Special offer. Get a £200 reward when you recommend ii to a friend. Find out more.

What would you like to do today?

Transfer to ii

Find out more

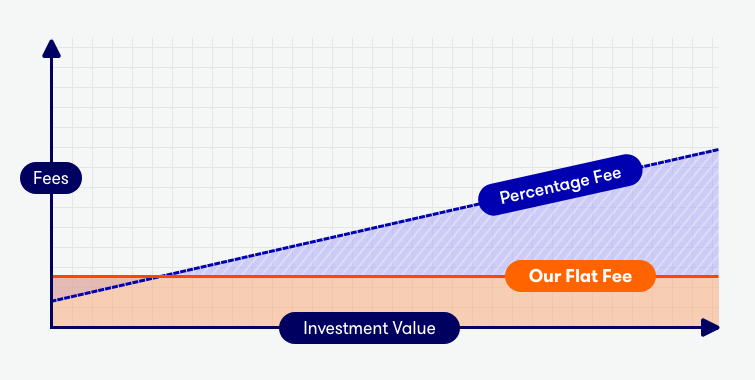

Why our flat fee matters

- Our flat fee never grows with your investments.

- You'll see higher returns over the long term.

- Research shows you could save thousands.

Read more: Charges and price comparisons.

Open an investment account

Self-Invested Personal Pension

Take control of your pension with our great value, Which? Recommended SIPP.

Stocks and Shares ISA

Make the most of your tax-free savings allowance with our award-winning ISA.

Trading Account

Our flexible account, where you can invest in all markets in the way you want.

Please remember, investment value can go up or down and you could get back less than you invest. If in doubt an investor should seek advice from an authorised investment advisor.

Looking for investment ideas?

Alastair Humphreys: The ii Family Money Show

Series 2 of The ii Family Money Show podcast draws to a close with former National Geographic Adventurer of the Year Alastair Humphreys. Alastair has cycled round the world, rowed the Atlantic and walked across India… but is his enterprising and often daring spirit reflected in his approach to money matters?

He tells Gabby how he has become a self-confessed money geek after years of ignoring his finances, how he funded a four-year trip around the world with just £7,000, and how he managed to get a pizza delivered in the middle of Alaska.

interactive investor joins Aberdeen Group plc

ii will continue to be the UK’s leading flat-fee investment platform offering subscription pricing and a whole-of-market investment choice. As part of one of Europe’s largest investment, wealth management and advice firms, we will be better able to help you take control of your financial future.

Latest news

Markets today

Values are delayed by at least 15 minutes. Page last updated on Friday, November 7th, 2025 at 11:03 AM.

Risk Warning: The price and value of investments and their income fluctuates: you may get back less than the amount you invested. If you are unsure about the suitability of a particular investment or think that you need a personal recommendation, you should speak to a suitably qualified financial adviser. Please note, the tax treatment of these products depends on the individual circumstances of each customer and may be subject to change in future. If you are uncertain about the tax treatment of the products you should contact HMRC or seek independent tax advice.