The top-performing UK fund we just bought

After a great month for sterling so far, Saltydog analyst is betting that UK stocks will reap rewards.

16th September 2019 13:40

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

After a great month for sterling so far, Saltydog analyst is betting that UK stocks will reap rewards.

Sterling strengthens in September

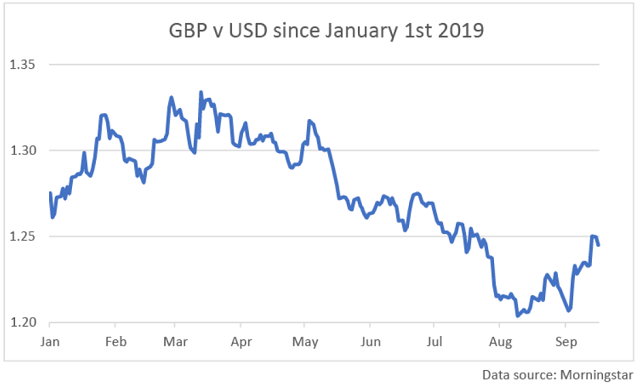

On the 9th August the pound ended the day at $1.2037. Its closing price hasn't been down at that level since 1985.

The pound has been getting weaker for most of the year. In March it briefly went above $1.33, but by the end of August it was below $1.22. A fall of nearly 9%.

So far in September we've seen the pound start to strengthen. Last week it went above $1.25, a gain of almost 3% since the beginning of the month.

When the value of the pound falls, funds with assets or earnings overseas see an immediate uplift. This has shown up in our numbers and, during June and July, the US, Global and Technology funds all performed well. They benefitted as the global economy recovered after a poor May, and at the same time got a boost as sterling went lower – a double whammy.

As the pound has started to recover, it's having the opposite effect on the funds investing abroad. They're no longer getting an advantage from the currency movement; it's now working against them. If the exchange rate moves back to $1.33 then they could see their value fall by a further 6%, just because of sterling strengthening.

We can see this change in our sector analysis, so last week invested in one of the funds in the UK All Companies sector, LF Lindsell Train UK Equity. The UK All companies sector is at the top of our 'Steady as She Goes' Group and this fund is at the top of our 26-week data table.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.