Three years on from Brexit vote: The best-performing funds

We reveal the best place for investors to have been since Britain voted to leave the European Union.

18th June 2019 09:42

by Tom Bailey from interactive investor

We reveal the best place for investors to have been since Britain voted to leave the European Union.

It is almost three years since the UK voted in a referendum to leave the European Union. While the UK has still not left, decided how it will leave, or who will be the prime minister when (or if) it eventually leaves, Brexit has been a constant factor weighing on investors' minds.

On the one hand, concerns have seen (often international) investors reduce their exposure to domestic-facing UK companies. This, many have argued, has made UK equities cheap and a great buying opportunity.

Yet, the continued weakness of the pound has (for the most part) helped to boost the performance of the FTSE 100 index, in turn benefiting those constituents in the index that are the most international facing, and therefore generating most of their earnings from abroad.

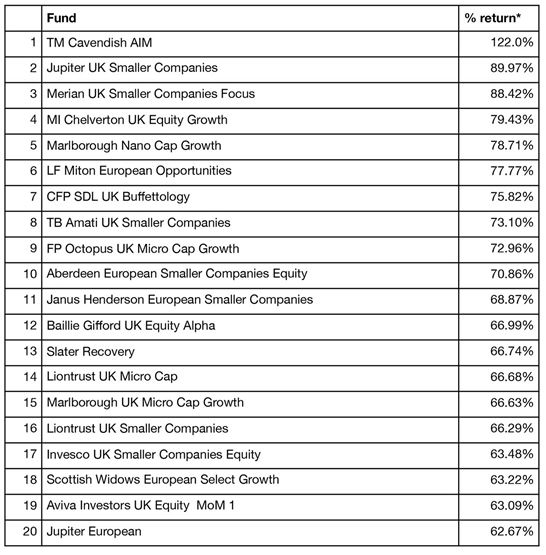

One of the best places for investors to have been over the past three years (at least in terms of UK and European exposure), however, was UK funds that buy small-sized British businesses. According to new research from Chelsea Financial Services, the average fund in the IA UK Smaller Companies sector has produced a return of 47.9% since 23 June 2016.

The sector outperformed all other UK and Europe ex-UK equity peers, as well as FTSE Small Cap index (excluding investment trusts), which provided returns of 26.3%.

The IA's UK All Companies sector produced a return of 32.1% and the IA's UK Equity Income 25.1%. Both failed to beat the FTSE 100, which has returned 35.7% over the period.

Within the UK Smaller Companies sector, the strongest performer has been TM Cavendish AIM fund, run by veteran investor Paul Mumford, which provided a return of 122%.

In second and third place were Jupiter UK Smaller Companies and Merian UK Smaller Companies Focus, each with returns of slightly below 90%.

Most UK investors, however, have missed out of the smaller companies rally.

According to Juliet Schooling Latter, research director at Chelsea Financial Services: "All the ongoing uncertainty and lack of any visibility on the eventual Brexit outcome has meant UK smaller companies funds have been very much out of favour.

"Indeed, it was the worst-selling sector among UK retail investors in 2016, 2017 and 2018.

"This means that our smaller companies are also under-owned by investors, many of whom may have missed out on their exceptional performance."

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.