The three funds I bought last week

Several of his fund choices have already performed well, so the Saltydog analyst is buying more.

23rd April 2019 11:04

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Several of his fund choices have already performed well, so the Saltydog analyst is buying more.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation

More of the same

Since the beginning of the year we have been busy reinvesting. We aim to pick the best-performing funds, from the best-performing sectors, but also take into account their historic volatility. We usually start with a relatively small investment and will then add to it if the fund continues to trend up.

Last week we added to a few funds that have been doing well for us.

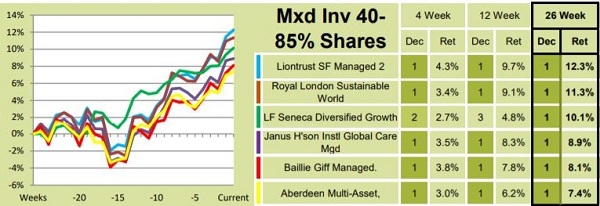

In the 'Slow Ahead' Group (which includes some of the less volatile sectors) the Mixed Investment 40-85% Shares sector has had another week at the top of our table, based on its cumulative four-week return. Several of the funds that we are invested in feature in this week's tables.

Data source: Morningstar. Past performance is not a guide to future performance

We invested in the Liontrust fund in February and have added to it a couple of times. We also went into the Janus Henderson fund in February, have added to it once and bought some more last week. We invested in the Royal London fund more recently and added to our holding last week. All three funds are in decile one over four, 12 and 26 weeks.

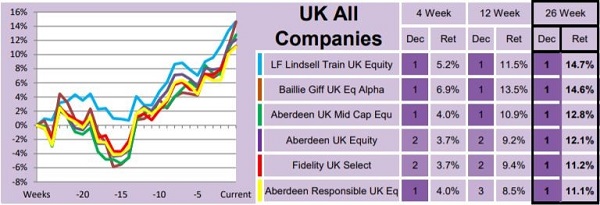

In the 'Steady as She Goes' Group, which includes some of the more volatile sectors, the UK All Companies sector was at the top of the table last week. Our portfolios are invested in several funds from this sector - Investec UK Special Situations, AXA Framlington UK Mid Cap and Baillie Gifford UK Equity Alpha. We only invested in them earlier this year and they're currently showing gains of between 7% and 12.2%.

The Baillie Gifford UK Equity Alpha fund features in both our four and 26-week data tables, and it's also been in decile one over four, 12 and 26 weeks. We increased our holding last week.

Data source: Morningstar. Past performance is not a guide to future performance

For more information about Saltydog Investor, or to take the 2-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.