Tesco shares: Reasons to be cheerful

Early selling following this Q1 update attracted bargain hunters. Our head of markets explains why.

13th June 2019 09:49

by Richard Hunter from interactive investor

Early selling following this Q1 update attracted bargain hunters. Our head of markets explains why.

Tesco (LSE:TSCO) recovery from the dark days of having taken its eye off the ball in the UK continues apace.

The radical overhaul which the business has undergone has seen Tesco's shares rise by 50% over the last three years. More recently, the acquisition of Booker is continuing to look like a masterstroke, the tie-up with Carrefour should provide further benefits and the launch of "Jack's" should prove an interesting move in the discount store space to its challengers.

The update is unsurprisingly light on strategic detail ahead of next week's Capital Markets Day, but the trading performance showed positive trends across the board, with the exception of its Central European business.

The rest of the group comfortably picked up that slack and a record Easter Sunday helped in nudging the numbers along. Meanwhile, the closure of Tesco Direct to concentrate on online grocery sales is also bearing fruit, with a 7% rise year-on-year. Progress in Asia is looking promising, with the highlight of the statement coming from the Booker contribution.

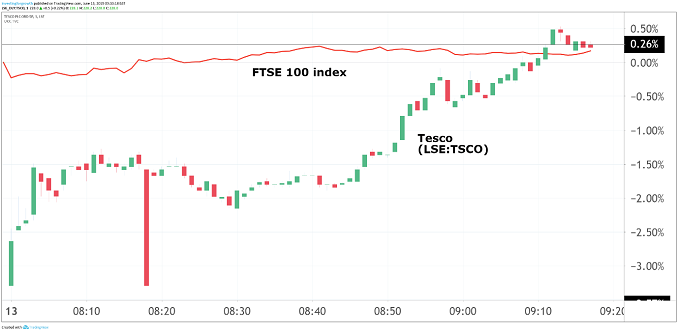

Source: TradingView Past performance is not a guide to future performance

Of course, hurdles remain in this notoriously competitive sector. Potential threats from the likes of Amazon persist, let alone the existing menace of the discount stores.

In terms of additional competition, it may well be that the disposal of Asda by Walmart to an interested party results in another round of fierce price competition. The dividend yield remains anaemic at its current 2.5%, although on a projected basis that number should climb above 3%, depending on earnings.

The share price performance more recently has been mixed, with a 9% decline over the last year, as compared to a 4.4% dip for the wider FTSE 100 index, being offset by a more positive run of late, with the shares up nearly 15% in the last six months.

Ahead of the update next week, where the company plans to unveil further value opportunities, and with many of its strategic plans already showing signs of success, prospects for Tesco are looking bright in the eyes of the market, where the general view of the shares as a 'strong buy' remains intact.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.