Trusts hit the mark in the ESG space

10th December 2021 14:09

For the savvy ESG-conscious investor, closed-ended funds have some of the best-performing ethical strategies.

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

ESG continues to be a critical consideration for investors, not just because of the importance to society of its ideas, but because of the potential source of alpha it can offer. We believe many investors use ESG ratings to guide their fund selection. While these are not perfect systems and are still works in progress, they are useful tools.

In this article, we uncover evidence from these ratings that investment trusts have intrinsic advantages when it comes to ESG, with investment trusts representing some of the outstanding options within their respective categories. We also look at some examples of trusts that stand out as top performers for ESG in their respective global, open- and closed-ended categories.

Where does the hammer fall?

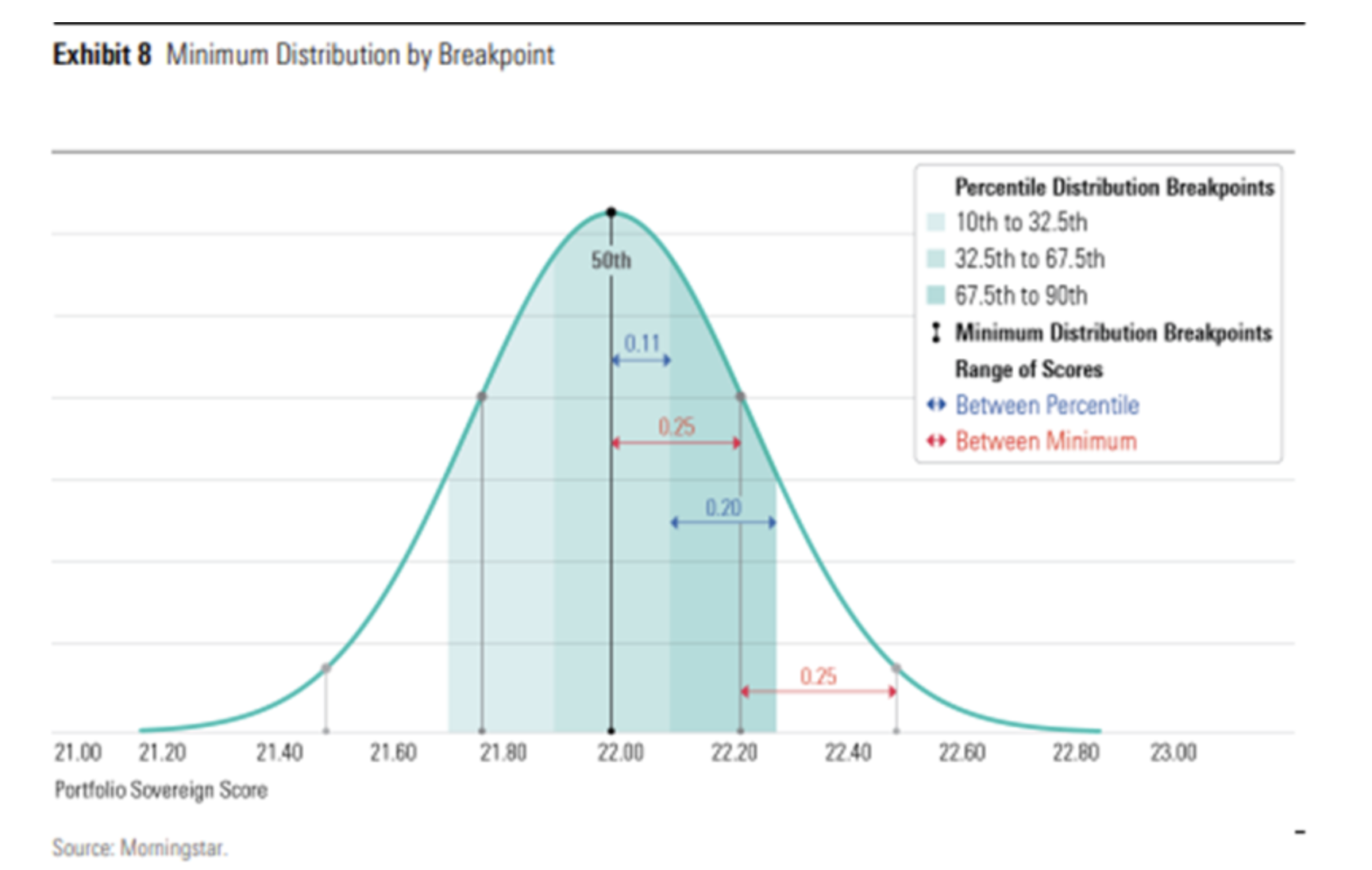

Morningstar is one of the two major ESG rating agencies. The Morningstar Sustainability Rating is based on detailed assessment of the E, S and G scores of the underlying holdings of open- and closed-ended funds across various sectors, with scores given on performance relative to these sectors. Each strategy can receive a one- to five-globe score, with one globe equating to a ‘low’ rating, and five to a ‘high’. What is relevant is that these scores are assigned based on a strategy’s ranking within a normal distribution of its respective global category’s sustainability scores.

The below graph is taken from Morningstar’s own explanation of these scores, with any strategy ranking below the 90th percentile being rated as ‘low’, any between the 67.5th and 90th percentiles as ‘below average’, any between the 32.5th and 67.5th percentiles as ‘average’, and any between the 32.5th and 10th percentiles as ‘above average’. Any strategies in the top 10th percentile are rated as ‘high’, the best possible ESG score. It is nevertheless important to caveat that comparisons between different global categories are complicated to make, as certain sectors are naturally more ESG-compliant than others (such as technology versus resources or energy). This means that even the sustainability score of the most ESG-compliant resources strategy may not compare to that of an average technology strategy.

MORNINGSTAR SUSTAINABILITY RATING DISTRIBUTION

Source: Morningstar

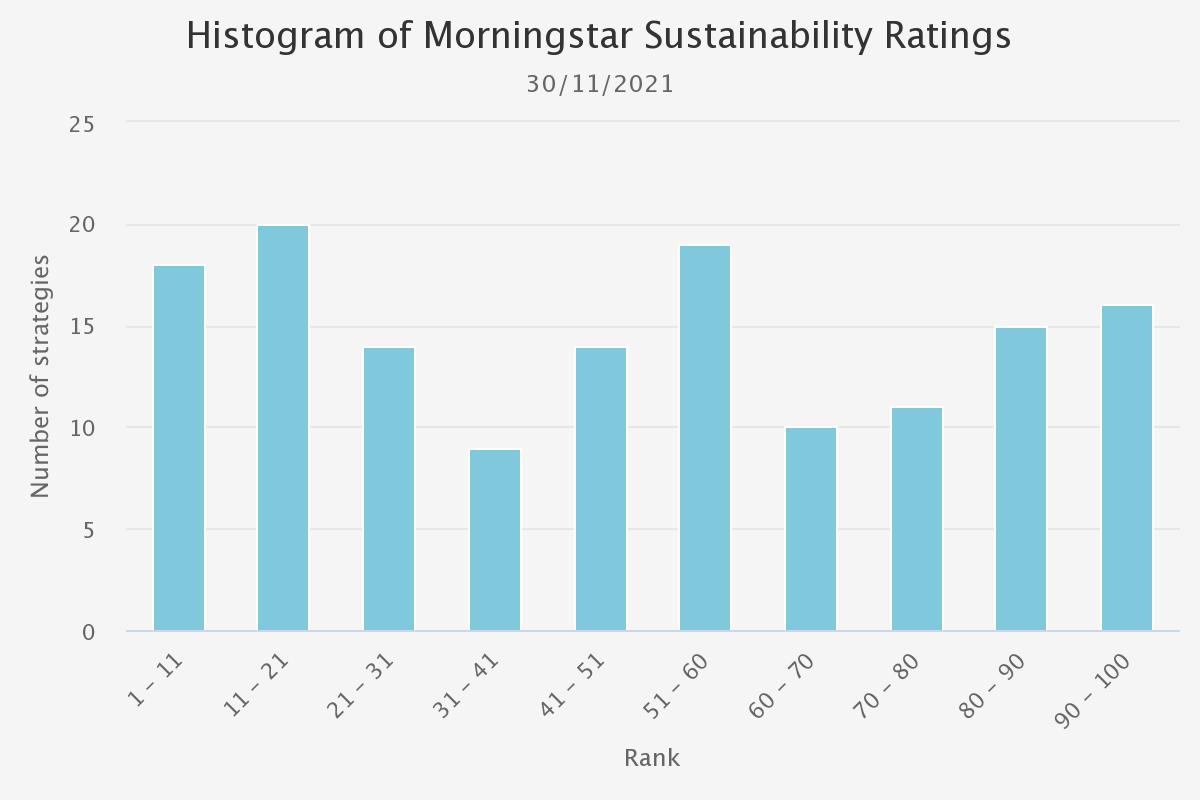

Investment trusts are included in these global categories of open- and closed-ended funds, assigned by sector. However, when we look at the scores of the investment trusts on their own we see a non-normal distribution, with an outsized number of trusts receiving high scores or low scores, and fewer ranking around the average. This is despite the fact that the average ranking of the rated AIC funds is the 49th percentile, entirely in line with the overall category.

The below histogram shows the distribution of the rankings of the rated closed-ended funds, and there are three clear peaks, showing a non-normal, multimodal distribution. There are clearly more closed-ended strategies that rank in the highest and lowest percentiles of their global categories than would be expected. This means that for the savvy ESG-conscious investor, closed-ended funds offer an unusually high number of attractive ESG opportunities if they know where and how to look.

HISTOGRAM OF MORNINGSTAR SUSTAINABILITY RATINGS

Source: Morningstar

Under (board) pressure

Why are the rankings of investment trusts so polarised? In our opinion, the most likely reason for the high number of outstanding scores is the oversight of independent boards, something open-ended funds lack. Given the ever-increasing importance of ESG – both in terms of the expectations of society as well as its potential to enhance returns – many boards have been pushing managers to include comprehensive ESG analysis within their process and to improve reporting. Keystone Positive Change (LSE:KPC) is an extreme example of this, as in February 2021 the board hired Baillie Gifford to follow an explicit ESG mandate, investing in companies whose products or services make a positive social or environmental impact.

Another example of a radical approach to ESG integration is BlackRock Sustainable American Income (LSE:BRSA). In July 2021, the board adopted a formal ESG investment policy, adding a target level of ESG-risk minimisation, as well as ensuring the trust now operates in accordance with key ESG policies. Nonetheless, BRSA will still continue to follow the fundamental investment approach of focussing on high-quality US value stocks, and as such may soon move up its category’s ESG rankings (we note that sustainability ratings are based on 12-month average scores, so there can be a lag in a strategy’s re-rating when it changes its approach).

KPC and BRSA join some existing trusts with explicit ESG mandates. Impax Environmental Markets (LSE:IEM)sits in the top decile of its global category. However, this is to be expected as IEM has long been a stalwart of environmental investing, with a track record spanning more than two decades. It sits in a peer group of wider global mid- and small-cap strategies, most of which don’t utilise a sustainable investment mandate like IEM’s. The environmental impact of IEM is clear, as the overarching theme behind Impax as a manager is that the world needs to transition to a more sustainable economy, although the team have long been using ESG considerations in their analysis to identify a company’s quality and risk. IEM’s smaller peer Jupiter Green (LSE:JGC)has a similar categorisation advantage to IEM’s, sitting in the global category despite its environmental focus. However, JGC has not been assigned a Morningstar Sustainability Score for long enough to be given a rating, though it is only a matter of time. JGC does, however, offer a discount advantage to IEM, as it currently trades on a 1.9% discount versus IEM’s 11% premium.

As time goes on, even the boards of trusts without an explicit ESG mandate have been encouraging their managers to further integrate ESG into their investment process so as to make their trusts more attractive to investors. Strategies like Alliance Trust (LSE:ATST) and F&C Investment Trust (LSE:FCIT), two multi-manager global equity strategies, are examples. Both trusts have adopted a policy of achieving net-carbon neutrality (based on the emissions of their underlying holdings) by 2050, in alignment with the Paris Accords.

We have addressed the positive end of the distribution, but what about the negative? Why do some investment trusts rank so poorly? We believe that one of the most likely reasons is also an inherent advantage of investment trusts, i.e. their ability to hold much less liquid assets. These are often small-cap companies whose lack of ESG disclosures leads them to have poor ESG ratings, although they may not inherently have bad ESG practices. In our mind, the best example of the mismatch between ESG ratings and actual potential is AVI Japan Opportunity (LSE:AJOT). Not only does AJOT focus on Japanese smaller companies whose poor ESG disclosures can cause them to run foul of rating agencies, but part of AJOT’s investment thesis is to actively engage with holdings to reform their poor governance issues, narrowing their intrinsic discounts in the process. Naturally this means investing in companies which might screen poorly for corporate governance. As a result Morningstar has given AJOT a sustainability score of ‘low’, despite the trust being a force in improving Japan’s ESG practices, and as such we believe that it remains an attractive choice for ESG-conscious investors.

Can’t stop them now

The below table contains a selection of the trusts within the top quintile which we believe offer some of the most attractive choices for ESG-conscious investors. What is interesting is the large presence of high-ranking emerging market strategies, which as we point out later is likely the result of a corporate culture supporting company-wide ESG, encouraging managers to step up in applying ESG to what is a rather opaque region for sustainability and ESG disclosures.

A SELECTION OF TOP-RANKING INVESTMENT TRUSTS

| TRUST | MORNINGSTAR GLOBAL CATEGORY | HISTORICAL CORPORATE SUSTAINABILITY PERCENTAGE RANK IN GLOBAL CATEGORY | FIVE-YEAR NAV RETURN (%) | DISCOUNT/PREMIUM (%) |

| JPMorgan Emerging Markets (LSE:JMG) | Global Emerging Markets Equity | 1 | 98.2 | -8.6 |

| Martin Currie Global Portfolio (LSE:MNP) | Global Equity Large Cap | 1 | 75.6* | 0.1 |

| Aberdeen New India (LSE:ANII) | India Equity | 5 | 81.5 | -15.6 |

| JPMorgan Indian (LSE:JII) | India Equity | 5 | 53.0 | -17.9 |

| JPMorgan Japanese (LSE:JFJ) | Japan Equity | 5 | 102.5 | -6.8 |

| Asia Dragon (LSE:DGN) | Asia ex Japan Equity | 8 | 77.0 | -10.2 |

| Impax Environmental Markets (LSE:IEM) | Global Equity Mid/Small Cap | 8 | 120.4 | 11.0 |

| Mid Wynd International (LSE:MWY) | Global Equity Large Cap | 12 | 114.5 | 1.7 |

Source: Morningstar, as at 02/12/2021. Past performance is not a reliable indicator of future returns

*We quote MNP’s returns since its change of manager on 30 June 2018. Since that date MNP has been the best-performing trust within the above selection.

One of the best examples of the pattern we have described above is the Indian equity category. Two of the four Indian equity trusts within the AIC India sector rank in the fifth percentile or above. In the case of JPMorgan Indian (LSE:JII), the team utilise JPMorgan’s proprietary ESG research process based around a 98-question checklist, as we describe in detail in our note on the trust. However, the JII team make a particular point to focus on issues of corporate governance, actively engaging with their investments when they deem it suitable. The team at Aberdeen New India (LSE:ANII) also use their parent company’s resources to aid in their ESG analysis, leveraging the 50-strong ESG team at abrdn. The ANII team take a disciplined approach to ESG investing and will often not invest if they think a company’s governance practices are particularly poor and there is no or limited scope for them to improve this, with the team happy to miss out on gains on a fashionable stock if they feel its ESG credentials will not meet their standards. The abrdn Asian equity team were in fact one of the early adopters of ESG investing, something which explains the success of many of abrdn’s strategies, including Asia Dragon (LSE:DGN). While DGN has a similar pedigree to ANII, DGN has recently added an ESG dimension to the growth opportunities it perceives, having invested in green energy and related technologies. The team are nevertheless conscious of the execution risk within this new industry, and will look for established industries and companies before investing, such as the solar power producer LONGi, a recent addition to DGN’s portfolio.

A strong ESG pedigree also underpins JPMorgan, as seen by the presence of a number of its trusts within the top rankings. Both JPMorgan Emerging Markets (LSE:JMG)and JPMorgan Japanese (LSE:JFJ)utilise the same proprietary ESG checklist as JII. The fact that all of JPMorgan’s strategies integrate this checklist should be of some assurance to investors, as it allows high-quality ESG analysis to be applied across all regions and industries. We believe this is particularly valuable in emerging markets, given the region’s relative lack of ESG considerations and disclosures when compared to developed peers. We note that in the case of JFJ, not only does the trust leverage JPMorgan’s ESG resources, but its team take an increasingly positive view on sustainability as a potential source of returns. The JFJ team have recently added a new ‘environmental’ bucket to their thematic allocation, a reflection of Japan’s increased commitment to transforming into a more environmentally sustainable society. The team highlight their holding Hitachi as one such example, with the company responsible for the production and installation of one of Japan’s largest solar plants.

Martin Currie Global Portfolio (LSE:MNP) is an example of a strategy in which ESG adoption has been advanced at the initiative of its manager, Zehrid Osmani. Zehrid has his own approach to ESG integration, utilising an ESG risk-factor matrix which accounts for more than 70 individual risks. The result of this is that MNP ranks in the top percentile in one of the largest fund categories available. Zehrid seeks out mega trends in his investment process, highlighting ‘resource scarcity’ as a potential opportunity. However, his approach to sustainable investing is somewhat nuanced, as he is conscious of the market potentially becoming ‘irrational’, with the valuations of certain sustainable assets becoming overstretched. He currently prefers to own ‘pick and shovel’ companies, like Atlas Copco, which are exposed to the construction and installation of renewable assets rather than the ownership of these assets.

Another example of manager-driven ESG integration is Mid Wynd International (LSE:MWY). The MWY team’s approach to ESG is primarily a reflection of the principles of MWY’s managers, Simon Edelsten and Alex Illingworth. They have recently replaced their ‘emerging market consumption’ theme with a ‘sustainable consumer’ theme, reflecting the opportunities presented by the world’s growing demand for sustainable consumption. MWY has been rated ‘high’ by Morningstar; however, the team do not look to exclude companies which score poorly on ESG, and in the past have even purchased resources companies, highlighting the need for raw materials in the transition to green energy.

Conclusion

The ratchet effect seems to be very much in play for ESG, not simply because of the advances made in COP26, but also because investment managers continue to hone their own approaches to ESG integration. We believe that investment trusts are in many ways at the forefront of this trend, something which can be backed up by the Morningstar sustainability rankings of AIC-listed investment trusts. We believe that this is in large part due to the impact of boards, which advance the ESG agendas of their trusts to ensure they remain attractive investment opportunities to shareholders (or at the very least ensure they avoid being blacklisted for poor ESG credentials). This can be done by adopting a carbon-neutrality target or reforming the strategy to have a formal sustainability objective.

What we find particularly interesting is the strong presence of highly rated emerging market strategies. Given that this region has often lagged the developed market in terms of sustainability and corporate disclosures, it is no small wonder that the well-resourced teams at JPMorgan and abrdn are able to add value in analysing ESG. JII ranks top in its peer group for sustainability, with the Asia-Pacific team at abrdn being able to produce top-decile strategies such as ANII and DGN. There are also strategies like MNP and MWY, where the strong convictions of their managers around ESG issues have led to their strategies having leading sustainability scores. Thus we believe that as the world becomes more and more focused on ESG investing, investment trusts will become equally more important, given their ability to generate leaders in sustainability.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.