Time to sell these star funds or stay invested?

The Salty Dog analyst discusses next steps after an amazing performance from a number of his funds.

29th April 2019 12:39

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

The Salty Dog analyst discusses next steps after an amazing performance from a number of his funds.

The higher they rise the harder they fall, and vice versa

After a disappointing end to 2018, stock markets around the world have had a positive start to 2019. This month we have seen the S&P 500 and the NASDAQ set new record highs. The FTSE 100 index also briefly went above 7,500, something we haven't seen since the end of September.

A rising tide lifts all boats, and so this general improvement in economic conditions has had a positive influence on most of the Investment Association sectors.

Our analysis last week showed that the only sectors that hadn't gone up over the last four weeks were 'Property', which was basically level, and 'UK Gilts & Index-Linked Gilts' which was down 2%. Over the last 12 weeks all sectors have made gains.

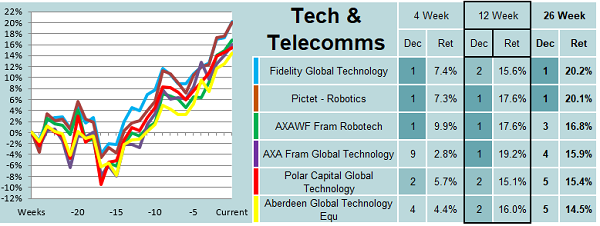

The best-performing sector over this period has been 'Technology and Telecommunications', where the leading fund is up by more than 19%.

Data source: Morningstar. Past performance is not a guide to future performance

Our demonstration portfolios invested in the Fidelity Global Technology and Polar Capital Global Technology funds in January and have subsequently added to their holdings.

As is often the case, it’s the funds that go down the most in unfavourable conditions that make the biggest gains when the tide turns. At the end of November, the Fidelity Global Technology fund had lost 8% in the previous 12 weeks and the Polar Capital Global Technology fund was down over 15%.

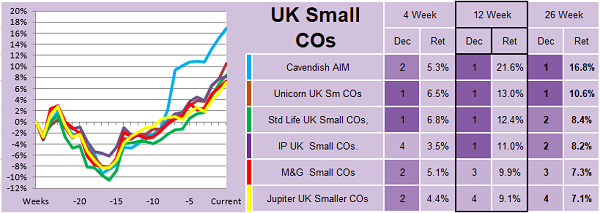

Closer to home, the 'UK All Companies', ‘'UK Smaller Companies', and 'UK Equity Income' sectors have all gained around 10% in the last three months, and some individual funds have done significantly better.

In the 'UK Smaller Companies' sector, the Cavendish AIM (which we also hold in our portfolios) has gone up by nearly 22% in the last 12 weeks.

Data source: Morningstar. Past performance is not a guide to future performance

The fact that these funds have done so well, might mean that they'll be hit the hardest if there's another market correction. But as long as they keep going up, we're happy to remain invested.

For more information about Saltydog Investor, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.