Wild’s Winter Portfolios 2023-24: up 25% with one month to go

This six-month trading strategy has so far generated significant gains way in excess of the wider stock market. Here’s how one of the two portfolios jumped almost 8% last month.

8th April 2024 09:18

by Lee Wild from interactive investor

A month ago, I wrote about UK stocks having “little to shout about”. Well, just weeks later, they were singing from the rooftops, hogging many of the top spots in the list of best global markets in March.

The FTSE 250 index added 4.35% over the month, beaten only by a 4.67% gain for the German DAX. The FTSE 350, FTSE 100 and All-Share indices each rose at least 4.20%. That compares with 3.10% for the S&P 500 and 1.79% for the Nasdaq Composite.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

Like the month before, takeover activity played its part. Telecoms firm Spirent Communications (LSE:SPT) almost doubled in value following a bid from Keysight Technologies Inc (NYSE:KEYS) worth £1.16 billion, or 199p plus 2.5p dividend. That trumped a previous approach from Arizona-based Viavi Solutions worth 172.5p in cash plus 2.5p dividend.

Virgin Money UK (LSE:VMUK) also rallied, up 38% following an agreed acquisition by Nationwide worth £2.9 billion, or 220p a share. And in the FTSE 100, International Paper Co (NYSE:IP) gatecrashed Mondi (LSE:MNDI)’s takeover of DS Smith (LSE:SMDS) with an all-share offer worth around £6.8 billion, sending Smith shares racing to 400p and beyond.

ITV (LSE:ITV) shares leapt 32% after it sold its 50% stake in digital subscription streaming service BritBox International to BBC Studios for £255 million cash. Miners Hochschild Mining (LSE:HOC), Endeavour Mining (LSE:EDV) and Centamin (LSE:CEY) also surged higher as the price of gold and copper rose significantly.

There’s been no takeover activity in either of Wild’s Winter Portfolios this season, but many of the constituents have seen share price moves over the past five months similar in scale to bid targets mentioned above.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- ISA insights: guides, investment ideas and tax tips

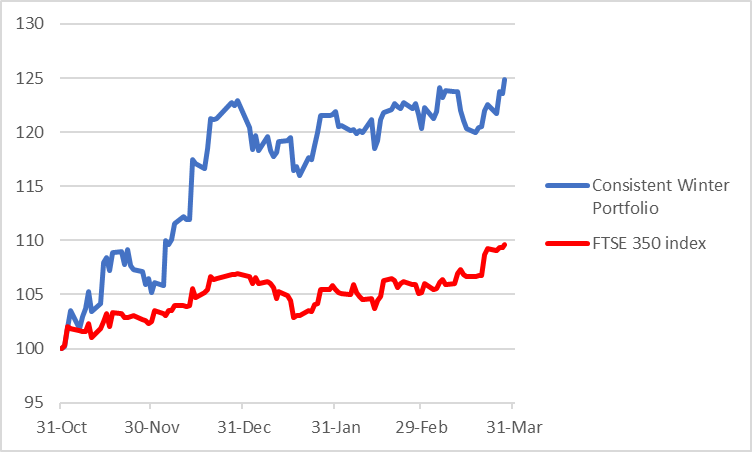

Wild’s Consistent Winter Portfolio - a basket of five FTSE 350 companies that have risen most winters (1 November to 30 April) over the past decade - jumped 3.8% in March. And at the end of month five of the six-month strategy, the portfolio is up 24.8%.

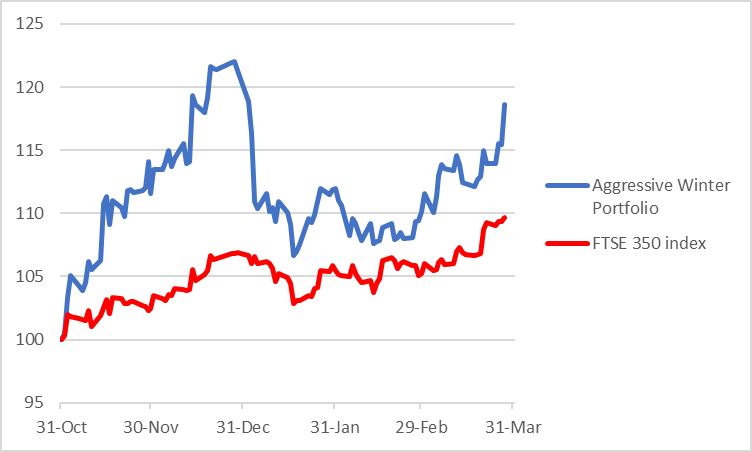

We relax the entry criteria slightly for Wild’s Aggressive Winter Portfolio, giving up some consistency in return for potentially bigger profits. However, all constituents must have risen in at least 80% of winters over the past decade. The higher risk portfolio had a great month, rallying 7.7% in March which extends profits this winter to 18.6%. That compares with a monthly gain of 4.2% for the FTSE 350 index and five-month gain of 9.7%.

You can find more information about the ‘consistent’ and ‘aggressive’ portfolios on our Winter Portfolio page.

Wild’s Consistent Winter Portfolio 2023-24

Past performance is not a guide to future performance.

Wild’s Consistent Winter Portfolio ended with gains in March despite declines at two of the constituent stocks.

Nothing has changed at InterContinental Hotels Group (LSE:IHG), but its chief commercial & technology officer decided to take advantage of a share price near a record high. George Turner sold 5,179 IHG shares at £84.54, netting him a cool £437,856. But while they lost 1.7% last month, IHG shares are still up 41.9% this winter, making it the biggest winner across both portfolios.

Self-storage firm Safestore Holdings Ordinary Shares (LSE:SAFE) also drifted lower, down 1.3% in March. There was no significant news, and the shares are still up 10.4% since the end of October, although they’re a long way off the 900p high we saw at the end of December.

- Shares for the future: this company makes my top 10

- Share Sleuth: taking profits boosts cash pile above £10,000

It was good to see electronics components firm discoverIE Group (LSE:DSCV) return from a bit of profit taking with an impressive 12.8% jump. A bounce back came just a few days after analysts at Liberum said the shares offer a “good entry point” with a price target of 980p. Shares ended March at 757p, up 22.7% this winter.

Elsewhere, Hilton Food Group (LSE:HFG) added 5.6% as investors got excited in the run up to annual results published on 3 April. As I’ve been saying in this column for some time, technical analysts will notice the shares are trying to “fill the gap”, returning to where they were before a major profit warning in September 2022, which is about 930p. Not far to go now.

And finally, Liontrust Asset Management (LSE:LIO) ended March 5% higher, taking five-month gains to 20.2%. That coincides with improvements in global stock markets and the economic and interest rate outlook.

Wild’s Aggressive Winter Portfolio 2023-24

Past performance is not a guide to future performance.

Things were more exciting and more profitable in the aggressive portfolio in March.

Engineering contractor Keller Group (LSE:KLR) grabbed top spot with a 21.2% gain for the month to prices not seen since the summer of 2018. Its shares are now up 35.2% this winter, the latest leg of the rally triggered by record annual results published early in the month.

“The strong momentum of the business is encouraging and whilst inevitably there will be fluctuations across the group, our diverse revenues and improved operational delivery underpin our expectation that 2024 will be another year of underlying progress,” said chief executive Michael Speakman.

- Merryn Somerset Webb: investing doesn’t have to be all about America

- How to build a £1 million pension and ISA portfolio

But Keller had some late competition from an unlikely source. At the start of the year, JD Sports Fashion (LSE:JD.) shares collapsed following a profits warning. But toward the end of March, the sports clothing retailer issued a reassuring trading update. Broker UBS said the shares could be worth 178p in a year peppered with major sporting events. JD shares ended March up 14.1% for the month and broke back into positive territory for the winter, up 5.5%.

Hill & Smith (LSE:HILS), the infrastructure products business, also did well following record annual results that emphasised the strength of its US business. Executive chair Alan Giddins, who spent nearly £74,000 on HILS shares after the figures, said he expects “good momentum to continue into 2024”. HILS shares added 7.8% last month for a five-month gain of 18.7%.

Construction and regeneration firm Morgan Sindall Group (LSE:MGNS) had already made a multi-year high on the back of February’s results, so it was little surprise to see it ease 1.1% over the following month. However, the shares are still up 23.4% since the end of October.

Safestore appears in both portfolios and is covered above.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.