These four star stocks defy the gloom

20th November 2018 15:14

by Graeme Evans from interactive investor

It's not all bad news on an otherwise grim day on global equity markets. Graeme Evans highlights some of the day's best performers.

A bruising session for European markets failed to halt some impressive share price gains today, led by FTSE 100-listed Compass Group and a clutch of mid-cap stocks.

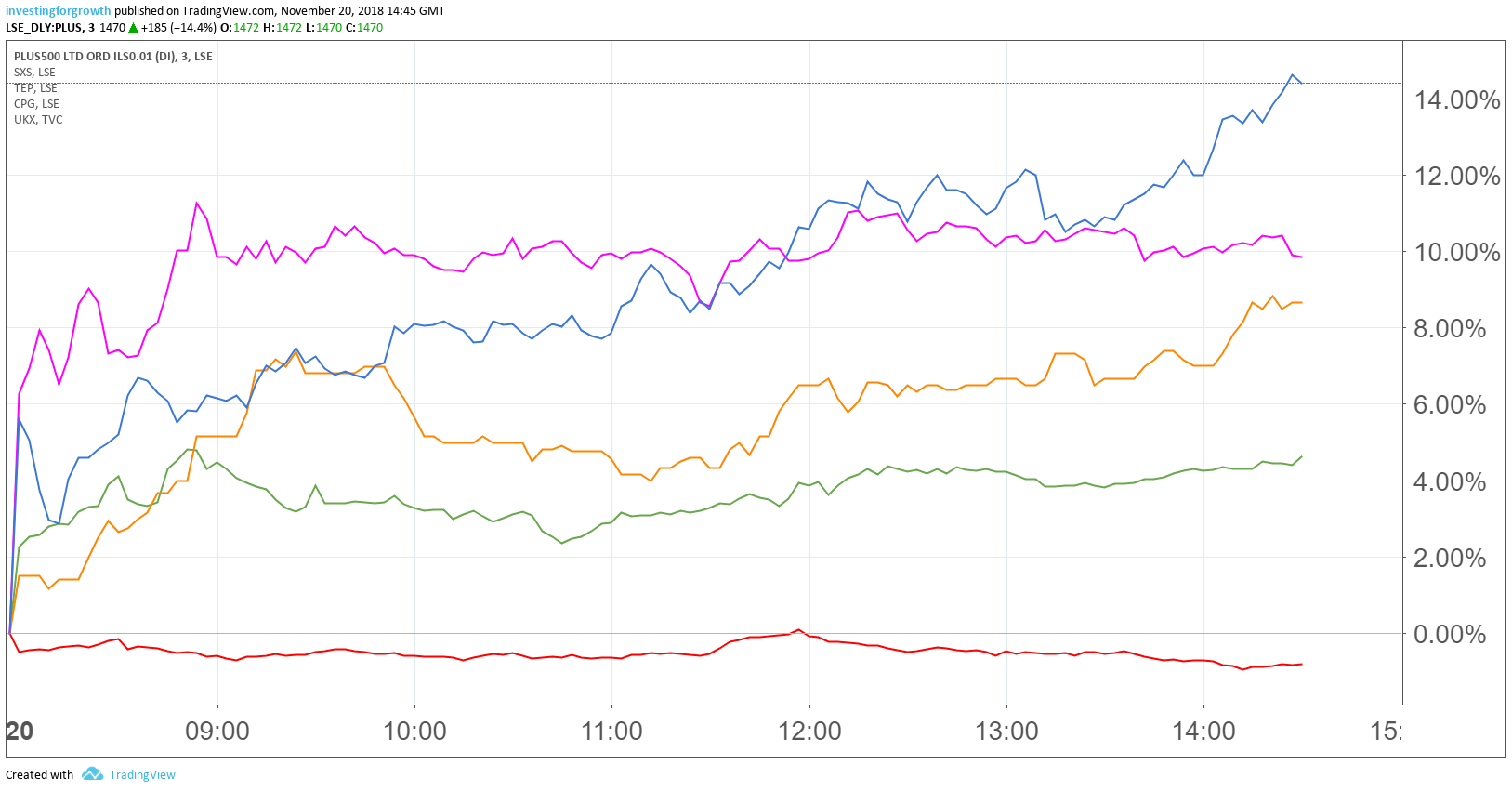

Annual results ensured catering giant Compass stepped up the share price recovery seen in the past month, while morale-boosting updates left instrumentation and controls firm Spectris and trading platform Plus500 more than 10% higher. Telecom Plus, which trades as Utility Warehouse, was also 7% higher after its half-year results showed revenues and profits at record levels.

In the FTSE 100 Index, Compass was the top performer as shares rose 4% on the back of another steady and reassuring set of results.

Earnings per share rose 12.5% to 77.6p in the year to September 30, with guidance for 2019 particularly comforting given that the company still thinks revenues growth will be in the middle of its 4% to 6% range.

Confidence in the outlook was reflected in today's full-year dividend award of 37.7p, which is up 12.5% on a year earlier for a yield in the region of 2.5%. UBS analyst Jarrod Castle has a 'buy' recommendation and is backing Compass shares to reach an all-time high of 1,815p.

Compass has been a consistently strong performer over many years, with a reputation for doing well over the winter months. Setting aside last year's disappointing performance, the previous time Compass fell in this six-month timeframe was 2007, with an average return over the past 10 winters of 13.6%.

Source: TradingView (Plus500, blue; Telecom Plus, orange; Spectris, pink; Compass, green; FTSE 100, red) (*) Past performance is not a guide to future performance

Outside the top top flight, Plus500 shares are back on form thanks to the return of stock market volatility. With the contracts for difference specialist reporting increased levels of activity in October and November, its 2018 results will now be ahead of previous market expectations.

Shares in the high-yielding stock rose sharply at the start of the year, triggered by a string of earnings updates as customers bet on the price of Bitcoin and other cryptos.

Having seen more normal levels of activity return in the summer, today's update will be a welcome boost for brokers who said recently that Plus500 shares could be worth as much as 2,800p.

CEO Asaf Elimelech said today: "We believe we are in a good position for 2019 and continue to focus on acquiring high value customers as well as growing in existing and new jurisdictions."

Like Plus500, shares in Spectris posted a double-digit percentage gain as the engineering firm issued a strong update for the four months to October showing an 8% rise in like-for-like sales.

Alongside this, impetus came from new CEO Andrew Heath announcing plans for a strategic review due to report alongside annual results in February.

He said: "There are significant opportunities to improve the operational performance of the group by taking a more focused approach. There are a number of self-help measures we can undertake."

Heath will look to improve the company's operating margin, which is below both historic highs and those of its peers, as well as seek to target higher growth markets where the company has competitive advantage.

Analysts at Stifel said the new boss had highlighted "all the key things that we wanted to hear". They added: "With Spectris's set of high gross margin businesses, and modest current valuations, we think that there is much more that can be achieved with an approach of this kind."

Shares rose to 2,320p, but Stifel, Morgan Stanley and Jefferies all think there's the potential to reach 3,000p.

Meanwhile, upbeat comments from Telecom Plus CEO Andrew Lindsay helped propel shares in the utility services company up by as much as 8% to the highest level since last summer. Announcing a 1.2% rise in half-year profits, he said it had been a number of years "since the overall outlook has appeared as positive".

Growth in customer numbers was double the previous year, rising by 10,479 to 621,218. Total services supplied for the period jumped by 86,372 to 2.4 million.

Lindsay said the introduction of the energy price cap at the end of 2018 should further improve the company's competitive position.

He added: "Revenues and profits are at record levels, and our balance sheet remains robust. In contrast to the majority of other energy suppliers, this puts us in a strong position now that the dynamics of the energy market have started to change in our favour."

With a price target of 1,360p, Peel Hunt said Telecom Plus offered potential for defensive growth, with free cash flow conversion and a dividend yield of 4.3%.

*Horizontal lines on charts represent levels of previous technical support and resistance. Trendlines are marked in red.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.