Shares for the future: this company makes my top 10

It helps protect the environment, keeps industry running and puts planes in the air, and columnist Richard Beddard believes this high-ranking business is probably a good long-term investment.

5th April 2024 15:01

by Richard Beddard from interactive investor

Even though revenue growth was unusually low in 2023, Porvair (LSE:PRV) is still a stalwart.

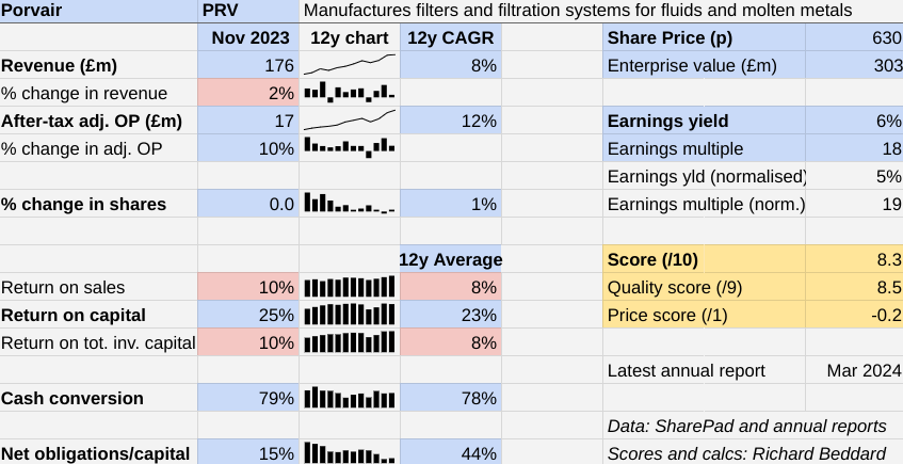

Scoring Porvair: compound growth

By stalwart, I mean reliable. Porvair grows not in great leaps and bounds but enough to impress long-term investors.

The Past (dependable) [3]

- Profitable growth: profit has grown at a CAGR of 12%, revenue 8% [1]

- Strong finances: Net obligations to capital is 15% [1]

- Through thick and thin: Lowest ROC 14% (2011) [1]

There are red flags in Porvair’s performance table, but they are not too much to worry about.

Revenue growth of 2% in 2023 is sub-par, and sub-inflation. It was because of supply shortages in the previous year, which encouraged customers of Porvair’s laboratory division to overstock and resulted in 18% revenue growth in that year. One year on, customers used some of their stockpiles, depressing sales.

The 10% profitability benchmarks for Return on Sales and Return on Total Invested Capital (ROTIC) are set at a level that might cause me concern were Porvair not such a reliable business. Porvair has triggered them by a rounding error.

Otherwise, Porvair is a highly efficient group of businesses. In 2023 it earned a 25% return on capital, slightly above average, and grew profit by 10%, slightly below average. It was cash generative and, despite acquisitions during the year, net obligations were at historic lows.

The Present (distinctive) [3]

- Discernible business: Manufactures specialist filters [1]

- With experienced people: Very experienced chief executive [1]

- That creates value for customers: Filters reduce costs and pollution [1]

Porvair makes most of its money from filters. These are bespoke consumables that protect equipment and the environment from contaminants in liquids and gases.

They are a small but essential component that reduces downtime, maintenance cost and pollution for operators of all manner of equipment, vehicles, and industrial plant.

The company says they are specified on most commercial aircraft in their fuel tank, hydraulic, and cooling systems.

They are used in harsh industrial environments. US based Selee, the mainstay of Porvair’s Metal Melt Quality division, manufactures porous ceramic filters used for filtering molten aluminium. It is, the company says, a world leader in aluminium cast house filtration.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Share Sleuth: taking profits boosts cash pile above £10,000

The filters are also used in nuclear reactors to contain fissile material, in the petrochemical industry, and in the manufacture of microelectronics.

Filters are reliable earners because they are designed into equipment and required to keep it going. Aviation filters are replaced according to maintenance schedules, generating repeat business, and metal filters are replaced every time they are used.

This repeat business is not subject to wild swings in demand as companies reel in or increase capital expenditure, and their development and certification means Porvair companies have ongoing relationships with their immediate customers (sub-assembly manufacturers) and end users (like airframe manufacturers).

Porvair filters are also used in laboratory sample preparation. Subsidiaries make instruments and consumables principally for testing water, including water analysers, robotic sample handlers, filters and microplates (the glass or plastic plates that hold samples in tiny wells).

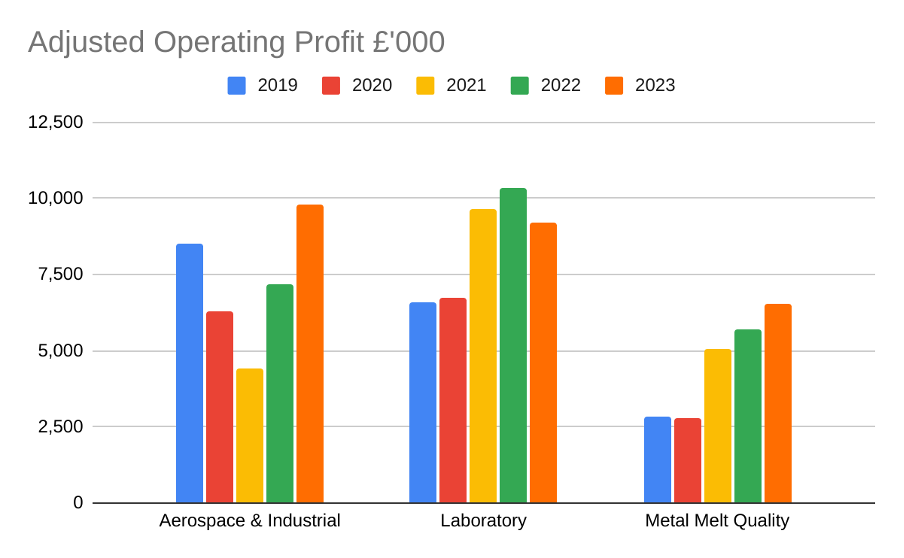

In recent years, the Laboratory division has been the principal contributor to growth, but in 2023 the Aerospace and Industrial division took up the slack as it continued its post-pandemic recovery.

The Metal Melt Quality division is going through a growth phase, propelled by demand for lightweight aluminium for electric vehicles (EVs) and relatively easy to recycle aluminium for packaging.

For the first time I can remember, in 2023 profit margins in the Metal Melt Quality division were comparable to the rest of the business. All three divisions achieved adjusted operating margins in the mid-teens.

Almost half of Porvair’s revenue is earned in the US, and most of the rest is distributed across Asia, Europe and the UK.

The architect of this specialist yet diversified business is Ben Stocks, the company’s chief executive of 26 years.

He has kept Porvair focused on profitable niches by developing new products and acquiring companies in adjacent niches.

The Future (directed) [2.5]

- Addressing challenges:Decarbonisation [1]

- With coherent actions: Buy and build focused on green economy [0.5]

- That reward all stakeholders fairly: Low and stable staff attrition [1]

Historically, Metal Melt Quality has been Porvair’s most cyclical and least profitable business. However, the popularity of aluminium and new patented filters have levelled the division up with the rest of the group.

Perhaps it will be a more reliable contributor to profit in future.

Efforts to decarbonise the economy threaten some of Porvair’s revenues, but also mean tighter regulations that will require more filtration during the transition. Meanwhile, Porvair is anticipating opportunities in a greener future.

Aviation (responsible for about 15% of sales) is under pressure to transition to cleaner fuels, but initially the emphasis will be on Sustainable Aviation Fuel (SAF), which requires filters. So too does hydrogen, regarded by some futurists as the next step in decarbonising aviation fuel.

Demand for filters used in cars and tractors with internal combustion engines (about 3.5% of revenue) will decline as EV sales continue to grow. So too may the production of fossil-fuel based chemicals and plastics (5% of revenue), although these are likely to be replaced by similar materials made with bio-feedstocks (raw materials) requiring similar levels of filtration.

The company’s long-established buy and build strategy seems well suited to keep up with events as it enables Porvair to acquire new capabilities and customers once trends are established.

- Trading Strategies: pick these stocks for your ISA not cash

- Merryn Somerset Webb: investing doesn’t have to be all about America

In 2023, Porvair acquired Ratiolab, a European manufacturer and distributor of laboratory consumables based in Budapest and Frankfurt. It also acquired a small manufacturer and supplier to its microelectronics filtration facility in Idaho, US.

In December 2023, after the November year end, the company acquired European Filter Corporation (EFC), based in Belgium. It makes mist eliminators, which removes droplets and aerosols in the production of industrial raw materials.

These acquisitions were, as usual, relatively modest in size, and consequently relatively low risk.

ROTIC is a reasonable but not outstanding 10%. A 10% return suggests Porvair is not acquiring subsidiaries at bargain prices, but bargains would be more risky. Porvair’s ability to reliably grow profit by 10% or so demonstrates that paying up for good businesses does not have to be.

I like Porvair. Its subsidiaries are given the freedom to operate entrepreneurially in their markets. Employee engagement is part of all general managers’ incentive schemes, and the Voluntary Quit rate is 9%, which implies employees like working for Porvair.

The company’s analysis equipment makes sure water is fit for consumption, its nuclear filters protect us from dangerous material, its metal filters cut waste and improve the strength of metals, and its petrochemical filtration solutions reduce refinery waste. Generally, it makes industry, transport and the environment cleaner and more efficient.

The company has halved its own carbon intensity ratio since it started measuring it in 2010 by upgrading its boilers, furnaces and ovens, installing solar panels, and designing products that use less carbon intensive raw materials.

Generally, Porvair’s choice of key performance measures, which include profitability and cash generation, reassure me that it aims to grow over the long term.

It is unusual in highlighting the compound annual growth in revenue and earnings per share over five, 10, and 15 years, a record it surely wants to extend.

The price (discounted?) [-0.2]

- No. A share price of 630p values the enterprise at £303 million, 19 times normalised profit.

A score of 8.3 out of 10 indicates that it is probably a good long-term investment.

Porvair is ranked 8 out of 40 shares by my Decision Engine.

22 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores once a year, soon after each company has published its annual report. The scores change daily due to price changes.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Bunzl (LSE:BNZL), Howden Joinery Group (LSE:HWDN), Judges Scientific (LSE:JDG), and XP Power Ltd (LSE:XPP) have all published annual reports and are due to be re-scored.

If a share is likely to be downgraded next time I score it, there is a “?” before its name in the table. This is usually because events have revealed something about the company that I had not previously considered adequately.

We will not know for sure until I have scored these companies again, but extra caution may be necessary.

Company | Description | Score |

Manufactures tableware for restaurants and eateries | 9.5 | |

Designs recording equipment, loudspeakers, and instruments for musicians | 9.0 | |

Manufacturer of scientific equipment for industry and academia | 8.6 | |

Supplies kitchens to small builders | 8.5 | |

Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | |

Translates documents and localises software and content for businesses | 8.5 | |

Distributor of protective packaging | 8.3 | |

Porvair | Manufactures filters and filtration systems for fluids and molten metals | 8.3 |

Manufactures surgical adhesives, sutures, fixation devices and dressings | 8.2 | |

Manufactures/retails Warhammer models, licences stories/characters | 7.8 | |

Manufactures natural animal feed additives | 7.8 | |

Manufactures power adapters for industrial and healthcare equipment | 7.8 | |

Imports and distributes timber and timber products | 7.8 | |

Makes light fittings for commercial and public buildings, roads, and tunnels | 7.6 | |

Develops and manufactures hygiene, baby, and beauty brands | 7.5 | |

Distributes essential everyday items consumed by organisations | 7.5 | |

Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.4 | |

Sources, processes and develops flavours esp. for soft drinks | 7.4 | |

Online retailer of domestic appliances and TVs | 7.3 | |

Casts and machines steel. Processes minerals for casting jewellery, tyres | 7.1 | |

Sells hardware and software to businesses and the public sector | 7.1 | |

Whiz bang manufacturer of automated machine tools and robots | 7.0 | |

Online marketplace for motor vehicles | 6.9 | |

Makes marketing and fraud prevention software, sells it as a service | 6.9 | |

Manufactures specialist paper, packaging and high-tech materials | 6.5 | |

Operates tenpin bowling and indoor crazy golf centres | 6.5 | |

Manufactures rugged computers, battery packs, radios. Distributes electronics | 6.4 | |

Manufactures vinyl flooring for commercial and public spaces | 6.4 | |

Manufactures military technology, does research and consultancy | 6.4 | |

Supplies vehicle tracking systems to small fleets and insurers | 6.3 | |

Flies holidaymakers to Europe, sells package holidays | 6.1 | |

Sells promotional materials like branded mugs and tee shirts direct | 6.1 | |

Publishes books, and digital collections for academics and professionals | 5.9 | |

Surveys and distributes public opinion online | 5.9 | |

Manufactures disinfectants for simple medical instruments and surfaces | 5.5 | |

Manufactures sports watches and instrumentation | 5.4 | |

Supplies software and services to the transport industry | 5.2 | |

Acquires and operates small scientific instrument manufacturers | 4.8 | |

Retails clothes and homewares | 4.6 | |

Runs a network of self-employed lawyers | 4.6 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price).

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Porvair and many of the shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.