 91.1 | 99.2 | 86.7 | 73.2 | 74.5 | 71.9 | 73.2 | 74.9 |

Source: historic Company REFS and company accounts.

Cautious about revenue and margin

It was possible to interpret Jegen dropping full-year financial guidance until interim results on 13 November, as wariness about performance seen in his first month in the job.

Annual results cited “sector-wide challenges” from higher employment costs, then Q1 saw deflation in selling prices for toys, garden and DIY products, which altogether seemed potentially negative for operating margins and profit in the first half.

More positively, “from Q2 new ranges being introduced have a higher bought-in trading gross margin”. Jegen said: “I see a significant opportunity and requirement to sharpen our commercial and operational execution...”

- 10 hottest ISA shares, funds and trusts: week ended 19 September 2025

- Sector Screener: two FTSE 100 stocks with long-term investment potential

After a spate of declines, Q1 like-for-like annualised revenue rose 1.4% for the core B&M UK business, or by 4.7% including net new store openings. On a similar basis, B&M France grew 7.6% to near 10% of the group total, although Heron Foods slipped 0.4%, also to near 10% of the total.

On the face of it, Jegen is eager to accumulate material shares before the restricted period ahead of results. Moreover, he sees it possible that their price could be higher after announcing the half-year figures. Today, Kingfisher (LSE:KGF) has leapt 19% to over 300p after its interims reported “high quality” (if modest) revenue growth and the full-year profit/cash flow is upgraded to high in the guidance range.

A matter of CEO remuneration policy?

It is not explained in the various share purchase announcements, but page 84 of the 2025 annual report cites a “shareholding guideline for the CEO and CFO to build up and maintain holdings of 200% and 175% of base salary respectively. Otherwise, they are expected to retain 50% of all shares which vest under the deferred bonus and LTIP [Long-Term Incentive Plan] after allowing for tax”.

At least it is positive how Jegen has opted for the riskier and more near-term option of spending his own money.

Page 85 shows the previous CEO was paid £3.2 million in respect of the year to March 2024, the last full financial year he gave service, although base salary is not specified. That his bonus was near 100% of max (curiously given earnings per share (EPS) growth was not even 7% and the “LTIP as a per cent of max” was 68%, does however imply base salary of at least £1 million.

Somewhat unfortunately then, Jegen’s buying close to £1.3 million worth does appear to link to this aspect of company policy, rather than pure intent to seize value. He might say, however, both apply given he is not taking the vested share choice later on.

Does B&M’s debt compromise intrinsic value?

Occasionally, high debt is cited as a reason to avoid the shares.

The 29 March balance sheet had long-term debt of £977 million, up 11% year-on-year, and £160 million of near-term debt, up 452%, albeit from a low base. With cash up 19% to £217 million, net financial debt of £920 million represented gearing of 122% based on £752 million net assets. Mind, there was £1,040 million of goodwill and intangible assets.

Additionally, there was £1,430 million of lease liabilities which even if chiefly long term, pushed the net interest charge up to £136 million – swiping 24% from operating profit. Not ideal, even if it’s not a significant drain on the business either.

A concern might be – for income-seekers buying for B&M’s special dividends - that the new CEO cuts these until financial gearing is lower. Kingfisher by comparison had £1,953 million (primarily) leases and net debt but is a £4.4 billion company versus £2.5 billion for B&M. Kingfisher’s net interest charge took nearly 12% of interim operating profit.

A scenario exists where the UK stumbles into a fiscal crisis where rising bond yields also affect the cost of corporate debt. It’s a classic argument about why governments should not stretch beyond their means, thus affecting private industry, a vital contributor to tax revenues.

Ordinary dividend yield could still be above 6%

Consensus forecasts show, curiously, an overall expectation for more than 40% dividend growth this year to 21.2p per share, then a slip to 20.6p. I interpret this as including one or two forecasts within the sample which assume a special payout, others maybe not. If the ordinary dividend grows by a small percent in line with trend, then it should only be around 15.5p after a total 15.0p in respect of this year. An additional special dividend of 15.0p has meant an historic yield around 12% at the current share price.

There’s been a sense among recovery buyers that scope exists now to lock in this kind of income with potential capital upside too. If the ordinary payout alone is maintained, then the dividend yield would be 6.3% with at least 1.5x cover even if profits/cash flow decline. That could however require less investment in new store openings which have recently been driving growth.

- Insider: Aviva chief among FTSE 100 director deals

- The UK income tracker fund the pros struggle to beat

The shares have risen 3% to 253p this morning, probably in sympathy with Kingfisher’s upgrade. Much will depend on the 26 November UK Budget and its impact on business costs and consumer confidence, although Labour has promised to protect “working people”, hence B&M’s customers might not take a further hit. They will still be affected by food inflation, so it depends if more people are attracted to B&B’s prices to offset lower basket spending perhaps.

This is no conviction share yet, but a case exists for taking a position based on a high-calibre CEO being applied to a well-established business. I upgrade B&M shares to “buy” versus “hold” at 280p in June, though this is quite speculative given the half-year results will give us a lot more information.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.